Copper has been on a wild ride this year. It started the year priced at $3.89 per pound before surging over 33% to reach a record high of $5.20 per pound. Since then, the price has fallen back 13% to $4.51, but still remains significantly

https://seekingalpha.com/article/4725289-taseko-mines-buy-stock-copper-demand-new-florence-mine

By Pratima Desai

London (Reuters) - The uptrend in demand for metals such as copper used in electric vehicles is intact despite doubts raised by the slowdown in EV sales, but estimating numbers is difficult as the market is evolving, commodity trader IXM's head of refined metal said.

Sales of electric vehicles have slowed for reasons including a lack of charging infrastructure and concerns about resale values.

"The electric vehicle industry is new. There are a lot of variables including penetration rates and battery chemistries which makes forecasting demand a guessing game," Tom Mackay said.

"Growth in electric vehicle sales is slowing, but sales are still increasing. It varies from region to region, but overall growth is strong and the demand story for metals is healthy."

According to consultancy Rho Motion, sales of battery EVs and plug-in hybrid EVs rose 32% last year to 13.63 million units, while in the first and second quarters of this year sales were down 25% and up 22% respectively from the previous quarters.

Copper is used in electric vehicle wiring. It is also used in the batteries, which typically contain lithium and depending on the chemistry nickel and cobalt.

"There have been some impressive technological advances in LFP (lithium ion phosphate) chemistry. Some LFP batteries can go for 1,000 kilometres and some can charge up to 80% in 10 minutes," said Mackay, who manages the copper cathode, zinc, lead nickel, cobalt and lithium books at the Swiss-based trader.

LFP batteries were developed for the Chinese market to provide a cheaper alternative to nickel cobalt manganese (NCM). But earlier LFP batteries could not be used for long distances.

"People still believe Western world battery demand will still be predominantly NCM, if only because of the higher value of recycling NCM batteries," Mackay said.

"Recyclability is a very important factor for automakers when deciding what chemistries to use."

Mackay added that the number of people working at IXM globally is lower than before, around 440.

"Focus has been on the quality of people. We exited the aluminium business because it wasn't providing the return we require from the resources."

(Reporting by Pratima Desai; editing by Emelia Sithole-Matarise)

Crude oil prices have reversed some of the gains they made on Monday as traders returned their attention to Chinese demand concerns.

Earlier in the day, oil held on to the gains that saw Brent crude breach $80 per barrel for the first time in months. The benchmarks had booked five straight days of gains amid rising tensions between Israel and Iran.

However, the war premium seems to be fading fast, once again, probably because traders are unwilling to wait for more than a day for Israel’s reaction to Iran’s missile attack last week. The more time passes between attack and retaliation, the weaker oil benchmarks will get, as suggested by Middle Eastern events from earlier in the year.

So, in the absence of anxiety about the Middle East, oil market players are once again turning their attention to the default factor directing prices these days: Chinese demand.

Per a Bloomberg report from earlier in the day, traders had expected more stimulus measures to be announced by the Chinese government at a much-awaited briefing by Beijing’s economic planner. Those expectations were apparently present despite a recent announcement of stimulus measures by the Chinese government.

“Crude is not getting the love from China that Chinese equities are,” Vishnu Varathan, head of Asia economics and strategy for Mizuho Bank, told Bloomberg. “Perhaps because the path of least resistance for the liquidity deluge is to the equity markets”

Some believe, however, that the price retreat today is a result of a reconsideration of the risk for oil supply disruption in the Middle East. “The geopolitical tensions in the Middle East rock on, but there has been some paring of exposure lately on some expectations that any disruptions to energy supplies may be more measured,” IG marketing strategist Yeap Jun Rong told Reuters.

Indeed, some observers have argued that it would be counterproductive for Israel to disrupt oil supply in the region—and the world—especially ahead of the U.S. elections. This has suggested a moderate rather than severe response to Iran.

By Irina Slav for Oilprice.com

https://oilprice.com/Latest-Energy-News/World-News/Oil-Prices-Drop-as-War-Premium-Fades.html

(Alliance News) - Central Asia Metals PLC on Wednesday said copper, zinc and lead production has fallen in the nine months to date, due to challenges posed by a new mining system at Sasa.

The London-based owner of Kounrad SX-EW copper project in central Kazakhstan and Sasa zinc-lead mine in North Macedonia said Sasa is now expected to achieve output towards the lower end of 2024 guidance, which currently stands at zinc-in-concentrate production between 19,000 and 21,000 tonnes, and lead-in-concentrate between 27,000 and 29,000 tonnes.

Kounrad is on track to achieve its full-year guidance for copper production, which stands between 13,000 and 14,000 tonnes.

Overall copper production for the first nine months of 2024 has fallen 1.2% to 10,248 tonnes from 10,377 tonnes for the same nine-month period in 2023. Zinc production was down 7.4% to 13,782 tonnes from 14,891 tonnes, and lead production fell 5.0% to 19,736 tonnes from 20,773 tonnes.

