By

James Grant

Though money can’t talk, people can’t stop talking about it. With the nomination of Judy Shelton to the Federal Reserve Board, the discussion has tilted to gold.

Gold is money, or a legacy form of money, Ms. Shelton contends, and the gold standard is a reputable, even superior, form of monetary organization. The economists can hardly believe their ears. The central bankers roll their eyes. How can this obviously intelligent woman be so ignorant? Let us see about that.

America was on one metallic standard or another from the Founding until President Richard Nixon announced the suspension of the Treasury’s standing offer to foreign governments to exchange dollars for gold, or vice versa, at the unvarying rate of $35 an ounce. The date was Aug. 15, 1971.

Ever since, the dollar has been undefined in law. Its value against other currencies rises or falls, as the market, sometimes with a nudge from this government or that, determines. The dollar isn’t unusual in this respect. With few exceptions, the values of the world’s currencies oscillate.

In the long sweep of monetary history, this is a new system. Not until relatively recently did any central bank attempt to promote full employment and what is called price stability (but is really a never-ending inflation) by issuing paper money and manipulating interest rates.

The advance of computer technology has made possible a world-wide monetary system based on the scientifically informed discretion of Ph.D. economists. The Fed alone employs 700 of them.

“Gold standard” means not one system but many. You can think of them as a Broadway hit, the roadshow version of the hit, and the high-school drama-club editions. The version Nixon scuttled didn’t have the starch, elegance, universality or populist inclusion of the classical gold standard. It was drama club.

The true-blue standard was sweet and simple. Participating nations defined their money as a fixed weight of gold. Citizens could exchange currency for gold, or gold for paper, as they chose. Gold moved freely across national borders. It went where interest rates and business opportunities beckoned. Gold was base money; over it rose the superstructure of credit.

Fixedness was one defining feature of the classical gold standard. Trust in the workings of supply and demand—in the “price mechanism”—was a second. Belief in individual responsibility for financial outcomes was a third.

A central bank’s single objective was to assure convertibility of the currency it managed at the fixed and statutory price. The exchange rate, not employment, growth or price stability, was the all in all.

The Bank of England was “very desirous not to exercise any power,” as a director of that institution testified before a committee of the House of Commons in 1832. The bank was content to allow the people to regulate the money supply by exercising their right to exchange bank notes for bullion.

A 20th-century scholar, reviewing the record of the gold standard from 1880-1914, was unabashedly admiring of it: “Only a trifling number of countries were forced off the gold standard, once adopted, and devaluations of gold currencies were highly exceptional. Yet all this was achieved in spite of a volume of international reserves that, for many of the countries at least, was amazingly small and in spite of a minimum of international cooperation . . . on monetary matters. This remarkable performance, essentially the product of an unusually favorable combination of historical circumstances, appears all the more striking when contrasted with the turbulence of post-1914 international financial experience and remains, even today, a source of some measure of fascination and indeed of puzzlement to students of monetary affairs.”

Arthur I. Bloomfield wrote those words, and the Federal Reserve Bank of New York published them, in 1959.

The gold standard, “the fly wheel of the Industrial Revolution,” as the historian Lewis E. Lehrman puts it, was as imperfect as any other human institution. Prices were stable over the long term but variable in the short run; sometimes—even for years on end—they fell. Sometimes governments interfered with gold movements. There were panics when the bankers overissued their IOUs. And when people ran on the banks to exchange those claims for gold—when stock prices crashed and business activity stopped cold—a central bank would respond by raising its interest rate to defend the exchange rate. It was the exchange rate, one’s standing in the international monetary community, that mattered.

Gold-standard central banking concerned itself with the present. Millennial central bankers dare to take a view of the future. The moderns forecast, or attempt to forecast, economic growth, inflation, employment.

It’s no fault of theirs that they usually miss, most memorably in 2008, when the biggest event of their professional lives took most of them unawares. The economists are dealing with human beings, not raindrops.

The National Weather Service, which does deal with raindrops, and which marshals enormous computing power and truly big data, has an ordinary forecasting horizon of seven to 10 days. The central bankers inadvisedly cast their predictions into the distant future.

The ideology of the gold standard was laissez-faire; that of the Ph.D. standard (let’s call it) is statism. Gold-standard central bankers bought few, if any, government securities. Today’s central bankers stuff their balance sheets with them.

In the gold-standard era, the stockholders of a commercial bank were responsible for the solvency of the institution in which they held a fractional interest. The Ph.D. standard brought the age of the government bailout and too big to fail.

While gold-standard central bankers set short-term interest rates, they did not seek to control longer-term rates, much less drive them to zero. In today’s monetary regime, some $13 trillion of debt securities world-wide are priced to deliver a yield of less than zero. There’s been nothing like it in 4,000 years of recorded interest-rate history.

And if gold could once be brushed aside as an anachronistic form of money, that time is no more, with private companies competing to bring digital gold to the blockchain.

In 1989, Ms. Shelton published “The Coming Soviet Crash,” a brilliant and courageous analysis of the weakness of an overrated collectivist economy. She could be just the woman to remind the Fed’s doctors of economics how monetary capitalism works.

Mr. Grant is founder and editor of Grant’s Interest Rate Observer and author of “Bagehot: The Life and Times of the Greatest Victorian,” out July 23.

Henry Ellenbogen: Increasingly, the most unpredictable thing about developed markets is elections. At a time of very low unemployment in the U.S., you would expect more political stability. Instead, our politics are increasingly divided. Many businesses are undergoing tremendous change, which has bred uncertainty. An estimated 30% of the companies in the S&P 500 are in industries going through technological change and face obsolescence risk, and even stable businesses have to become more agile, which puts more stress on employees. Economic instability has led to political instability and pressure on central bankers to be more accommodative with monetary policy to drive economic growth and some level of stability.

The global population growth rate peaked long ago. The absolute increase of the population per year has peaked in the late 1980s at over 90 million additional people each year and can be seen here.

https://ourworldindata.org/world-population-growth

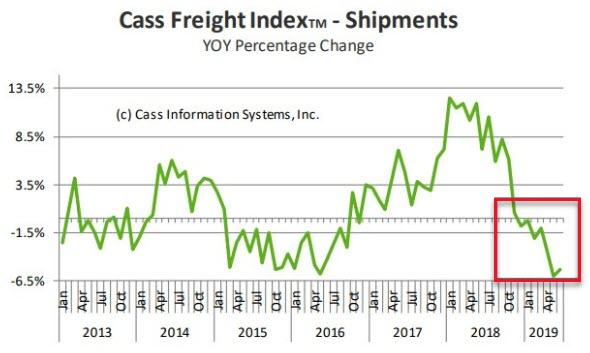

With the -5.3% drop in June following the -6.0% drop in May, we repeat our message from last month: the shipments index has gone from “warning of a potential slowdown” to “signaling an economic contraction.”

May and June’s drops are significant enough to pose the question, “Will the Q2 ’19 GDP be negative?”

We acknowledge that all of these negative percentages are against extremely tough comparisons; and the Cass Shipments Index has gone negative before without being followed by a negative GDP.

The weakness in spot market pricing for many transportation services, especially trucking, is consistent with the negative Cass Shipments Index and, along with airfreight and railroad volume data, strengthens our concerns about the economy and the risk of ongoing trade policy disputes. Weakness in commodity prices and the decline in interest rates have joined the chorus of signals calling for an economic contraction.

We are concerned about the severe declines in international airfreight volumes (especially in Asia) and the ongoing swoon in railroad volumes, especially in auto and building materials.

We see the weakness in spot market pricing for transportation services, especially in trucking, as consistent with and a confirmation of the negative trend in the Cass Shipments Index.

As volumes of chemical shipments have lost momentum, our concerns of the global slowdown spreading to the U.S., and the trade dispute reaching a ‘point of no return’ from an economic perspective, grow.

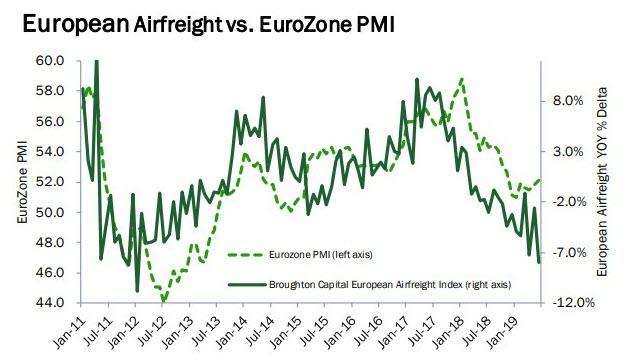

European Airfreight

European airfreight volumes have been negative since March 2018, but only by a small single-digit margins (-1% to -3%), until November 2018. Unfortunately, since then, volumes have started to further deteriorate. Our European Airfreight Index was down a concerning -7.2% in April, only down -2.6% in May, before dropping -7.9% in June. Although by itself distressing, it’s the Asian data that has become the most alarming.

