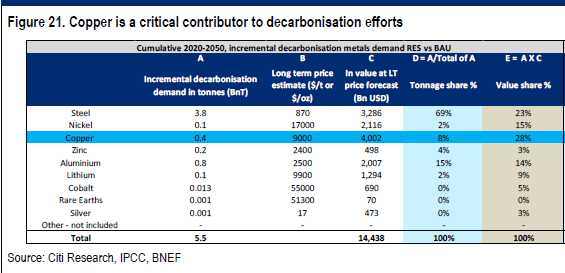

High grade iron ore will be an essential ingredient in the only form of green steelmaking currently anywhere near commercial viability – direct reduced iron.

DRI plants already exist on a moderate scale around the world. They currently run off natural gas, and produce around a fifth of the CO2 emissions of the blast furnace process, which requires metallurgical coal as a reducing agent and currently produces around 2.2t of CO2 for every tonne of steel.

The theory is hydrogen could replace the gas in DRI plants, either in new plants or by retrofitting old ones.

The most advanced green steel research project in the world is using hydrogen in a DRI style process — Sweden’s Hybrit Consortium has already produced steel for delivery to Volvo and could be commercial by 2026.

But DRI has limitations in terms of the iron ore it can consume.

“DRI you don’t produce a slag in the furnace so the impurities you start with are the impurities you end with in the final product,” Fastmarkets MB senior price development manager Peter Hannah said.

“So there’s an imperative to really keep the grade, the raw material grade, super high and the impurities very low.

“They’re very constrained on the raw materials they can use and it’s just high grade, whereas blast furnaces will tend to consume a blend of … around about 62 or 63% Fe and they’ll just kind of play around that.”

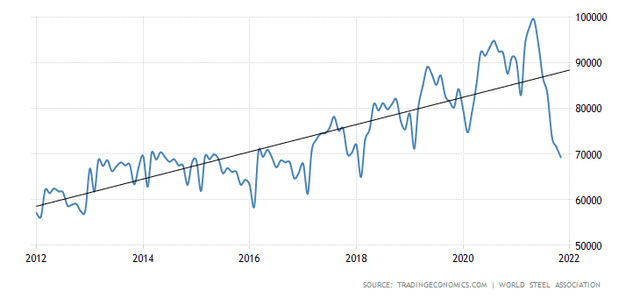

Low grade ores garner demand from the current blast furnace process that dominated the steel industry in China, the world’s largest steel market with around 60% of global production.

There they are blended with high grade fines to approximate a 62% iron ore product with a mix of impurities best suited to the mill in question.

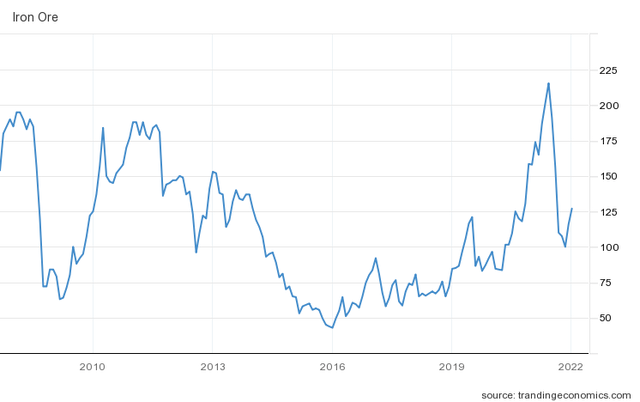

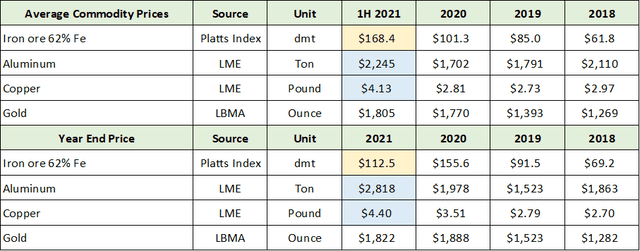

But discounts for low grade ores are rising, and experts are unsure if the conditions that supported the growth of that segment of the market over the past two decades (think Fortescue, MinRes and Roy Hill) will reemerge again as green investment becomes the norm.

Price realisation for lower grades slide

Price spreads for lower grade iron ore first became a big story in 2017 and 2018, when China’s efforts to curb pollution from steel mills led to big discounts for 58% iron ore.

They peaked at a 46% discount, which in that market threatened to make producers like FMG unprofitable and led to the temporary closure of Cleveland Cliffs’ Koolyanobbing mine in WA before it was salvaged when the State Government brokered its sale to MinRes.

That situation unwound quickly, with the price gap getting as low as 11% in late 2020 as super high iron ore prices made sub-grade products more palatable for steel mills.