Chief Executive Officer Gavin Ferrar said: "Kounrad continued to perform well in the third quarter of 2024, in line with its production performance in the corresponding period of last year, and maintained its excellent safety record. The third quarter is seasonally Kounrad's strongest quarter, and the operation remains on track to achieve full-year production firmly within the guidance range given at the start of this year.

"Sasa also performed well in the third quarter of 2024, with the tonnage processed recovering from the levels of the first half 2024 towards the level recorded in the third quarter last year. This represents a great achievement by the Sasa team, given the challenges posed by the transition to the new mining system designed to ensure the operation's long-term future. Head grades, in particular zinc, also recovered relative to the first half of 2024. We look forward to maintaining this progress in the fourth quarter, which we expect to result in full-year production towards the lower end of the guidance range.

"Meanwhile, the capital projects programme at Sasa is nearing completion, which includes moving to the use of paste backfill in mining and adopting dry-stack tailings. Together, these technologies form the core of Sasa's long-term strategy; maximising resource extraction, and extending the life of Sasa tailings storage facility 4 and thus avoiding the need for a new conventional tailings storage facility. Together, these developments ensure Sasa's planned life to at least 2039."

Shares in Central Asia Metals were down 0.2% at 190.30 pence each in London on Wednesday morning.

By Emily Parsons, Alliance News reporter

Comments and questions to newsroom@alliancenews.com

Metals Acquisition Limited (MAC), which is dual listed on the ASX and the New York Stock Exchange, has raised $150 million as it eyes future mergers and acquisitions.

The company said it attracted support from new and existing shareholders from both Australia and overseas, with 8.33 million new CHESS Depositary Interests issued at $18.00 per new CDI.

This represents a 13 per cent discount from MAC’s closing share price of $20.70 per CDI on Tuesday.

CDIs give ASX investors the same beneficial interests in internationally listed companies as holding these shares on a foreign exchange.

Metals Acquisition will use the funds to retire a mezzanine debt facility and optimise its balance sheet following the acquisition of the CSA copper mine from Glencore in 2023.

The company said it is also on the lookout for inorganic growth opportunities to build its footprint.

MAC launched the capital raise on Tuesday as it looked to raise $140 million, with the completed placement exceeding this number.

MAC chief executive officer Mick McMullen explained the inspiration behind the placement.

“Following the acquisition of CSA in mid-2023 and listing on the ASX in early 2024, MAC has placed greater focus on optimising its balance sheet and determining an appropriate capital structure more reflective of the strong asset quality and the markedly improved credit proposition that MAC today represents compared to mid-2023,” he said.

“Feedback from investors has been strong that moving to a more typical long-term capital structure is desired.”

McMullen said it was in the best interests of the company and its shareholders to retire the mezzanine debt facility by paying back the debts. The placement has enabled MAC to reduce its net debt position from $US455 million following the acquisition of the CSA mine to about $US134 million upon completion of the raise.

The CSA mine delivered 10,159 tonnes of copper at an average grade of 4 per cent copper in the September quarter of 2024. MAC said C1 cash costs were expected to be in the $US1.90–2 per pound range.

“We remain on track to deliver around the mid-point of our full-year 2024 copper production guidance of between 38,000-43,000 tonnes and will provide a more fulsome update on the status of operations as part of our quarterly report later this month,” McMullen said.

https://www.australianresourcesandinvestment.com.au/2024/10/10/nsw-copper-miner-raises-150-million/

October 4, 2024

Tribes in the upper Colorado River basin are still struggling to get compensated for water to which they are entitled but aren’t using.

Tribes had hoped to be included in a new round of federal funding through the U.S. Bureau of Reclamation aimed at conservation programs in the Upper Basin and possibly get paid for their water that they aren’t using. But it appears that will not be the case, Lorelei Cloud, vice chair of the Southern Ute Indian Tribe, said on Sept. 20.

“Reclamation agreed to include tribal forbearance programs under the B2W program where we were looking forward to announcing and working on a proposal,” Cloud said. “On Sept. 18, the state of Colorado informed the Southern Ute Indian Tribe that Reclamation has reconsidered its position and will no longer include tribal programs in the B2W program. This decision needs to be reversed.”

The comments came during a panel discussion at the Colorado River Water Conservation District’s annual seminar in Grand Junction. Cloud put out a call to action for attendees to help them plead their case to federal officials. She noted that the title of the panel was “Does History Repeat Itself?”

“We haven’t changed anything,” she said. “No matter how tribes are trying, we haven’t changed anything.”

Becky Mitchell, Colorado’s representative to the Upper Colorado River Commission and the state’s lead negotiator on Colorado River issues, has advocated for more tribal inclusion. She said Colorado officials were notified by phone that Reclamation would not fund forbearance with B2W money.

“Both the tribes and the states thought that this was an option for the use of that funding,” Mitchell said. “There are commitments that have been made, not just in this last year, but in the last 200 years, and it’s time to make good. … We’re going to continue to work with the tribes to pursue federal funding in an effort to correct these historic injustices.”