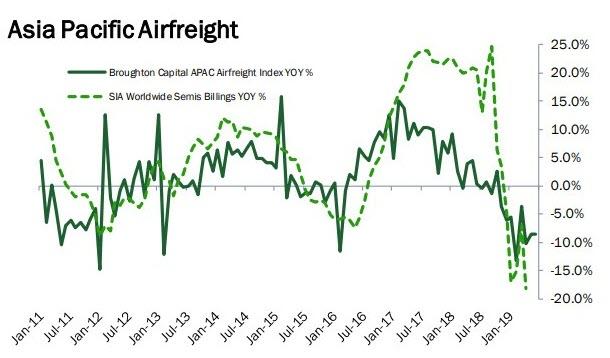

Asia Pacific Airfreight

Asian airfreight volumes were essentially flat from June to October 2018, but have since deteriorated at an accelerating pace (November -3.5%, December -6.1%, January -5.4%, February -13.3%, March -3.6%, -10.2% in April, -8.5% in May, and -8.6% in June).

Shanghai Airfreight

If the overall volume wasn’t distressing enough, the volumes of the three largest airports (Hong Kong, Shanghai, and Incheon) are experiencing the highest rates of contraction. Even more alarming, the inbound volumes for Shanghai have plummeted. This concerns us since it is the inbound shipment of high value/low density parts and pieces that are assembled into the high-value tech devices that are shipped to the rest of the world.

Free Markets

It is extremely refreshing to see analysis giving free trade a big plug. And in the face of Trumpian foolishnees, it is all the more refreshing.

This is what Cass had to say:

The data underlying economic history is clear: the more unrestricted and robust global trade is, the more prosperous the global population becomes. Open markets of free trade are the greatest method to efficiently allocate resources and ensure that the best quality goods made by the most efficient producers are available to everyone. Unrestricted global trade lifts hundreds of millions, even billions, of the world’s population out of poverty. ‘Protectionism,’ like so many government regulations and programs, frequently produces results that are the exact opposite of the intended outcome.

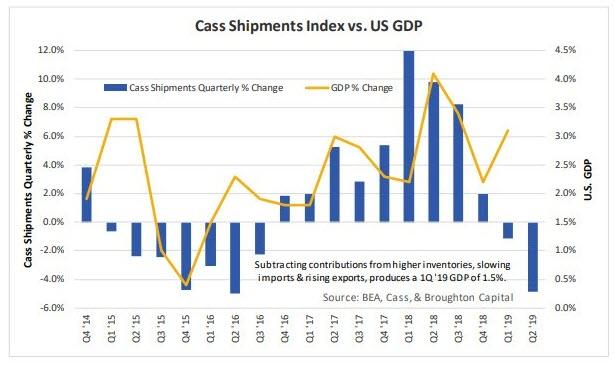

Shipment Index vs GDP

At first glance, the GDP for the 1st quarter seems very inconsistent with overall freight volumes. Using the Cass Shipments Index as a predictive proxy, we did not expect the BEA to report 3.2% as its initial estimate or 3.1% as its first revision. We won’t be surprised if the final report includes further downward revisions.

In the methodology used to calculate GDP, all increases in inventory are counted as additions to the GDP, all imports are counted as a negative to the GDP and all exports are counted as a positive to the GDP. Backing out the rising inventories, slowing imports and slightly higher exports, reduces the Q1 GDP to less than 1.5%.

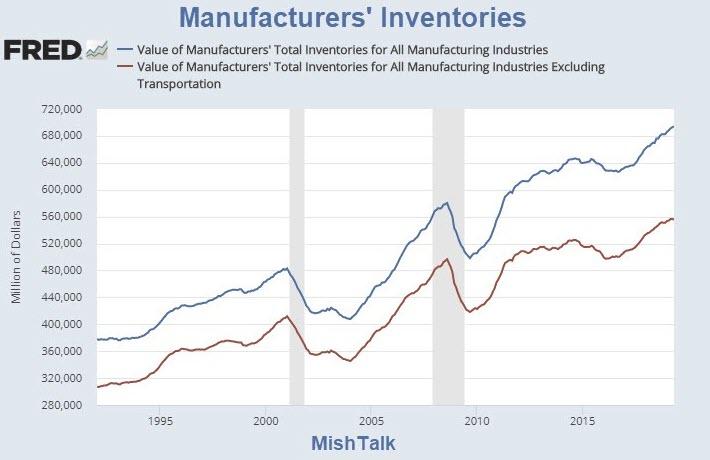

Inventories

Inventories Piling Up

I agree with the Cass take on inventories.

Yet, the July 10 GDPNow Assessment of 1.4% includes a -1.01 adjustment for inventories.

Thus, the "Real Final Sales" estimate by the GDPNow model is 2.4%.

Real Final Sales is the true bottom line assessment of the economy.

Why a Negative Adjustment?

But why does GDPNow have a negative inventory build?

I have been struggling with that all quarter.

On July 3, I commented the Manufacturing Sector is Rolling Over But Inventories Keep Piling Up.

Inventory Wildcard

If inventories are somehow negative, real final sales, will be higher than the baseline report.

The reverse is also true. If the baseline GDP number is 1.3% and CIPI (Change in Private Inventories) ass 1.0%, we are talking a bottom line estimate of 0.3%, more in line with what Cass expects.

We will have a better idea tomorrow when a slew of economic reports on inventories, industrial production, and retail sales.

Bottom Line

Cass concludes with this bottom line assessment: "More and more data are indicating that this is the beginning of an economic contraction. If a contraction occurs, then the Cass Shipments Index will have been one of the first early indicators once again."

https://www.zerohedge.com/news/2019-07-16/recession-looms-cass-freight-index-negative-7th-month

Chevron Corp. is seeking approval to modify its plans for a liquefied natural gas export facility on Canada’s Pacific Coast to an all-electric design that it says will result in the lowest greenhouse-gas emissions per ton of LNG of any large project in the world.

Chevron and its partner Woodside Petroleum Ltd. earlier this year had announced they’d applied to expand the capacity of their LNG project in Kitimat, British Columbia, by as much as 80% to 18 million metric tons a year.

That triggered a new federal screening of the project that’s expected to “commence shortly,” according to a July 8 letter filed by Chevron to the provincial environmental assessment office. As part of the fresh round of approvals sought, the project is proposing to become an “all-electric plant” powered by hydroelectricity, allowing expanded capacity without the corresponding increase in emissions of a traditional LNG facility, the letter said.

LNG is created by cooling gas to minus 260 degrees Fahrenheit (minus 127 degrees Celsius) in an energy-intensive process typically powered by burning natural gas. Kitimat LNG instead proposes electric motor drives totaling 700 megawatts to run all liquefaction, utility compressors, pumps and fans with hydropower bought from the provincial utility, according to its revised project description dated July 8. It will have backup diesel power generators onsite for emergencies.

The proposed plant “will achieve the lowest emissions intensity of any large-scale LNG facility in the world,” according to the project description. Kitimat LNG will produce less than 0.1 ton of carbon dioxide equivalent for every ton of LNG compared with a global average of more than 0.3 ton of CO2 equivalent, according to the document.

Chevron and Woodside expect to make a final investment decision in 2022 to 2023 with production starting by 2029, according to the project description. The revised proposal may trigger the need for a federal environmental assessment, according to the document.

The account offers customers a way to convert funds into physical gold amounts which can then be spent using a debit card

One Tally is equal to one milligram of gold

Tally Ltd has officially launched its physical gold-backed bank account and app of the same name following a soft launch on the Google Play and Apple App stores in June.

The account offers customers a way to transfer funds that are then converted automatically into Tally gold, physical gold amounts that are owned by the account holder and kept in a secure vault in Switzerland. Customers can then spend this gold using a debit card.

One Tally is equal to one milligram of gold that can be spent like normal currency, however, its value will not decrease as a result of inflation and political uncertainty.

Tally accounts are also insured to the full value, not limited to £85K like most bank accounts, and have no interactional transaction or foreign exchange fees.

The costs for a Tally account are a single monthly charge of 0.1% of the average monthly holding, which then decreases to 0.05% for holdings of over half a million Tally, equivalent to around £18,000.

“Confidence has been eroded in government issued currency. We wanted to offer consumers a stronger form of money, protected from the risk of bank collapse, 100% insured and designed to hold its value”, said Cameron Parry, Tally’s co-founder and chief executive.

“The solution was a platform using a physical asset kept outside of the banking system while seamlessly operating with it. This is what Tally delivers.”