But they are back up around the 40% mark, and experts like Hannah say they don’t think the conditions which created a boom market for low grade iron ore a decade ago will emerge again.

Unlike before, environmental management and specifically reducing CO2 emissions has emerged as China’s primary policy objective, with the country planning to hit peak emissions by 2025 and become a Net Zero state by 2060.

Higher grade iron ores produce less slag and require less coke for processing into crude steel, meaning coal consumption and resulting emissions are lower.

Flight to quality

Lower grade iron ore fines do receive demand as a blending product with higher grade 65% fines. Currently a mix of premium 65% fines and discounted 58% fines enables many mills to blend a 62% product cheaper than the prevailing 62% fines price.

Some miners have been happy to propose large scale lower grade developments with the aim that the greater economies of scale will have costs so low that the discount will be worth it.

But there is a clear flight to quality happening across the majors.

BHP (ASX:BHP) has just opened its US$3.6 billion 80Mtpa South Flank mine as a replacement for the Yandicoogina project. South Flank mainly produces lump, a premium ore that does not need sintering to process.

It will make BHP the largest producer of lump in the world, with about one-third of its Pilbara output being exported in that form.

Rio Tinto plans to make an investment decision this year on the development of its share of the Simandou development, one of the highest grade DSO orebodies in the world situated in troubled Guinea in Africa.

Fortescue Metals Group (ASX:FMG) has weathered a series of setbacks at its Iron Bridge magnetite development, but despite blowouts in its schedule and cost to ~US$3.5 billion (US$900m more than initially planned), the lure of producing 22Mtpa of 67-68% magnetite concentrate that would garner super premium prices has seen it stay the course.

That said, most Australian tonnes are coming at lower and lower grades as the good hematite ore in the Pilbara becomes harder to find. These resources have proven difficult to convert to higher grades as well.

While there are a handful of very high grade hematite direct shipping ores around, notably in Brazil and Africa, most high grade producers process and upgrade magnetite iron ore.

This material is lower grade in situ, but unlike standard Pilbara ores can be upgraded to a super rich 66% product or above, the kind that gets ultra high premiums from steel factories.

If the steel industry can go completely green by 2050 – at a cost of around US$278b – BloombergNEF says Australia risks losing its standing as the clear number one player to countries with higher grade iron ore reserves like Brazil and Russia.

High grade iron ore is hard to find — less than 30% of all iron ore produced is at the premium standard 65% plus — but a group of Australian explorers, miners and developers with an eye to iron ore’s high grade, green future have emerged in recent years.

There are too many to list them all here, and many companies have both high and low grade projects on their books. Here are some of the ASX-listed companies looking to capture the tailwinds for high grade iron ore.

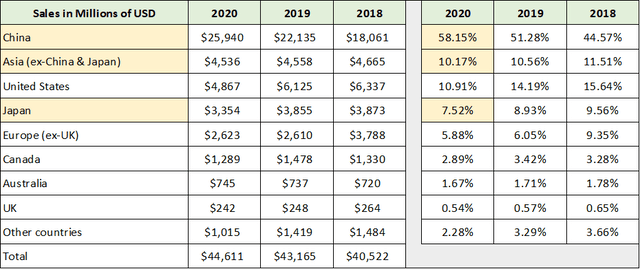

Champion Iron is the largest high grade specialist on the ASX, producing 7.5Mtpa of 66.2% and 67.5% plus DRI quality iron ore concentrate from its Bloom Lake complex in Quebec, Canada.

Its origin story was an incredible counter-cyclical move from Champion and its Australian figurehead Michael O’Keefe, renowned for being part of the Riversdale Mining team that made a motsa selling the ill-fated Mozambique coal assets to Rio Tinto.

Champion bought Bloom Lake, which runs off renewable hydroelectric power, for just $10.5 million off Cliffs in 2016 at the height of the mining bust when iron ore prices were in the toilet.

It is now a $3.2 billion company, up around 3000% in the six years since signing off on the Bloom Lake deal.

The company says its 66.2% concentrate reduces emissions in the blast furnace steelmaking process, while its >67.5% pellet feed concentrate can be used in electric arc furnaces which normally require scrap steel as a feed source, 50% less emissions intense than blast furnaces.

Champion Iron has built on its success to fund an expansion of Bloom Lake to 15Mtpa, due to be complete by mid-2022, and is conducting research on producing a 69% super premium pellet iron ore product. The company has growth options as well at projects along the Labrador Trough.

Champion Iron share price today:

A clear leader in the listed Australian high grade space, Grange owns the Savage River mine in Tasmania from where iron ore has been produced for more than 55 years.

Largely owned by Chinese investors, Grange is small in stature but big in profitability, recording a $205.9m profit in the 2020-21 financial year, up 207% from the $67m profit it generated in FY20.