The Middle East is currently engulfed in a state of uncertainty regarding the next steps following Iran’s launch of nearly 200 ballistic missiles directly from its territory towards Israel on the evening of October 1, 2024. This action was in retaliation for the assassinations of Hamas’s political bureau chief, Ismail Haniyeh, in Tehran on July 31, and the Secretary-General of Hezbollah, Hassan Nasrallah, along with the Deputy Commander of the Iranian Revolutionary Guard, Abbas Nehrujan, in Beirut on September 27.

A Climate of Anticipation

Just as Israel responded to the initial direct Iranian attack in April, Tel Aviv pledged at the beginning of October to retaliate for what it deemed the “largest missile attack” in Israel’s history. Notably, the United States has shown a strong commitment to responding, with American officials emphasizing the necessity of consequences for the Iranian missile assault. Jake Sullivan, the U.S. National Security Advisor, even refrained from urging Israel to “exercise restraint,” signaling that Washington might be prepared for the first time to risk direct support for a new Israeli offensive against Iranian territory. This marks a significant and unprecedented shift in U.S. policy, particularly within Democratic administrations, regarding the tools used to respond to Tehran. Historically, Democrats have aimed to de-escalate tensions between Israel and Iran.

As the Middle East braces for these developments, numerous indicators suggest that an Israeli response could trigger a qualitatively different phase of direct conflict with Iran. If Tel Aviv follows through on its threats to bomb Iranian infrastructure or vital facilities, such as oil and gas storage sites, there is a real possibility of targeting nuclear reactors in Bushehr, Natanz, and Fordow. This situation suggests that the region may be on the brink of a prolonged war of attrition, especially given Iranian forces’ pledges to target U.S. and Western interests in Yemen, Iraq, and Syria. Thus, the pressing questions remain: What scenarios could unfold in the Middle East in the coming days? Is there any room for diplomacy amid Iranian missiles and Israeli fighter jets?

Possible Scenarios

One of the most complex factors surrounding the calculations of Middle Eastern countries is the “political and military euphoria” of both sides in the conflict. Following the assassination of Hassan Nasrallah and Israel’s military successes since the “Beiger” bombings on September 17, Israel’s confidence—particularly among its intelligence and military agencies—has surged. Prime Minister Benjamin Netanyahu expressed hopes of achieving a historical victory by “silencing opponents” on multiple fronts, including Iran, Iraq, Syria, Hezbollah in Lebanon, the Houthis in Yemen, and Hamas.

Conversely, Iran’s response on October 1, utilizing a large number of ballistic missiles that reached Israeli airspace in just 12 minutes, marked a unique “field euphoria” for Tehran’s forces. This was particularly significant after many believed Iran had abandoned its regional allies due to delays in avenging Haniyeh’s assassination.

In this volatile military environment, characterized by a lack of common ground among the warring parties and the absence of a regional or international entity willing to exert pressure to prevent a slide into political and military chaos, the region stands on the verge of several key scenarios:

Bilateral War Erupts: This scenario posits that significant and widespread attacks would be confined to Iran and Israel only. The nature of the Israeli response to the Iranian missile attack would dictate this. If Tel Aviv carries out its threats of a “hybrid attack,” combining security and military responses by conducting massive sabotage operations alongside strikes on any oil and gas wells, missile launch pads, or Iranian nuclear facilities, Tehran would have no choice but to escalate and launch successive waves of missile strikes against Israel without pause. Under these conditions, the region could experience a war akin to the Iraq-Iran conflict from 1980 to 1988. Both Israel and Iran possess the necessary tools to propel themselves into this scenario. Tehran boasts the largest missile arsenal in the region, with over 17,000 “Sejil” missiles capable of hitting targets 2,500 kilometers away, along with “Khaybar” missiles that reach about 2,000 kilometers. Additionally, Iran has long-range missiles such as “Fateh” and “Imad,” according to the Arms Control Association, a Washington, D.C.-based NGO, which noted that Iran possesses highly accurate solid-fuel missiles capable of reaching distant targets. All this indicates that Iran could enter into a long war with Israel, which has over 600 modern fighter jets like the F-15, F-16, and F-35, all capable of reaching Iranian territory. This scenario may only cease if either side realizes it is fatigued or faces an existential threat, such as the downfall of the Iranian regime or significant Israeli casualties due to ongoing Iranian missile attacks.

Outbreak of a Comprehensive Regional War: This scenario could occur if the United States directly partners with Israel in targeting Iranian territory. In such a case, we would be looking at the emergence of “regional warfare,” creating two opposing alliances: one led by the United States, Israel, and Britain—who have announced their involvement in countering Iranian missiles—and the other composed of Iran and its proxies, particularly the Houthis in Yemen, Hezbollah in Lebanon, and the Popular Mobilization Forces in Iraq. Should war break out according to this scenario, it would likely target American and Western interests not only in the region but also potentially Israeli and Western embassies elsewhere around the world. The recent bombings near the Israeli embassy in Copenhagen in early October serve as an indicator of what could transpire in the event of a comprehensive regional war.