Hartford Courant-10 Jul 2019

Initial agreement on redeveloping Hartford trash plant reached after ... in a 15 percent increase in tipping fees for member municipalities that took effect July 1. ... tax-exempt bonds to finance redevelopment of the trash-burning ...

7NEWS-25 Jun 2019

South Australian Premier Steven Marshall has deflected the blame as local councilsjack up their rates to cope with the new 'bin tax'.

Leeds Live-8 Jul 2019

Councillor blames 'DIY tax' for rise in fly-tipping in Leeds ... to dump old tyres and other waste is leading to increased fly-tipping in the city. ... At a full council meeting in September 2018, Pudsey councillor Mark Harrison (Con) ...

The Advertiser-11 Jul 2019

Metropolitan Adelaide councils have fixed their rates — with some going up and some going down — in the wake of the surprise rubbish tax increase. ... “The sudden spike in the Solid Waste Levy is not about delivering better ...

Closure of refuse plants for maintenance has caused havoc amid record heatwave

zoom Image courtesy of Cheniere

Liquefied natural gas (LNG) exports from the United States have increased week over week.

Twelve LNG vessels with a combined LNG-carrying capacity of 44 billion cubic feet departed the United States between July 4 and July 10.

Out of the twelve vessels, seven were shipped from Sabine Pass, two from Cove Point, two from Corpus Christi, and one from Cameron LNG facility, data from the Energy Information Administration shows.

One vessel was loading at the Sabine Pass terminal on Wednesday.

Natural gas feedstock deliveries to U.S. liquefaction facilities set a new record last week, reaching 6.3 billion cubic feet per day on July 4 and July 7, 2019. They averaged 6.1 Bcf/d for the report week—the highest weekly average to date—EIA notes, citing PointLogic Energy data.

Flows to the newly commissioned Cameron Train 1 and Corpus Christi Train 2 increased, indicating that both trains have ramped up feedstock deliveries to full capacity.

Last week, the first cargo was loaded with LNG produced at the newly-commissioned Train 2 at the Corpus Christi LNG facility.

The Corpus Christi terminal in Texas consists of three trains, each with a baseload nameplate capacity of 0.6 Bcf/d. Two trains are now fully operational. The third train is under construction and is expected to come online in May 2021.

The El Niño weather pattern is likely to transition into ENSO-neutral conditions in the next month or two, a U.S. government weather forecaster said on Thursday.

ENSO-neutral refers to those periods in which neither El Niño nor La Niña is present, according to the National Weather Service’s Climate Prediction Center (CPC).

The ENSO-neutral conditions are most likely to continue through the northern hemisphere fall and winter, the CPC said in its monthly forecast.

China’s economic growth slowed to 6.2% in the second quarter, its weakest pace in at least 27 years, as demand at home and abroad faltered in the face of mounting U.S. trade pressure.

While more upbeat June factory output and retail sales offered signs of improvement, some analysts cautioned the gains may not be sustainable, and expect Beijing will continue to roll out more support measures in coming months.

China’s trading partners and financial markets are closely watching the health of the world’s second-largest economy as the Sino-U.S. trade war gets longer and costlier, fuelling worries of a global recession.

Monday’s growth data marked a loss of momentum for the economy from the first quarter’s 6.4%, amid expectations that Beijing needs to do more to boost consumption and investment and restore business confidence.

The April-June pace was in line with analysts’ expectations for the slowest since the first quarter of 1992, the earliest quarterly data on record.

“China’s growth could slow to 6% to 6.1% in the second half,” said Nie Wen, an economist at Hwabao Trust. That would test the lower end of Beijing’s 2019 target range of 6-6.5%.

Cutting banks’ reserve requirement ratios (RRR) “is still very likely as the authorities want to support the real economy in a long run,” he said, predicting the economy would continue to slow before stabilizing around mid-2020.

China has already slashed RRR six times since early 2018 to free up more funds for lending and analysts polled by Reuters forecast two more cuts this quarter and next.

Beijing has leaned largely on fiscal stimulus to underpin growth this year, announcing massive tax cuts worth nearly 2 trillion yuan ($291 billion) and a quota of 2.15 trillion yuan for special bond issuance by local governments aimed at boosting infrastructure construction.

The economy has been slow to respond, however, and business sentiment remains cautious.

Trade pressures have intensified since Washington sharply hiked tariffs on Chinese goods in May. While the two sides have since agreed to resume trade talks and hold off on further punitive action, they remain at odds over significant issues needed for an agreement.

Data on Friday showed China’s exports fell in June and its imports shrank more than expected, while an official survey showed factories were shedding jobs at the fastest pace since the global crisis..

Premier Li Keqiang said this month that China will make timely use of cuts in banks’ reserve ratios and other financing tools to support smaller firms, while repeating a vow not to use “flood-like” stimulus.

IS BETTER DATA SUSTAINABLE?

A steady string of weak economic data in recent months and the sudden escalation in the U.S.-China trade war had sparked questions over whether more forceful easing may be needed to get the Chinese economy back on steadier footing, including some form of interest rate cuts.

But June activity data on Monday showed industrial production, retail sales and fixed-asset investment all beat analysts’ forecasts, suggesting that Beijing’s earlier growth-boosting efforts may be starting to have an effect.

Analysts also say room for more aggressive monetary policy easing is being limited by fears of adding to high debt levels and structural risks.

“Cutting the benchmark deposit and lending rates — the likelihood is very low. It’s more possible (that) they twist the market-oriented rates — cutting the interest rates of all those liquidity facilities also sends an important signal to the market,” said Aidan Yao, senior Asia emerging markets economist at AXA Investment Managers in Hong Kong.

“Fiscal policy is likely to be in the driving seat and monetary policy will act in a supportive role in the coming months.”

Industrial output climbed 6.3% from a year earlier, data from the National Bureau of Statistics showed, picking up from May’s 17-year low and handily beating a forecast for 5.2% growth.

Daily output for crude steel and aluminum both rose to record levels.

Retail sales jumped 9.8% - the fastest clip since March 2018 - and confounding expectations for a slight pullback to 8.3%. Gains were led by a 17.2% surge in car sales.

Some analysts, however, questioned the apparent recovery in both output and sales.

Capital Economics said its in-house model suggested slower industrial growth, while the jump in car sales may have been partly due to a one-off factor.

Car dealers in China are offering big discounts to customers to reduce high inventories that have built up due to changing emission standards. Motor vehicle production actually fell 15.2%, the 11th monthly decline in a row, suggesting automakers don’t expect a sustained bounce in demand any time soon.

“The monthly data were better than expected... (But) we are skeptical of this apparent recovery given broader evidence of weakness in factory activity,” said Julian Evans-Pritchard, Senior China Economist at

“Looking ahead, we doubt that the data for June will mark the start of a turnaround.”

INVESTMENT ALSO SLOWLY PICKING UP

Fixed-asset investment for the first half of the year rose 5.8% from a year earlier, compared with a 5.5% forecast and 5.6% in the first five months of the year.

Real estate investment, a major growth driver for the world’s second-largest economy, quickened in June. It rose 10.1% from a year earlier, accelerating from a 9.5% gain in May but still slower than in April, Reuters calculated.

Still, the economy remains in a complex situation, with external uncertainties on the rise, the statistics bureau said, adding China will work to ensure steady growth.

China's power output rose for the second month in June with a 4.4% increase from the month prior, statistics data show.

Chairperson of the African Union (AU) Commission Moussa Faki Mahamat (C) announces the operational phase of the African Continental Free Trade Area (AfCFTA) Agreement during the launching ceremony in Niamey, capital of Niger, July 7, 2019. (Str/Xinhua)

ACCRA, July 15 (Xinhua) -- It would be prudent for Chinese manufacturing firms that export to Africa to relocate to the continent under the African Continental Free Trade Area (AfCFTA) agreement, Ekwow Spio-Garbrah, Ghana's former trade minister has said.

He told Xinhua that this was necessary for China to retain its trading ties with the continent with the expected boom in intra-African trade.

"The incoming arrangement is going to make tariffs lower and eventually non-existent to make it more affordable for African countries to import from one another's countries, than from outside the continent," the former minister said.

For that reason, he said Chinese manufacturers such as rubber processing, textile manufacturers, oil palm mills, and furniture companies that sourced their raw materials from Africa would be far better off locating themselves in Africa.

"This will make them derive benefits from the boom in intra-African trade under AfCFTA," he said.

Spio-Garbrah said there was a need for the manufacturing firms that would relocate to Africa to include metals such as steel, aluminum, and copper, as well as products that used a lot of pulp and paper, plastics and agro-based raw materials, which were abundant on the continent.