The premium offered for Grange’s pellets when prices are flying is beyond ridiculous.

In the June quarter of 2021, when iron ore reach its zenith, Grange ore was selling for US$287.15/t, generating a margin of almost AUD$300 on every tonne of iron ore shipped. It helped Grange pay two healthy dividends in 2021, first a 2c a share dividend on its annual results then a 10c a share Xmas special, liquidating some of the $554.6m in cash sitting in its bank account after a bumper 2021.

Grange is looking at going harder for longer at Savage River, completing a PFS in December that showed it could up “green pellet production” threefold from ~2Mtpa to ~6Mtpa over 10 years by switching from open pit to underground caving methods.

A DFS and board decision are due in the first half of 2022. Grange has a second growth option at the 5Mtpa Southdown magnetite project near Albany in WA’s Great Southern region, where a PFS is being undertaken.

A decade-old study placed a prohibitive US$2.9 billion price tag on a larger 10Mtpa Southdown development.

Grange Resources share price today:

Mount Gibson Iron was one of the low grade iron ore miners caught short when the iron ore price nosedived and freight rates skyrocketed last year, sending its newly opened Shine operation near Geraldton into mothballs.

But the high grades at its Koolan Island operation provided motivation to keep going with a pre-strip to open a new orebody at the mine in WA’s north.

Koolan Island is a rarity in Australian iron ore, a hematite DSO mine which produces a 65% product.

It was the site of one of BHP’s original iron ore operations, producing 68 million tonnes of hematite grading 67% between 1963 and its initial closure in 1994.

The mine closed in 2014 when a seawall that shielded it from the oceans in the surrounding Buccaneer Archipelago failed, prompting a massive insurance claim Mount Gibson used to dewater the mine and recommence shipments as iron ore prices rose in 2019.

Mount Gibson has around five years left at Koolan after completing a pre-strip last year and upgrading its crusher, and expects to ramp up to ship 1.7Mt from the mine this financial year after selling just 400,000t through the first half of FY2022.

Mount Gibson Iron share price today:

Few companies on this list are as wedded to the narrative around high grade iron ore and green steel making as Magnetite Mines.

Technical director Mark Eames, an iron ore executive whose career has included stints at BHP, Rio, Glencore and X-Strata, even wrote a company white paper last year about the industry’s transformation.

A pre-feasibility study on its Razorback iron ore mine in South Australia last year placed a price tag of up to $675 million for its go forward case, involving the production of 3Mtpa of 68% iron ore concentrate a year over a 23-year mine life.

That capex estimate is three times less than the number produced by the previous management of the company.

One of those costs savings could be a potential ESG boon for the junior iron ore hopeful, which wants to leverage the work the South Australian Government has done to shift most of its grid electricity supply to wind power.

By connecting to the grid through a transmission line MGT expects to save considerable money it would otherwise have spent on a standalone power plant and capture an ESG premium by using renewable energy to power its processing operations.

Magnetite, which is up 280% over the past year, is set to complete a DFS before the end of 2022 aiming at a production start date of 2024.

Magnetite Mines share price today:

Strike’s proposed Paulsens East mine in the Pilbara is relatively standard fare for a WA iron ore junior, boasting a 9.6Mt resource at a decent grade of 61.1% iron and a 1.5Mtpa run rate consisting of a 75-25 split of 62% lump and 59% fines.

This project could be a nice cash generator at current iron ore prices, shipping 1.5-2Mtpa at a start-up cost of just $5m and cash costs of US$63-69/t.

But Strike’s big high grade gambit is in Peru at its Apurimac operations, where it has already begun exporting small quantities of ~65% DSO product at a rate of up to 125,000tpa, making its first shipment in August last year.

The larger magnetite resource contains 269Mt of iron ore at 57.3%, which according to studies dating back to 2010, could produce ~20Mtpa of 66% concentrate at a build cost of US$2.6-2.9b and opex of US$17-20/t.

Given the age of that study Strike, which last year spun out its lithium and graphite assets into float Lithium Energy (ASX:LEL), is preparing a new PFS on the larger Apurimac project.

One area where it expects to make a saving is via the construction of the US$4.6 billion, 577km long Andahuaylas Railway by the Peruvian Government which would connect the mine to port, with construction expected to start as soon as next year.

Strike Resources share price today:

Fenix Resources’ small Iron Ridge mine in the Mid West is a modest orebody but has one of the highest grades of any hematite iron ore project in WA.

Built at a cost of just $12 million, Iron Ridge has an ore reserve of 7.76Mt at 63.9% Fe. Built in just four months in late 2020, the mine is expected to produce 1.25Mtpa over a 6.5-year life.