Threat to the Iranian Regime: This scenario suggests that Washington and Tel Aviv might exploit the Iranian missile attack to target leaders of the Iranian regime, similar to the killings of Haniyeh and Nasrallah, while simultaneously bombing vital facilities. This action could encourage Iranians to rebel against their ruling regime from the American and Israeli perspectives. Despite previous failures by Washington to employ this option to topple the Iranian regime, Netanyahu’s direct address to the Iranian people from the United Nations, coupled with the U.S.’s tougher rhetoric following recent Israeli successes and the Iranian assault on Israel, suggests that this scenario cannot be entirely ruled out. Israeli officials have confirmed that key Iranian economic targets are part of Israel’s response, and Netanyahu and the Israeli military have indicated multiple times that their message to the Tehran regime will mirror their actions against Nasrallah.

April 2024 Scenario: In April, Israel retaliated against Iran’s launch of over 330 drones, cruise missiles, and ballistic missiles with a calculated attack near the Bushehr nuclear power station without hitting it, resulting in no Iranian response at that time. However, this scenario is somewhat unlikely under current circumstances for several reasons. First, Iran used approximately 200 ballistic missiles in its October 1 attack, double the number used in April’s assault. Second, the U.S. position is more rigid this time regarding Iran, encouraging Tel Aviv to retaliate; American calculations assume that allowing Tehran to go unanswered may embolden it and its allies to target American interests and forces in the region.

Focus on Lebanon: This scenario assumes that Israel’s response to Iran will be limited, with a return to focusing on southern Lebanon, aiming to bring back approximately 100,000 Israelis who have evacuated their homes since October 8, 2023, and to establish a buffer zone in southern Lebanon to ensure that events similar to those on October 7 do not recur from the north. This can be achieved by weakening Hezbollah’s capabilities. Israel may pursue this goal through one or more phases, beginning with a broad ground war aimed at expelling Hezbollah’s “Radwan Forces” from southern Lebanon. This scenario may take one of the following paths:

Demarcation of Land Borders: This would depend on Israel’s willingness to demarcate land borders with Lebanon, whether before or after a ground incursion, similar to the maritime border demarcation in 2022. This would resolve disputes over 13 land points that have lingered since the Israeli withdrawal from southern Lebanon in May 2000. Under this path, Hezbollah would retreat to the north of the Litani River, with the Lebanese Army replacing it on the border with Israel.

Hochstein Path: This involves the path that U.S. envoy Amos Hochstein attempted, persuading Hezbollah to withdraw eight kilometers north of the Blue Line, thereby reassuring Israel that Hezbollah elements would not infiltrate to abduct Israeli civilians, as occurred on October 7, 2023. It appears that Tel Aviv is seeking more than this in light of the intelligence and military successes it has achieved since September 17.

Buffer Zone to the Litani River: Given Iran and Hezbollah’s rejection of separating the fronts in Lebanon and Gaza, indicators suggest that the Israeli military will continue to act on its threats to push Hezbollah forces back approximately 30 kilometers. This buffer zone would extend from the eastern Bekaa Valley to the mouth of the Litani River in the Mediterranean Sea. This path would require Israel to engage in a potentially protracted ground war with Hezbollah forces, similar to the year-long conflict with Hamas in the Gaza Strip.

In conclusion, the Middle East stands on a precarious precipice, awaiting clarity on the extent of Israel’s response to the Iranian missile attack, a reaction that will delineate a new phase not only for regional security but also potentially lead to profound ramifications for issues and matters beyond the region.

https://www.politics-dz.com/five-scenarios-for-military-escalation-between-israel-and-iran/

Slovakian left-wing nationalist Prime Minister Robert Fico has reiterated his claim that Ukraine will not become a member of NATO as long as he is the leader of Slovakia.

“Ukraine’s accession to NATO would be a good basis for a third world war,” Fico said in an interview on Sunday, October 6th, one day before his visit to Ukraine.

The conservative government of Hungary along with Fico’s cabinet—which came to power a year ago— have been the only governments in the EU who have refused to send weapons to Ukraine, and have criticised EU sanctions against Russia for harming Europe’s economy.

The two countries have been in a bitter dispute with Ukraine following Kyiv’s decision to halt Russian company Lukoil’s pipeline oil exports through the territory of Ukraine, and into Hungary and Slovakia, endangering the two countries’ energy security.

Echoing Hungarian Prime Minister Viktor Orbán’s words, Robert Fico has said that the EU must strive for peace, instead of fanning the flames of the Russian-Ukrainian war.

“There is a military conflict in a neighbouring country where Slavs are killing each other, and Europe is significantly supporting this killing, which I just don’t understand,” he said on Sunday.

Comments like these, and Fico’s desire to pursue a sovereign foreign policy, have drawn the ire of the European liberal elites who are intent on punishing his government and withholding EU funds under a ‘rule of law’ pretext.

Fico—who survived an assassination attempt by a pro-Ukrainian protester in May—has previously said that the war cannot be solved militarily: Russia would never give back Crimea, the Ukrainian peninsula it annexed in 2014, and its troops would never leave the eastern Ukraine territories it invaded. While Europe has to prepare for a Russian military victory, NATO cannot get involved as it would provoke a new world war, he said earlier this year.