"The Chinese government can give special incentives and low-interest loans to Chinese companies which relocate to Africa, to be closer to raw materials; then process the raw materials and export to African countries as well as back to China," the former minister said.

“Citizens are just outraged and this makes it easier for people to decide to go seek opportunity outside the state,” Halbrook told the Chambana Sun. “These tax policies and all the other policies are driving people out of their homes. They just can’t afford to live here anymore and none of this stuff that was passed this spring puts us on better financial footing.”

Illinois state Rep. Brad Halbrook (R-Shelbyville) wonders how long Illinois can survive with policies like the new $85 billion state budget just signed into law by Gov. J.B. Pritzker setting the tone for the way the state operates.

With Illinois Policy Institute (IPI) reporting that the so-called Rebuild Illinois part of Pritzker’s spending plan is filled with pork-barrel projects with questionable, perhaps politically driven motives, Halbrook laments that things may get worse before they have a chance to get better. Of the $45 billion set aside for the capital spending part of Pritzker’s state budget, IPI reports that upwards of $50 million has been set aside for such projects as noise abatement at the Chicago Belt Railway Yard in House Speaker Mike Madigan’s (D-Chicago) home district, capital improvements grants to parks and recreational units and funding for the Illinois Arts Council chaired by Madigan’s wife, Shirley.

Halbrook said the abuse hardly ends there.

“It’s interesting that as a result of this capital bill, the representative from Kankakee [Sue Scherer-D] can give $3 million to her park district's water park when there is rebar showing up on the roads around the area,” he said. “We gave $3 million to a water park when highways need repair.”

Halbrook said it also baffles him how lawmakers in Springfield could be asking taxpayers for more from their pockets to cover all the added costs when so many of them are already expressing their displeasure by putting the state in their rearview mirrors.

“When the citizens of Illinois are leaving in droves, we continue to ask them for more with things like this gas-tax increase,” he said. "Unless we correct something soon, we’re going to continue to have a smaller population in the state of Illinois and I think it’s going to mean less wage earners and less employers and more taxes and fees.”

Rio Tinto on Tuesday flagged a cost blowout of up to $1.9 billion and a delay of up to 30 months at its Oyu Tolgoi underground copper mine in Mongolia, the miner’s key growth project.

Rio said the delay stemmed from the project’s challenging geology. It expected to determine the preferred mine design, along with a final estimate of cost in the second half of 2020, and was also reviewing the value of its investment.

The cost blowout was bigger than analysts had expected after the company had earlier flagged issues with the original mine design.

Rio said first production could be achieved between May 2022 and June 2023, a delay of 16 to 30 months, while the capital cost of the project was estimated at $6.5 billion to $7.2 billion, up from an original estimate of $5.3 billion.

“It is a world class orebody in terms of the size, the grade etc. What we are trying to work out now, is can it be developed and mined economically to convert what is a world class orebody into world class mine,” said Glyn Lawcock, analyst at UBS.

“Overall, it was below our expectations for the quarter.”

The news of the blowout came as Rio reported a 3.5% drop in second-quarter iron ore shipments, as disruptions caused by tropical cyclone Veronica in late March squeezed output in the April-June period.

The company shipped 85.4 million tonnes of the steelmaking ingredient in the quarter ended June 30, down from 88.5 million tonnes a year earlier. Brokerage UBS had estimated quarterly shipments of 85.2 million tonnes.

Veronica ravaged the coast of Western Australia earlier this year, damaging several iron ore export hubs and prompting Australia’s biggest listed miners to cut their 2019 forecast for iron ore output.

Rio on Tuesday maintained its annual iron ore exports forecast in the 320 million to 330 million tonnes range.

In Mongolia, the miner said it had made significant progress at Oyu Tolgoi during 2019.

“The ground conditions are more challenging than expected and we are having to review our mine plan and consider a number of options,” said Stephen McIntosh, Group executive, Growth & Innovation.

“Delays are not unusual for such a large and complex project,” he added.

Rio said it was reviewing the carrying value of its investment in Oyu Tolgoi and would announce if any changes were needed at its half-year results on Aug. 1.

India’s imports declined to their lowest level in four months in June to $40.29 billion, down 9% from a year ago, indicating weakening consumption in Asia’s third largest economy, economists said.

The Indian economy grew at 5.8% in the January-March period, a five-year low, hurt by weak consumption and tepid private investment. The latest data added to fears that the economy may have slowed further in April-June.

In the last two quarters, the Indian economy has seen a sharp fall in sales of automobiles, petroleum products and consumer goods.

India’s oil imports during June fell 13.33% to $11.03 billion, partly due to low oil prices, while gold imports surged 13% to $2.70 billion.

Imports excluding gold and oil also fell 9% to $26.57 billion in June 2019, the data showed.

“This (falling imports) is not a positive sign ... this is a serious kind of slowdown,” said Rupa Rege Nitsure, chief economist at L&T Financial Holdings.

India’s merchandise exports also fell in June, for the first time in nine months, by a year-on-year 9.71% to $25.01 billion, narrowing the trade deficit for the month by 8% to $15.28 billion.

Economists linked the weakness in exports to a trade war between the United States and China and the protectionist measures taken by countries.

“(The) de-growth in exports is a reflection of sluggish global demand and rising tariff war ... US-China trade war and developments in Iran further aggravated the problem of the world economy,” Sharad Kumar Saraf, president of the Federation of Indian Export Organisations, said in a statement.

Partial shutdowns at Reliance Industries, operator of the world’s biggest refining complex in western Gujarat state, and at Managalore Refinery and Petrochemicals Ltd dragged down India’s exports for refined products, trade secretary Anup Wadhawan said.

Exports of commodities, excluding oil and precious metals, also fell 4.86% to $19.15 billion in June from a year ago.

biofuels

Biofuels and Carbon Offsets Power Delta’s First Carbon-Neutral Flights

Delta partnered with Air BP to supply biofuels for an initial 20 delivery flights from the Airbus final assembly line in Mobile, Alabama, which are manufactured and refined via sustainable sources and processes. The first flight flew from Mobile to Kansas City where final induction work will be performed before the aircraft moves into service for Delta’s customers across its domestic route network.

“This delivery flight was a milestone on Delta’s sustainability journey as we work to cut carbon emissions in half by 2050,” said Alison Lathrop, Delta’s Managing Director – Global Environment, Sustainability and Compliance. “We are excited to partner with Air BP and Airbus to power these delivery flights with biofuels and carbon offsets, and will explore opportunities to bring this level of sustainability to all delivery flights going forward.”

Since 2005, the airline has reduced its jet fuel consumption, leading to an 11 percent decrease in emissions as it works toward its long-term goal of achieving carbon-neutral growth and reducing carbon emissions by 50 percent by 2050.

“Airbus is committed to being part of the solution for meeting aviation’s global CO 2 emissions reduction targets,” said Simone Rauer, Head of Aircraft Operations for Environmental Affairs at Airbus. “Contributing to a lasting decrease of our industry’s carbon footprint is key to ensuring a sustainable future for aviation.”

Delta is also recycling aluminum cans, plastic bottles and cups, and newspapers and magazines from aircraft, accounting for the recycling of more than 3 million pounds of aluminum from onboard waste. The airline is also removing a variety of single-use plastic items, including stir sticks, wrappers, utensils and straws from its aircraft and Sky Clubs, and has removed all plastic wrapping from international Main Cabin cutlery and its new amenity kits for all cabins. These efforts will divert over 300,000 pounds of plastic from landfills each year.

This sustainability work and more has resulted in Delta being awarded the Vision for America Award by Keep America Beautiful in 2017 and the Captain Planet Foundation’s Superhero Corporate Award in 2018, as well as being named to the FTSE4Good Index four consecutive years and the Dow Jones Sustainability North America Index for eight consecutive years.

Source: Xinhua| 2019-07-16 22:22:06|Editor: huaxia

Video Player Close

HEFEI, July 16 (Xinhua) -- A train goes between rocky cliffs, up into the clouds and emerges on the other side with a view of mountain peaks shrouded by white clouds. Such video clips about Mount Huangshan as above have captivated millions on Chinese social media.

Mount Huangshan in east China's Anhui Province, with its imposing scenery and vast number of works of art and literature inspired by it, has won an entry on the UNESCO World Heritage List for cultural value and natural scenery. It, however, has another lesser known role -- the place where China's modern mass tourism took off 40 years ago.

Aerial photo taken on July 11, 2019 shows a view of Mount Huangshan at sunrise, in east China's Anhui Province. (Xinhua/Tang Yang)

In July 1979, the then Chinese leader Deng Xiaoping paid a visit to the mountain at the age of 75, where he called for all-out efforts to accelerate the nation's tourism development in a number of speeches during the visit.