It was expected to make $16.4m in annual EBITDA, but caught iron ore’s record run to US$230/t perfectly in May, generating revenues of $65.3m and a net profit of $49m after tax on just 500,000t of lump and fines sales.

An innovative hedging strategy helped Fenix generate a profit margin of $64 on each of its first million tonnes sold, with the big question now being what will MD Rob Brierley do with his war chest, which already funded a $24.5m, 5.25c a share maiden dividend in September.

Fenix is yet to diversify into the high grade magnetite iron ore projects of many of its peers in the Mid West and Yilgarn iron ore district like Juno Minerals (ASX:JNO), Macarthur Minerals (ASX:MIO) and a host of other small companies operating in inland WA.

CuFe Limited’s (ASX:CUF) 60% owned JWD project (GWR Group holds the balance) near Wiluna is another example of a company with a relatively high grade DSO project but no long term plan to produce DRI quality high grade ore.

Its JWD ore, sold under an offtake deal with Glencore, generates a high-grade lump premium – currently around US$30/t over benchmark 62% fines prices – and comes from a resource of 10.7 Mt at 63.7% Fe, 2.8% SiO2 and 1.5% Al2O3.

Mid West and Yilgarn miners share prices today:

Pearl Gull Iron (ASX:PLG) completed a $4 million listing at 20c last September on the same day the iron ore price fell below US$100/t for the first time in a year.

It was inopportune timing for the new junior, which owns leases on Cockatoo Island.

Located near Koolan Island in the Kimberley, Cockatoo Island was the site of BHP’s first iron ore mine in WA and boasted a similar grade.

Pearl Gull does not hold the rights to the original Cockatoo Island orebody, the subject of the Pluton Resources collapse a few years ago.

But it has had some success in drilling at its Switch Pit target adjacent to the historic Seawall Pit mine.

The first drilling by Pearl Gull at the Switch Pit starting in July last year included an intersection of 44.7m at 69.5%, described by director Jonathan Fisher as “some of the highest grade iron ore results I have ever seen”.

Unfortunately Pearl Gull has been unable to keep up the momentum despite releasing more drill results in December and is down over 60% since its listing to 7.5c a share.

Pearl Gull Iron share price today

Formerly known as Carpentaria Resources, Hawsons owns the deposit of the same name near the historic mining town of Broken Hill in New South Wales, birthplace of BHP.

Hawsons boasts a maiden probable reserve 755Mt at 14.7% Davis Tube Recovery grade it says could be upgraded to 111Mt of “Supergrade” 70% magnetite concentrate, which it is marketing as a “green steel” product.

A PFS was released in 2017 estimating it would cost US$1.4 billion to deliver a project shipping 10Mtpa at an all-in FOB cost of US$48.03/dmt.

Hawsons, which has seen its shares climb 380% over the past year, was able to nestle away $35.6 million from investors last year to fund a bankable feasibility study.

Hawsons Iron share price today

Iron Road owns the Central Eyre Iron Project near Warramboo in South Australia.

Recently it has been one of the proponents of a new “green” export facility at Cape Hardy in region SA, but news about the project underpinning those plans has been relatively scant.

An “optimisation” study back in 2015 placed a US$4.6 billion overall cost (including a $570m pre-strip) on developing a 24Mtpa mine producing a 67% concentrate with low impurities, a capital investment even BHP and Rio would struggle to find the money for at that sort of production rate.

In 2017 that was cut to $US3.7b and then US$1.74 billion in 2019 by reducing its targeted production rate to 12Mtpa, replacing rail with road trains and a reduction in power requirements.

South Australia has a rich history of magnetite iron ore production, with Whyalla Steelworks owner GFG Alliance running the Simec Mining Middleback Ranges mine site around 60km from the steel town.

Most of the 1.3Mtpa of high grade pellets is supplied to the Whyalla Steelworks with around 10Mtpa of hematite ore shipped to Asian customers.

Iron Road share price today

Another ASX-listed but overseas focused stock, Magnum Mining and Exploration owns the Buena Vista Iron Ore project in Nevada over in the USA.

Magnum’s plan is to go beyond just mining iron ore to selling “green” hot briquetted iron and pig iron products to customers in the States and Asia.

It is currently trialling a method using biochar rather than coal or coke in the steel production process.

The company has had an agreement to negotiate on offtake with Anglo American in place since mid-2021, but late last year extended the time to complete the deal to November 30, 2022, amid the changing scope of the Buena Vista project from a magnetite concentrate mine to a “green iron” development.

Magnum Mining share price today

At Stockhead, we tell it like it is. While Magnetite Mines, Strike Resources and CuFe Ltd are a Stockhead advertisers, they did not sponsor this article.

https://stockhead.com.au/resources/higher-higher-which-companies-can-supply-the-green-steel-of-the-future-with-high-grade-iron-ore/