While many NATO member states have welcomed the idea of Ukraine joining NATO, and the joint statement made at the military alliance’s summit in July declares that Ukraine is on an “irreversible” path to membership, in practice, all NATO members would have to agree to accept Ukraine. The country would only be able to join the alliance once its war with Russia is over.

Nevertheless, on his first visit to Ukraine a few days ago, new NATO chief Mark Rutte insisted that “Ukraine is closer to NATO than ever before.”

While the Slovakian PM believes Ukraine joining NATO would be a provocation in the eyes of Moscow, Fico has no problem with Ukraine wanting to join the EU. “We support your path to the EU 100%. Your membership will be important and valuable for us,” he told his Ukrainian counterpart Denys Shmyhal at their meeting near the western Ukrainian city of Uzhhorod on Monday.

https://europeanconservative.com/articles/news/fico-warns-against-ukrainian-nato-membership/

During the European Council meeting on October 17-18, recent developments in relations with Ukraine will be discussed. The EU intends to stand by Kyiv for as long as necessary, according to European Commission (EC) Vice President Maroš Šefčovič during the EU Council meeting.

Šefčovič emphasized the importance of reaching an agreement on the proposal to allocate macro-financial assistance to Ukraine amounting to up to 35 billion euros as soon as possible.

"The funds must be allocated by the end of this year to provide Ukraine with the necessary fiscal space," he said, recalling the promise made by the G7 in June.

The Vice President of the European Commission also noted the efforts being made to prepare Ukraine for the upcoming winter.

"Together with our partners, we are repairing, reconnecting, and stabilizing Ukraine's energy supply," Šefčovič said.

As part of the winter plan for Ukraine, 160 million euros have already been allocated, supplementing the previously provided 2 billion euros for the country's energy security.

He added that the EU's goal remains unchanged: "to put Ukraine in a position to negotiate peace on favorable terms and to help it on its path to full membership in the European Union."

Assistance to Ukraine bypassing Hungary

Hungary has been blocking the financing of military assistance to Ukraine amounting to 6.5 billion euros from the European Peace Facility for several months. This is related to Budapest's concerns that the funds contributed to the facility would be directed to support Ukraine.

Recently, Hungarian Foreign Minister Péter Szijjártó said that Budapest will continue to block the decision to allocate 6.5 billion euros until Ukraine restores the transit of Russian oil from Lukoil.

https://newsukraine.rbc.ua/news/eu-seeks-to-set-ukraine-up-for-successful-1728381309.html

The world's largest oil exporter Saudi Arabia says that it is staying neutral and on the sidelines when it comes to the ratcheting wars in Lebanon, Gaza, and Yemen - and the Iran vs. Israel showdown.

Other members of the Gulf Cooperation Council (GCC) - which includes Qatar, the United Arab Emirates, Bahrain, Oman, and Kuwait - have also this week "sought to reassure Iran of their neutrality" in the Iran-Israel conflict, Reuters has reported.

Saudi Arabian Foreign Minister Faisal bin Farhan Al-Saud (R) and Iranian President Masoud Pezeshkian (L) meet at Asia Cooperation Dialogue (ACD) in Doha, Qatar on October 3, 2024. Iranian Presidency/Anadolu Agency

Prior to the Gaza war, Saudi Arabia was widely seen as on the cusp of signing a full normalization and diplomatic relations deal with Israel, as part of the Abraham Accords - but that was derailed in the wake of Oct.7.

At the same time, Riyadh and Tehran have recently made peace. The kingdom is now seeking to assure Iran it will not join Israel's side.

The Saudis and other GGC states wish to avoid the kind of attacks which could impact its oil production and exports, such as the 2019 Abqaiq–Khurais Saudi Aramco drones strikes. The US blamed Iran for those historic attacks, but Tehran leaders never owned up to it.

Iranian President Masoud Pezeshkian has been in Doha this week. He told Saudi Foreign Minister Faisal bin Farhan on Thursday, "We consider Islamic countries, including Saudi Arabia, as our brothers, and we emphasize the importance of setting aside differences to enhance cooperation."

Bin Farhan also expressed the desire to set aside all rifts. "We aim to permanently close the chapter on our differences and focus on resolving issues, developing relations as two friendly and brotherly countries," he said, as cited in Iranian state media.

Regional tensions are soaring, and global oil markets have been reacting with each big headline and statement related to reports that Israel could be preparing major strikes on Iran's oil and gas fields.

As for the latest Friday afternoon, which sent oil sliding...

President Biden asked Friday for clarification on his Thursday’s comment about potential Israeli strikes on Iranian oil facilities: “I think if I were in their shoes, I’d be thinking about other alternatives than striking oil fields.”#OOTT — Javier Blas (@JavierBlas) October 4, 2024

More broadly, things between the Gulf states and Iran began cooling in the wake of the decade-long proxy war in Syria to oust Assad. The GCC countries were active in funding jihadist rebels seeking to conquer Damascus (and to counter the Iranian/Shia axis), but once it became clear that the Syrian government emerged victorious, GCC diplomats began racing back to Damascus.