Today, tourism has become one of China's important economic drivers. About 5.5 billion trips were made in China in 2018, contributing nearly 10 trillion yuan (1.45 trillion U.S. dollars) to the country's GDP, or 11 percent, according to statistics given by the Ministry of Culture and Tourism.

More than 3.3 million people visited Mount Huangshan in 2018. Forty years ago, the number was around 100,000. Over the years, the government has been improving services, infrastructure, as well as protection of the site.

ECONOMIC BOOST

In the late 1970s, China was at the beginning of its reform and opening-up. Tourism was still a new sector in the country. Many locals didn't see the tourism value of this mountain. Some even took it as a kind of obstacle since it hindered agricultural activity.

Pan Meili, manager of a local four-star hotel, was born in 1969 in a small village at the foot of Mount Huangshan, where all people used to make a living on farming.

Aerial photo taken on July 11, 2019 shows a view of Mount Huangshan and villages at its foot, in east China's Anhui Province. (Xinhua/Tang Yang)

After 1979, the villagers started to realize the economic benefits of tourism as more tourists came. Pan's parents also saw the potential of tourism and opened a family hotel.

"There were only three rooms in the family hotel which could accommodate at most 10 guests," said Pan.

Tourism gradually replaced farming in the village to be the main source of income. In the 1980s, almost everyone in the village was doing something related to tourism, such as running hotels, restaurants, souvenir shops, or working as tour guides.

"We are contributors as well as beneficiaries of tourism associated with Mount Huangshan," Pan said.

IMPROVED SERVICES

Services have been improved in the mountain for facilitating visits to the site.

"It took me 10 hours to climb to the top the first time I came to Huangshan. But we rode the cable car this time. It's much easier," said Weimar Arcila, a businessman from Colombia who is on his sixth trip to Mount Huangshan over the past decades.

Cable car service at Mount Huangshan began in 1986, which could transport people to the top in just eight minutes.

Workers perform a maintenance check of a cableway at Mount Huangshan, in east China's Anhui Province, Sept. 22, 2018. (Xinhua/Tang Yang)

Today cable car service has expanded to four cableways, including a sightseeing rail track service, to connect different parts of the mountain. The sightseeing train rose to fame after a video went viral on TikTok, a short video-sharing app, showing breathtaking views of rocks and pines in the midst of clouds when the train goes from the peak to the valley.

As more people flock to Mount Huangshan, the administration has also added options for tourists to scan a QR code and buy tickets on their cellphones.

After spending a day on the mountain, Arcila and his family decided to stay at Yupinglou Hotel for the night, at about 1,700 meters above sea level. As an old patron of the hotel, he was amazed by its recent changes.

"The hotel has been renovated. We established an art gallery displaying the history and culture of Mount Huangshan," said Pan, the hotel manager. The hotel also offers cultural activities such as tea ceremony, yoga and Taichi lessons every night at the lobby.

GREEN DEVELOPMENT

With more and more tourists, the administration for Mount Huangshan has rolled out a series of policies to strike a balance between tourism promotion and conservation, such as introducing a cap on the daily tourist number at 50,000.

Aerial photo taken on July 11, 2019 shows the Bright Summit of Mount Huangshan, in east China's Anhui Province. (Xinhua/Tang Yang)

"More tourists mean more money, but we can't be greedy. We're pursuing sustainable development," said Ge Xufang with Mount Huangshan scenic area management committee.

The administration for the mountain pioneered the practice to alternately open different tourist sites to the public in 1987. The practice was later adopted by administrative authorities of other mountain scenic spots in the country.

Lotus Peak, the highest of Mount Huangshan, was reopened to tourists this March after closing for five years, while another site Tiandu Peak was subsequently closed to tourists for maintenance.

The Mount Huangshan scenic area is also home to plenty of old and rare trees, out of which 137 are under special protection. Different measures have been adopted for protection of different trees, according to Ge.

Not far from Yupinglou Hotel stands the Greeting Pine, one of China's most well-known trees. The pine tree, growing out of the rocks with a long branch extending over the mouth of a cave, got the name mainly because it appears to be greeting anyone who arrives on the scene. It is believed to be between 800 and 1,000 years old.

To protect the pine, the local government has introduced a system of designating guardians or rangers. The first guardian was appointed in 1981. The tradition has been going on ever since.

Hu Xiaochun, the 19th guardian of the Greeting Pine, examines the tree on Mount Huangshan in east China's Anhui Province, Nov. 2, 2018. (Handout via Xinhua)

"Normally I check the tree and record details of its condition every two hours. I will nonetheless check it every 30 minutes in extreme weather when strong winds blow and heavy snow hits the mountain," said Hu Xiaochun, the pine tree's 19th guardian.

"The work can be boring if you simply view the pine as a tree, but it's a different story if you see it as a senior member of your family," said Hu. "I treat it the same way I would my own family." Enditem

(Video Reporter: Liu Fangqiang, Qu Yan, Shui Jinchen, Tang Yang; Video Editor: Zheng Xin)

BHP Group Ltd (BHP.AX), the world’s biggest miner, on Tuesday reported a rebound in iron ore output in the fourth quarter after a cyclone hit production in March, and forecast modest output growth in 2019/20 amid a surge in prices.

BHP met its revised target for iron ore production, but flagged $1 billion in productivity losses for fiscal 2019 in its quarterly production report, flowing from disruptions to operations across its commodities.

The Anglo-Australian miner’s iron ore output fell to 71 million tonnes during the fourth-quarter ended June 30, compared with 72 million tonnes a year earlier. The figure was below a UBS estimate of 72.6 million tonnes, but up 12 percent on the March quarter.

Production across its suite of commodities broadly recovered from March, which is typically the weakest quarter due to Australian weather conditions.

“Generally speaking, it’s just a little bit softer than we expected, although it’s strong sequentially,” said analyst Glyn Lawcock at UBS in Sydney.

“If you look at their guidance it’s highlighting that they aren’t really growing their volumes, so that means price is key going into next year.”

Miners have benefited from iron ore prices at five-year highs, after a dam disaster in Brazil led to a global shortage of the steel-making ingredient. Analysts expect some of the windfall profits to be passed on to shareholders when Australian miners report their profits next month.

BHP forecast iron ore production at 273 million to 286 million tonnes for the 2020 fiscal year, a 1%-6% increase from 2019 production of 270 million tonnes, which was slightly down from 275 million tonnes for 2018.

The iron ore shortage was exacerbated after Cyclone Veronica tore down the coast of Western Australia in March, hitting several iron ore export hubs, in a return of more turbulent weather after several moderate years.

BHP was on track with its growth projects, Lawcock noted, after Rio Tinto flagged a cost blow out at its key growth copper project in Mongolia when it reported on Tuesday.

The $1 billion in productivity losses followed flooding in Australia’s Queensland state that hit BHP’s metallurgical coal operations, as well as changes to its Nickel West mine plan and higher costs in thermal coal, it said.

That added to disruptions mostly at its Australian operations in the first half that included an acid plant outage Olympic Dam, a fire at its Kalgoorlie nickel smelter, and a train derailment.

The figure did not include disruptions from Cyclone Veronica BHP said.

In other metals BHP forecast around a 9-4 percent decline in petroleum production and growth of 1-8 percent in copper over the next financial year. It forecast a decline in energy coal output.

The German ZEW headline numbers for July showed that the economic sentiment index came in at -24.5 versus -22.3 expectations and -21.1 last. While the sub-index current conditions figure unexpectedly dropped to -1.1 in July versus 5.0 expected and 7.8 booked previously.

ZEW President Professor Achim Wambach noted: “In particular the continued negative trend in incoming orders in the German industry is likely to have reinforced the financial market experts’ pessimistic sentiment. A lasting containment of the factors that are causing uncertainty in the export-oriented sectors of the German economy is currently not in sight. The Iran conflict seems to be intensifying and the ongoing trade dispute between the USA and China is a burden not only to Chinese economic development. Furthermore, no discernible progress has been made in the negotiations as to what Brexit will look like.”

Meanwhile, the Eurozone ZEW economic sentiment for July arrived at -20.3 vs. -20.9 expected and -20.2 last.

Shares of Rio Tinto PLC (NYSE:RIO) closed 1.76% lower at $60.43 on Tuesday after the company released production results for the second quarter.

Due to Cyclone Veronica’s impact on operations in Western Australia in March, bad weather conditions in Quebec in the first quarter and lower copper ore grades processed in Utah and Chile, Rio Tinto generated less iron ore shipments and copper production volumes.

The production of mined copper decreased 13% to 137,000 tons and shipments of iron ore produced from the asset located in the Pilbara region of Western Australia also fell 3% year over year to 85.4 million tons. Copper equivalent production for the first part of the year saw a 2% decline.