By Zerohedge.com

https://oilprice.com/Geopolitics/Middle-East/Saudis-Declare-Neutrality-On-Iran-Israel-Conflict.html

Saudi Arabia has raised its official selling price for Arab Light crude to Asia by 90 cents per barrel amid rising market volatility and geopolitical tensions in the Middle East. This move, surpassing market expectations, comes as oil prices surge in response to escalating regional conflicts.

Saudi Aramco Raises Arab Light Crude Price for Asia, Lowers Costs for U.S. and Europe Amid Tensions

Saudi Arabia increased its primary oil prices for Asian consumers in response to the increased volatility in the crude market, as traders closely monitor the progress of the Middle East conflict.

According to a price list obtained by Bloomberg, Saudi Aramco, the state producer, has raised the official selling price of its primary Arab Light crude grade by 90 cents, resulting in a premium of $2.20 per barrel over the regional benchmark for purchasers in Asia. According to a survey of merchants and refiners, the company anticipated increasing the premium by 65 cents per barrel.

Simultaneously, Aramco reduced the cost of all grades in the United States and Europe.

Oil prices have surged since the beginning of October as Iran responded to the devastating assaults in Lebanon that nearly eliminated the Hezbollah leadership by launching missile strikes on Israel. This week, benchmark Brent crude increased by over 8% in response to the strikes and anticipation of a potential Israeli reprisal, trading at approximately $78 per barrel.

OPEC+ Suspends Output Increase Amid Concerns Over China’s Sluggish Oil Demand and Market Surplus

Currently, the markets have largely ignored most of the regional risks this year, as the conflict has not resulted in a reduction in supply, and traders have instead concentrated on exacerbating concerns regarding sluggish demand. Last month, the OPEC+ alliance, which Saudi Arabia and Russia lead, suspended a planned output increase for two months, until the beginning of December, in response to concerns that China's slow oil consumption will result in an excess of crude in the market.

Group members who made voluntary output adjustments will not implement the previous plan to begin rolling back the reductions in October and November. Due to the delay in the resumption of hydrocarbon production, Saudi Arabia may continue to export less than 6 million barrels per day, as it has for the past four months.

- US Adds 254,000 jobs in August

- Hourly earnings increase by 4%

- Unemployment rate drops to 4.1%

Key Events:

FOMC Minutes Meeting (Wednesday)

Crude Oil Inventories (Wednesday)

US CPI core, y/y, m/m (Thursday)

US Economic Indicators

Friday’s labor market data reinforced a strong economic outlook:

- Pushing the US Dollar Index above 102 and boosting stock markets to their record highs

- Reducing expectations of a large rate cut to 25 bps

- Enhancing expected oil demand alongside improving labor market conditions

This week, FOMC meeting minutes and US CPI data are likely to add volatility to the market, especially with their influence on rate cut expectations. As labor market concerns ease, these events will play a key role in determining oil price trends from a monetary policy perspective.

Middle East Tensions

On the supply side, escalating tensions in the Middle East have shifted away from ceasefire hopes, adding upward pressure on oil prices due to potential supply disruptions. As threats of strikes on oil facilities increase, oil retested the $75/barrel zone last Friday.

--- Written by Razan Hilal, CMT – on X: @Rh_waves

By Tsvetana Paraskova - Oct 04, 2024, 4:32 AM CDT

International crude oil prices could surge by $20 per barrel if Iran’s oil supply drops in a possible escalation of the Middle East conflict, Goldman Sachs says.

“If you were to see a sustained 1 million barrels per day drop in Iranian production, then you would see a peak boost to oil prices next year of around $20 per barrel,” Daan Struyven, co-head of global commodities research at Goldman Sachs, told CNBC’s “Squawk Box Asia” on Friday.

However, this projection is based on the assumption that the OPEC+ group would not respond to a potential disruption to supply from Iran by boosting production, Goldman’s Struyven noted.

If major OPEC+ producers with enough spare production capacity, such as Saudi Arabia and the United Arab Emirates (UAE), increase output and offset some of the potential losses from Iran, oil prices could rise more modestly, and the impact could be slightly less than $10 barrel, Goldman’s analyst added.

Most analysts say that the OPEC spare capacity, concentrated in Saudi Arabia and the UAE, would be enough to compensate for an Iranian loss of supply.

“In theory, if we lost all Iranian production - which is not our base case - OPEC+ has enough spare capacity to make up for the shock,” Amrita Sen, co-founder of Energy Aspects, told Reuters this week.

According to analysts, Saudi Arabia could be able to increase its oil production by about 3 million bpd and the UAE by 1.4 million bpd.

Iran currently produces around 3.5 million bpd, of which an estimated 1 million bpd are exported, mostly in China, which hasn’t stopped buying Iranian oil after the U.S. re-imposed sanctions on Tehran’s oil industry.

An even more significant disruption to supply from the Middle East could lead to triple-digit oil prices. But analysts currently believe attacks on oil infrastructure in other producers in the region or the closure of the Strait of Hormuz are low-probability events.

Early on Friday in European trade, Brent and WTI prices were up by about 1% as the markets expected the Israeli response to Iran’s missile attack on Israel earlier this week. Oil prices were on track for a strong weekly gain amid the escalation of the conflict.