The company was also forced to lower 2019 guidance for Pilbara iron ore shipments and for the Canadian production of iron ore pellets and concentrate.

Rio Tinto guided for Pilbara iron ore shipments of 320 million to 330 million tons at a higher unit cost of $14 to $15 per tonne versus, down from the previous forecast of 333 million to 343 million tonnes at a unit cost of $13 to $14 per tonne. The miner forecasted Canadian iron ore production of 10.7 million to 11.3 million tonnes compared to the previous range of 11.3 million to 12.3 million tonnes.

In contrast, as a result of several operating improvements, titanium dioxide slag production grew 31% to 303,000 tons and bauxite production increased 1% to 13.4 million tonnes. Production of aluminium, at 0.8 million tonnes, was flat compared to the prior-year quarter.

Additionally, Rio Tinto said it will allocate approximately $509 million to the development of mineral projects located in South Africa and Arizona.

The stock had a market capitalization of about $102.77 billion at close on Tuesday, a price-book ratio of 2.38 versus the industry median of 1.46 and an enterprise value-Ebitda ratio of 5.90 compared to the industry median of 8.36.

Following a 10% rise for the 52 weeks through July 16, the share price is now slightly off the 100- and 50-day simple moving average lines and far above the 200-day line.

The 52-week range is $44.62 to $64.02.

Wall Street issued a hold recommendation rating for shares of Rio Tinto with an average target price of $80.01, reflecting 31.6% upside from Tuesday’s closing price.

Disclosure: I have no positions in any securities mentioned.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

About the author:

CSX Corp (CSX.O) on Tuesday posted quarterly profit that missed Wall Street’s target and cut its full-year revenue forecast after weakness in its trade-related intermodal business weighed on results.

CSX now expects 2019 revenue to fall 1%-2%. The Jacksonville, Florida-based company previously anticipated growth of 1%-2%.

Results from the third-largest U.S. railroad landed amid worries that a “freight recession” is under way in the U.S. transportation industry, which is broadly viewed as an economic bellwether.

U.S. truck and rail freight volumes were down in the first half of 2019 and appear to be deteriorating further as President Donald Trump’s ongoing trade war with China takes a toll on Main Street shopkeepers, Midwestern farmers and other domestic businesses.

“Analysis of U.S. rail traffic trends shows that most commodity groups have seen declines worsening in recent weeks,” CFRA Research analyst Jim Corridore said in a client note.

CSX Chief Executive James Foote told Reuters the economy is flashing “confusing” signs as U.S. companies grapple with uncertainty created by U.S. trade policies and other issues.

“There’s been a lot of angst and noise in the marketplace,” Foote said.

An 11% drop in intermodal - the segment that includes freight that moves from cargo ships or trucks to railroads - dragged CSX’s total revenue down 1% to $3.06 billion during the second quarter. CSX executives attributed a portion of the intermodal declines to the revamping of intermodal routes to boost profits.

U.S. importers, including retailers and automakers, late last year stockpiled goods made in China to avoid the Trump administration’s new tariffs.

Cargo container volumes at U.S. seaports are easing off 2018’s record levels as importers work through those inventories.

CSX serves most of the eastern third of the United States, including seaports in New York/New Jersey, Virginia and South Carolina.

Revenue from coal and metals shipments also were down during the quarter. Separately, a massive fire closed Philadelphia Energy Solutions Inc’s large East Coast oil refinery, affecting 1% of volume at CSX.

Net income slipped 0.8 percent to $870 million, or $1.08 per share, for the second quarter. Analysts had expected a profit of $1.11 per share, according to Refinitiv IBES data.

CSX’s pricing held up during the second quarter, but investors are bracing for a potential downturn as competing long-distance truck rates fall.

AAR reported that the overall rail traffic volumes for  rail carriers fell 5.6% YoY in week 28.

rail carriers fell 5.6% YoY in week 28.

The index contracted 24 out of the last 25 weeks.

Link: https://bit.ly/2LqUIO2

Swedish engineering group Sandvik reported quarterly operating earnings below market expectations on Wednesday and said it would cut around 2 000 jobs to buttress profitability in the face of early signs of slowing market demand.

Sandvik said it had seen weaker demand in its parts of its business, primarily from customers in the automotive and general engineering sectors, towards the end of the second quarter.

"We will take further action in all business areas to deliver strong margins long-term," Sandvik CEO Bjorn Rosengren said in a statement. "These activities will be promptly implemented and include a personnel reduction of approximately 2 000."

Operating earnings at the maker of metal-cutting tools and mining gear maker edged up to 5.08-billion Swedish crowns ($542-million) from 5.04 billion in the year-ago quarter, but came in below the 5.18-billion mean forecast in a poll of analysts based on Refinitiv data.

Sandvik said the results had also been boosted to the tune of 110-million crowns due to an adjustment of the purchase price of a previously announced sale of one of its smaller businesses.

The company's order bookings fell 5% on a like-for-like basis, compared with the 6% growth reported for the first quarter of the year.

China will take targeted measures to implement production halts on high energy-consuming industrial companies in a bid to encourage more environmentally friendly production, the Economic Information Daily reported Thursday.

Authorities are mulling a rating scheme for firms in 15 key industries including steel, coal and cement, and those with the highest pollutant emissions will be subject to the strictest production limits, the Xinhua-run newspaper said.

Those with an A-rating, the highest, will be required to suspend production only in extreme weather, while the C-rated companies will be subject to additional bans during the winter heating season, when pollution is the most severe.

Such measures will incentivize some high energy-consuming companies to upgrade their pollution-control facilities, analysts said.

China has launched a series of campaigns to fight pollution and environmental degradation, with thousands of officials punished for environmental damage following inspections by central authorities.

While implementing strict policies, authorities have reiterated that no "one-size-fits-all" approach should be adopted to address environmental issues, and blanket shutdowns of industrial activities are not acceptable.

According to Liu Bingjiang, an official with the Ministry of Ecology and Environment, the rating scheme would address the "bad money drives out good" problem, as some high-emission steel firms currently invest far less in environmental protection than their low-emission counterparts.

"There is no way to implement the same control policies with these companies," Liu said.

China will continue to implement strict production control policies during this coming winter as the country is expected to meet many environmental targets next year, said Li Xinchuang, head of the China Metallurgical Industry Planning and Research Institute.

As the basis for their challenge, Environmental Petitioners contended that payment by generators of hazardous secondary materials to a reclaimer to accept such materials meant that in all cases the hazardous secondary materials were “discarded." Under RCRA and the long line of RCRA regulatory definition of solid waste cases, materials can only be “solid” and “hazardous wastes” and subject to full RCRA Subtitle C regulation, if they are “discarded.” Environmental Petitioners argued that any ambiguity about the meaning of “discard” does not extend to materials generators pay to get rid of which “fall so easily into the ordinary meaning of discarded.” The D.C. Circuit rejected Environmental Petitioners’ claims under a traditional Chevron step one and step two analysis and an Administrative Procedure Act (APA) arbitrary and capricious analysis.

On January 23, when US-backed opposition leader Juan Guaido declared himself interim president of Venezuela, he thought deposing President Nicolas Maduro from power would be easy.

He had a simple, three-thronged plan: declare Maduro's presidency illegitimate by exposing the irregularities in the election that brought him to power, establish a transition government, and hold new elections that would bring the opposition to power.

However, almost six months on, Guaido is not any closer to loosening Maduro's grasp on power. The main reason behind the 35-year-old opposition leader's failure to bring Maduro down is the support that some prominent international powers, most significantly China, have given to the Venezuelan government.

China, a global power with significant financial and military ties to Venezuela, refused to recognise Guaido's presidency on the grounds that doing so would amount to intervening in the internal affairs of a sovereign state.

Guaido's foreign backers, the US chief among them, interpreted China's stance on the issue as support for Maduro and his government and even implied that China is responsible for the ongoing crisis in Venezuela. On April 13, for example, during a visit to Chile, US Secretary of State Mike Pompeo said that he believes "China's bankrolling of the Maduro regime helped precipitate and prolong the crisis in that country." More recently, US Southern Command Chief Admiral Craig Faller claimed that Chinese support to Venezuela in the form of surveillance technology has been “used to monitor and repress the Venezuelan people".

Meanwhile, acknowledging the important role China has been playing in the ongoing crisis, Guaido started a campaign to convince Beijing to end its support for the Chavista government.

Only a day after Pompeo's criticism of China, the self-declared interim president published an op-ed in Bloomberg titled, Why China Should Switch Sides in Venezuela. In the article, Guaido argued that the opposition government would protect China's interests and investments better than the Chavistas and pledged to give China new financial incentives in Venezuela if it agrees to seize its support to the current government.