By Tsvetana Paraskova for Oilprice.com

https://oilprice.com/Energy/Energy-General/Goldman-Sachs-Sees-20-Upside-to-Oil-Prices-on-Iran-Supply-Shock.html

Oil bets are most bullish in two years as Mideast tension flares

BYALEX LONGLEY, DAVID MARINO AND BLOOMBERG

October 6, 2024 at 11:06 PM GMT+1

Last week, traders snapped up December calls on Brent crude to bet on oil reaching $100 or higher.

Oil futures posted their largest gain in more than a year last week. And the frenzy was even bigger in the options market.

As traders fretted over the risk of a major price spike, the call skew on second-month West Texas Intermediate futures jumped to the highest since March 2022, when Russia’s invasion of Ukraine sparked concerns that millions of barrels a day of oil from one of the world’s top producers would suddenly disappear from the market.

In a stunning turnaround, hedge funds, commodity trading advisors and other money managers raced to reverse positions that in mid-September had turned bearish on crude on concern that slower economic growth in China and elsewhere would crimp demand just as OPEC+ producers were getting set to boost supply. About two weeks ago, put volume peaked, with traders paying up for bearish options as futures slumped toward $70 a barrel.

But the escalation in the Middle East has changed everything. While some traders got out of calls they had previously sold, most are now looking to buy insurance against a surge in prices.

“We have seen a sizeable bid in volatility and increased demand for upside exposure to oil prices,” said Anurag Maheshwari, head of oil options at Optiver. Implied volatility has surpassed a high from October of last year, “which seems reasonable given that this escalation is potentially more impactful on oil supplies.”

Last week, traders snapped up December calls on Brent crude to bet on oil reaching $100 or higher, with aggregate call volume hitting a record on Wednesday. WTI futures surged as much as 11% amid concern that Israel might strike oil facilities in retaliation for Iran’s missile attack, raising fears of a Middle East supply disruption. The concerns eased slightly on Friday as US President Joe Biden sought to discourage such a move.

Money managers’ net long positions in Brent crude jumped by more than 20,000 contracts in the week through Oct. 1, according to ICE Futures Europe data, extending a bullish shift that started in earnest after China announced a massive stimulus package to bolster its economy.

“Option traders had given up on the idea of a rally, leaving the implied volatility in oil call options near multiyear lows,” said Carley Garner, senior strategist and founder at DeCarley Trading. “In essence, the market was unprepared for the surprise, and we are seeing FOMO now that prices are finally moving in favor of the bulls.”

As well as outright crude prices, traders also snapped up outlandish bets on the futures curve structure rallying heavily. More than 5 million barrels wagering on the nearest Brent spread hitting $3 a barrel traded last week — it was at 62 cents on Friday.

The stress on the market was seen most in short-dated contracts, with the term structure for 25-delta options showing that the bullish trading spiked in recent days. Implied volatility for December calls climbed more than 30 points last week, more than triple that for puts, while there was almost no change for either bullish or bearish positions for July contracts and onward.

The bullishness for the commodity — both on Brent and WTI — has exceeded that for producers, which are likely to see a benefit only if prices remain higher for longer. Volatility and call skew in one-month options on the US Oil Fund LP exchange-traded fund both surged more than for the SPDR S&P Oil & Gas Exploration & Production ETF.

“The escalation in the Middle East has sparked a massive amount of short covering in crude oil as CTAs have flipped from short to neutral,” said Rebecca Babin, senior equity trader at CIBC Private Wealth Group. “Fundamental energy investors remain fairly sour on 2025 and are using call options as opposed to chasing the rally in crude to get upside exposure to a potential supply disruption.”

04 October, 2024

Almost two months after shutting down two of its major fields, Libya is now resuming its operations.

Libya produces more than 1.2 million barrels of oil per day [GETTY]

Libya's eastern administration said on Thursday it had lifted a month-long oil production and exports blockade over a central bank dispute. The move comes days after new leadership for the bank was named under a UN-backed deal.

The Benghazi-based administration, which controls most of Libya's oilfields, said in a Facebook post it was "lifting the force majeure on all oil fields and resuming production and exports".

The National Oil Corporation said in a statement that it would resume production at the Sharara and El-Feel oil fields and export shipments from Es Sider, the country's largest port.

In August, the company declared "force majeure," a legal maneuver that allows a company to terminate its contracts due to extraordinary circumstances.

"As part of continuing review of the force majeure situation, we have recently received a formal security assessment concerning Sharara, El-Feel and Essider, which confirms that NOC can resume the operations of crude oil production and exporting operations to its customers," the statement read.

The National Oil Corporation previously blamed the shutdown on the Fezzan Movement, a local protest group.

However, Libyan local media reported that the suspension was placed due to retaliation by military commander Khalifa Haftar against a Spanish company that partially operates the Sharara field for an arrest warrant issued by Spanish authorities accusing him of arms smuggling.

Most recently, the divided country has been thrown again into crisis by a dispute over the governance of its Central Bank. In August, the UN warned that the government was poised to face even greater instability.