Guaido's article and Pompeo's statements only confirm a fact many Venezuela watchers have been aware of for a very long time: China's political stance is the key factor that will determine the future of Venezuela.

Why is Venezuela important to China?

While Beijing is an indispensable economic and political partner to Caracas, the Latin American nation is also very important to China.

China views the oil-rich socialist country as a significant trading partner and a geopolitical ally in its main political and economic rival US's backyard. Moreover, the investments Beijing made in the country in the last couple of decades made Venezuela an important component in China's future economic prosperity and energy security.

Cooperation between China and Venezuela began to grow significantly following Hugo Chavez' ascent to power in 1999. Following Chavez' death in 2013, the good relations between the two nations continued under Maduro's presidency. From 2000 to 2018, the trade between the two countries increased more than 20-fold and the value of Chinese direct investment to the country reached $6bn. Meanwhile, the total value of Chinese loans to Venezuela surpassed the $60bn mark.

The majority of China's loans to and investments in Venezuela have been related to the oil sector. In 2007, Beijing created the China-Venezuelan Joint Fund (FCCV), which allowed Venezuela to receive loans from China in tranches of up to five billion dollars, and pay them with shipments of crude oil. The FCCV allowed the Chinese government to get involved in oil production in the Orinoco Oil Belt, which is considered to be the world's largest oil reservoir.

Why is China still standing by Maduro?

Having accumulated a significant amount of debt over the past two decades, Venezuela is struggling to repay Chinese loans, as its oil production continues to decline due to the ongoing crisis casts. This puts China's economy and energy security at risk. Meanwhile, the majority of Chinese direct investments in Venezuela have either been put on hold or completely abandoned due to the unfavourable conditions for business in the country.

Acknowledging the risk it is currently facing in Venezuela, China reevaluated its objectives and limited the issuing of new infrastructure loans in the country. It focused on financing mixed enterprises that it has created in partnership with Venezuela's state-owned energy firm Petroleos de Venezuela SA. It has also increased the mechanisms of control over the final use of the credit issued to Caracas.

Despite these challenges and the risk of suffering potential economic losses, Beijing continues to stand by the Maduro government, at least for now. The official reason behind this position is that the Chinese government is not willing to intervene in a sovereign nation's internal affairs. However, this cannot explain its motivation to continue supporting the embattled Venezuelan president at a great cost to its economy.

Unofficially, there are a number of other reasons. Beijing is still siding with the Venezuelan government because it believes having a like-minded socialist ally in the US' backyard is more important than any costs it may incur as a result of the ongoing Venezuelan crisis.

Additionally, "south-south cooperation" is currently one of the mainstays of China's foreign policy and Beijing does not want to risk its reputation as a leading trading partner and trustworthy investor in the global south by siding with a US-backed opposition group and supporting its attempt to unlawfully topple the legitimate government of a sovereign country.

Moreover, despite Guaido's best efforts, China has no reason to trust the Venezuelan opposition. For years, the position of the opposition regarding Venezuelan debt commitments to China has been ambiguous. Today, Beijing has no reason to believe that after taking power the opposition would agree to pay back the debts accumulated under Chavista governments.

The Venezuelan opposition's close relations with the Trump administration is another reason why China continues to support Maduro. The Chinese government does not believe Venezuelan elites who appear to be under the tutelage of the Trump White House would protect its interests in Venezuela or in the wider region.

China's position, however, is not set in stone. Guaido and his supporters can still convince the Chinese to change their mind by distancing themselves from the Trump administration and providing some form of reassurances that they would honour Venezuela's financial commitments to China.

If the opposition indeed finds a way to win the trust of Beijing, it would have a much better chance at challenging the Chavistas and eventually taking power in Venezuela.

The views expressed in this article are the author's own and do not necessarily reflect Al Jazeera's editorial stance.

‘Crude’ front is heating up. Events are beginning to happen, and, in quick succession. Ominous clouds could be seen hovering all around.

Amid, escalating UK-Iran tensions, the UK is deploying a second warship in the Persian Gulf, where reportedly, three Iranian boats had attempted last Thursday to “impede the passage” of a British oil tanker, forcing the UK warship HMS Montrose to intervene. However, Iran’s Revolutionary Guards denied the incident. “There has been no confrontation in the last 24 hours with any foreign vessels, including British ones”.

This happened in the backdrop of reports that the British Royal Marines had seized an Iranian crude supertanker off the coast of Gibraltar, carrying oil to Syria, in contravention of the ‘EU sanctions’ against Bashar Al-Assad.

The Government of Gibraltar later confirmed that the Iranian supertanker was laden with 2 million barrels of crude oil. Iran however, insisted the tanker was in international waters, not headed to Syria, and the seizure was done at the behest of the United States.

Iranian Foreign Ministry spokesman in a tweet said, that the British Ambassador Rob Macaire was summoned over the “illegal interception”. Tehran also vowed to retaliate. “It will be reciprocated, at a suitable time and in a suitable place,” Mohammad Bagheri, the chief of staff for Iran’s armed forces warned.

In a precautionary move, BP Plc was reportedly keeping an oil carrier empty inside the Persian Gulf, close to Saudi Arabia, rather than risk its seizure by Iran.

In the meantime, the London based Al-Araby Al-Jadeed reported that the Egyptian authorities have also detained a Ukrainian tanker carrying Iranian crude, as it was passing through the Suez Canal. News of the seizure came a day after Egypt’s Supreme State Security Criminal Court sentenced six people to jail on charges of spying for Iran.

Since early May, six oil tankers have been attacked, near the strategically important Straits of Hormuz. The U.S. and its allies blamed Iran for the incidents, a charge that Tehran denies. The temperature gauge is beginning to turn red.

Consequent to all this, tankers are shunning the port of Fujairah in the UAE, the main refuelling hub of the Middle East, Bloomberg quoted traders as saying.

Tanker owners were worried about the situation and were opting to refuel elsewhere. Insurance premiums are going up. The port of Fujairah, Matt Stanley from Dubai-based Star Fuels told Bloomberg, is experiencing “a significant drop in demand owing to war-risk premiums”. Insurers were quick to raise premiums after the tanker attacks. Between the end of May and the middle of June, tanker insurance premiums jumped by between 5 and 15 percent, Oilprice reported.

In another related development, late in June, Iran shot down a US drone, allegedly launched from the UAE territory, claiming it was violating the Iranian airspace. This made the temperature only rise. President Trump opted out of the retaliatory strikes, literally minutes before they were to take place.

On the other hand, while the US continues to insist on its maximum pressure campaign, Iran has so far managed to keep its oil exports from collapsing to zero. The Iranian Oil Minister Bijan Zanganeh is hopeful of improvement in its crude exports. “I am very hopeful that our oil exports will improve,” Zanganeh told the Iranian state TV.

Battling what he called “the most severe organised sanctions in history,” Zanganeh last week vowed to keep selling oil via “unconventional means”. As the New York Times reported, some oil tankers have recently resorted to switching off their transponders as they enter the Persian Gulf, likely loading up with Iranian oil and then heading out towards markets in Asia.

Despite Washington’s ‘zero tolerance policy’, China and Turkey appear to be the most obvious destinations for the Iranian crude. The Islamic Republic state TV recently aired a programme showing an Iranian-flagged tanker, delivering one million barrels of crude oil to China, despite the sanctions.

Kpler, a firm that tracks the movement of oil tankers, told media that Iran exported 186,000 barrels per day of oil to China in June. It said the oil tanker Salina delivered 1.05 barrels of oil to China and another Iranian tanker, The Horse, 2.13m barrels of crude to Chinese ports. Turkey in the meantime, has also received 1.03m barrel shipment from Iran, the report added.

Interestingly, power politics continue to rule the world while the hawks in Washington appear least bothered. And as a battle of ‘crude’ wits is on, disastrous and unintended consequences remain very much a possibility.

Published in Dawn, July 14th, 2019

Delivered 380 CST bunker fuel premium in Singapore has jumped to the highest level in more than 16 years, as it continued to trend up steadily since end-June, S&P Global Platts data showed Friday.

Stay up to date with the latest commodity content. Sign up for our free daily Commodities Bulletin.

Sign Up The Singapore delivered 380 CST bunker premium over MOPS 380 CST HSFO rose to $33.57/mt at Thursday's close, and was last higher at $34.13/mt on March 20, 2003, Platts data showed.

A stronger fuel oil market helped bunker premiums to rise steadily in July so far, buoyed by tight availability for prompt delivery dates, market sources said.

"Cargo premiums are already at crazy highs and backwardation was never this steep before," a bunker trader said.

The Singapore 380 CST HSFO August/September timespread was assessed at $35.75/mt at Thursday's close, a record-high 380 CST timespread to date.

Singapore is expected to receive only 2.5 million-3 million mt of fuel oil cargoes from Europe and the US in July, down from around 4 million mt/month earlier in the year, according to estimates from traders.

The inflow of arbitraged cargoes in August will also remain low as the arbitrage window had been shut amid supply tightness at Rotterdam, traders added.

While some traders said they did not wish to bring in high sulfur fuel oil cargoes owing to current steep backwardation, others were increasingly looking to switch to low sulfur fuel oil storage.

"I guess [IMO] 2020 is also a game-changer...most of the VLCCs outside are now storing LSFO," another bunker trader said.

Fuel oil traders in Singapore use VLCCs and other tankers to store fuel oil, while about 20 VLCCs were floating around Singapore as fuel oil storages, according to sources.

China’s crude oil imports on a daily basis in June rose 15.2% from a year earlier, customs data showed on Friday, as the start up of new large-scale refiners spurred demand for feedstocks.

A new plant owned by Hengli Petrochemical, capable of processing 400,000 barrels per day (bpd) of crude, reached full operations in late May, while a similar sized plant owned by Zhejiang Petrochemical has started trial runs.

June imports by the world’s largest crude oil importer came in at 39.58 million tonnes, according to data from the General Administration of Customs.

That works out to 9.63 million bpd, up 1.7% from 9.47 million bpd level in May and up from 8.36 million bpd a year ago.

For the first six months of 2019, crude imports grew 8.8% from a year earlier to 244.6 million tonnes, or about 9.87 million bpd.

June imports rose despite poor margins limiting runs at some plants and amid shut downs for maintenance.

Last month, Sinopec’s 200,000-bpd Luoyang refinery, PetroChina’s 140,000-bpd Jinzhou refinery and a 200,000-bpd Liaoyang Petrochemical plant were shut for planned repairs.

Two coastal refineries under top state refiner Sinopec Corp suffered losses in June for the first time this year, plant sources have said, as they processed higher-priced crude while domestic fuel prices trended lower.

China’s crude oil purchases are expected to be subdued in July as fuel supply from mammoth new refineries stokes an already-sizeable glut.

Customs data also showed China exported 5.43 million tonnes of oil products in June, up 13.5% from a year earlier and rising from 4.49 million tonnes in May, reflecting the growing surplus.

Exports for the first half of 2019 totalled 32.52 million tonnes, up 7.3% from a year ago.

Natural gas imports, including liquefied natural gas (LNG) and pipeline imports, were 7.52 million tonnes last month, the customs data showed, easing from 7.56 million tonnes in May.

Imports of the cleaner fuel have slowed since March from peaks in the winter months when heating demand surges.

Norwegian oil firm Aker BP has made an oil discovery off Norway which could strengthen its hand in negotiations with sometimes partner Equinor on how to develop fields.

Aker BP, formed from a merger of BP’s Norwegian oil assets and the Det norske oil firm controlled by billionaire Kjell-Inge Roekke, said on Thursday it had made an oil discovery with its Polish partner LOTOS.

The find is estimated to hold between 80 million and 200 million barrels of recoverable oil equivalent (boe), in an area with several oil and gas discoveries, nicknamed NOAKA.

Up to 700 million boe are in place overall at the discovery, called Liataarnet, but Aker BP needs to do more work to find out how much it can extract, the company said.

Aker BP and its partner in some of the NOAKA fields, state-controlled Equinor, are at odds about how to develop them.

“This is a clear message to partner Equinor in terms of development solutions for NOAKA. We believe the Liataarnet discovery will improve Aker BP’s negotiation position vs. Equinor,” Sparebank 1 Markets said in a note to clients.

Aker BP shares were up 1% at 0818 GMT, outperforming the STOXX European oil and gas index, which was up 0.3%.

JOHAN SVERDRUP

Aker BP and Equinor are also partners in the Johan Sverdrup oilfield off Norway, which is scheduled to start production in November.

The biggest oil find made off Norway in more than three decades, Sverdrup could start earlier than planned, Aker BP CEO Karl Johnny Hersvik said during an earnings presentation.

“I am really happy about the progress on Johan Sverdrup,” he said. “The start-up is going according to plan and we could even start earlier than planned ... We have a couple of deadlines coming up (and will know more then).”

Sverdrup, which is likely to account for 25% of the Nordic country’s total petroleum output at its peak in 2022, is co-owned by Lundin Petroleum and Total.

Aker BP also said it would slightly increase its capital and exploration spending this year.

Spending on exploring new oil and gas fields will rise to $550 million this year, from its previous guidance for $500 million. Capital expenditure is now seen in a range of $1.6-$1.7 billion compared with previous guidance for $1.6 billion.

Overall, Aker’s net income fell to $62 million in the second quarter from $128 million a year earlier.

MANILA, Philippines — In separate advisories, oil firms announced gasoline prices would be raised by P1.05 per liter, diesel prices by P0.70 and kerosene by P0.70 per liter.

Caltex Philippines said it implemented its price adjustments across fuel products at 12:01 a.m. today.

Eastern Petroleum, Petro Gazz, Phoenix Petroleum Philippines, Pilipinas Shell Petroleum Corp., PTT Philippines and Total Philippines raised pump prices at 6 a.m.

Other oil companies have yet to announce their respective price increases.

During last week’s trading, global oil prices jumped to near six-week highs as US oil producers in the Gulf of Mexico reduced their output by over half, amid a tropical storm, Reuters reported.

Continuing Middle East tensions also propped up prices last week. These pushed Brent Crude over $66 per barrel.

This is the fourth consecutive week gasoline prices were increased.

Last week, oil companies raised gasoline prices P0.25 per liter, while diesel prices were reduced by P0.40 per liter and kerosene by P0.35 per liter.

Based on Department of Energy data, year-to-date adjustments stand at a net increase of P5.15 per liter for gasoline, P3.30 per liter for diesel and P1.75 per liter for kerosene.

Crude-oil production from seven major U.S. shale plays is forecast to climb by 49,000 barrels a day in August to 8.546 million barrels a day, according to a report from the Energy Information Administration released Monday.

Oil output from the Permian Basin, which covers parts of western Texas and southeastern New Mexico, is expected to see an increase of 34,000 barrels a day in August from July. Shale oil output from the Anadarko and Eagle Ford regions, however, are expected to see slight monthly declines, the report showed.

Here at Zacks, we focus on our proven ranking system, which places an emphasis on earnings estimates and estimate revisions, to find winning stocks. But we also understand that investors develop their own strategies, so we are constantly looking at the latest trends in value, growth, and momentum to find strong companies for our readers.

Of these, value investing is easily one of the most popular ways to find great stocks in any market environment. Value investors use tried-and-true metrics and fundamental analysis to find companies that they believe are undervalued at their current share price levels.

Luckily, Zacks has developed its own Style Scores system in an effort to find stocks with specific traits. Value investors will be interested in the system's "Value" category. Stocks with both "A" grades in the Value category and high Zacks Ranks are among the strongest value stocks on the market right now.

TOTAL S.A. (TOT) is a stock many investors are watching right now. TOT is currently sporting a Zacks Rank of #2 (Buy) and an A for Value. The stock holds a P/E ratio of 9.55, while its industry has an average P/E of 12.94. TOT's Forward P/E has been as high as 11.29 and as low as 8.70, with a median of 9.88, all within the past year.

TOT is also sporting a PEG ratio of 1.08. This metric is used similarly to the famous P/E ratio, but the PEG ratio also takes into account the stock's expected earnings growth rate. TOT's PEG compares to its industry's average PEG of 1.68. TOT's PEG has been as high as 1.61 and as low as 0.71, with a median of 0.98, all within the past year.

Another notable valuation metric for TOT is its P/B ratio of 1.17. The P/B ratio is used to compare a stock's market value with its book value, which is defined as total assets minus total liabilities. This stock's P/B looks solid versus its industry's average P/B of 1.24. TOT's P/B has been as high as 1.35 and as low as 1.04, with a median of 1.17, over the past year.

Finally, investors should note that TOT has a P/CF ratio of 5.44. This data point considers a firm's operating cash flow and is frequently used to find companies that are undervalued when considering their solid cash outlook. This stock's P/CF looks attractive against its industry's average P/CF of 5.90. Over the past year, TOT's P/CF has been as high as 6.72 and as low as 4.93, with a median of 5.59.

Value investors will likely look at more than just these metrics, but the above data helps show that TOTAL S.A. Is likely undervalued currently. And when considering the strength of its earnings outlook, TOT sticks out at as one of the market's strongest value stocks.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report