But that was resolved recently when the country's parliament appointed a new governor to the bank.

Libya produces more than 1.2 million barrels of oil per day, and Sharara is the country's largest field, producing up to 300,000 barrels per day.

The oil-rich country has been in political turmoil since a NATO-backed uprising toppled and killed longtime dictator Moammar Gadhafi in 2011.

Since then, Libya has been split between rival administrations in the east and the west, each backed by militias and foreign governments.

https://www.newarab.com/news/libya-resume-crude-oil-production-after-shutting-down?amp

Energy – Saudi raises OSPs for Asian buyers

Oil prices eased this morning as traders await new developments in the Middle East. US President Joe Biden is reportedly discouraging Israel from planning a strike on Iran’s facilities (in response to Iran’s missile attack last week). According to OPEC’s latest monthly oil market report, Iran has been producing around 3.3m bbls/d and any disruption to this supply could create shortages in the oil market.

Saudi Arabia raised its Official Selling Prices (OSP) for buyers in Asia for November loadings while trimming prices for European and US buyers. For its Arab Light crude oil, Aramco (TADAWUL: ) raised the premiums by US$0.90/bbl for Asian buyers to US$2.2/bbl. The market expected a smaller increment of around US$0.65/bbl. Meanwhile, OSPs for all grades to Europe saw cuts of US$0.9/bbl for November loadings, possibly in an effort to regain market share in the European market. The divergent price views for different regions may also hint at expectations of local imbalances in the oil market.

Drilling activity in the US remained weak over the last week. The latest rig data from Baker Hughes shows that the number of active US oil rigs decreased by five over the week to 479, the lowest since mid-July. The total rig count (oil and gas combined) stood at 585 over the reporting week, down from 587 a week earlier. This was also lower compared to the 619 rigs seen this time last year. Meanwhile, primary Vision’s frac spread count, which gives an idea of completion activity, also dropped by two over the week to 236.

Turning to speculative bets, the managed money net long position in NYMEX WTI decreased by 20,688 lots after rising for two previous consecutive weeks to 141,240 lots for the week ending 1 October 2024. The move was driven by rising shorts with gross short positions increasing by 14,102 lots to 62,643 lots over the reporting week. In contrast, speculators increased net longs in ICE (NYSE: ) by 20,013 lots for a third straight week, leaving them with net longs of 41,782 lots as of 1 October 2024. The move was driven by a combination of shorts liquidating and fresh longs. In refined products, the net bullish bets for gasoline rose by 1,883 lots for a third consecutive week to 25,762 lots over the reporting week, the highest since the week ending 16 July 2024.

Crude oil inventories in the United States rose by a shocking 10.9 million barrels for the week ending October 4, according to The American Petroleum Institute (API). Analysts had expected a build of 1.95 million barrels.

For the week prior, the API reported a 1.5-million-barrel decrease in crude inventories.

So far this year, crude oil inventories have slumped by just 5 million barrels since the beginning of the year, according to API data.

On Tuesday, the Department of Energy (DoE) reported that crude oil inventories in the Strategic Petroleum Reserve (SPR) rose by 0.3 million barrels as of October 4. SPR inventories are now at 382.9 million barrels, a figure that reflects an increase of more than 35 million from its multi-decade low last summer, yet 252 million from when President Biden took office. At the current rate of replenishment, it will take more than five years to return to January 2020 levels.

Oil prices shrugged off what is now becoming rather for the markets—threats of a possible supply shock in the wake of continued conflict in the Middle East. WTI and Brent fell sharply ahead of the API data release as traders took handsome profits from the recent oil rally and their kept their eyes on soft demand from China.

At 3:39 pm ET, Brent crude was trading down $3.46 (-4.28%) on the day at $77.47—a nearly $4 per barrel gain from this time last week. The U.S. benchmark WTI was also trading sharply down on the day by $3.29 (-4.26%) at $73.85—a $3.70 per barrel gain from this time last Tuesday.

Gasoline inventories fell this week by 557,000 barrels, compared to last week’s 900,000-barrel increase. As of last week, gasoline inventories are 1% below the five-year average for this time of year, according to the latest EIA data.

Distillate inventories fell by 2.59 million barrels, on top of last week’s 2.7-million-barrel decrease. Distillates were already about 8% below the five-year average as of the week ending September 27, the latest EIA data shows.

Cushing inventories—the benchmark crude stored and traded at the key delivery point for U.S. futures contracts in Cushing, Oklahoma, rose by 1.359 million barrels, according to API data, on top of the 700,000-barrel build of the previous week. Inventories at Cushing are now under 24 million barrels.

By Julianne Geiger for Oilprice.com

In recent developments, reports of Iran conducting a nuclear bomb test have set off alarm bells across the globe, particularly in Israel. The reports, although unverified, have prompted urgent discussions in Israel, with concerns about the shifting balance of power in the region. This development comes at a time of heightened tension between Israel and Iran, both of which have long been engaged in a war of rhetoric and regional influence.

Unverified Reports of Iranian Nuclear Test

Speculation about Iran successfully testing a nuclear device has surfaced from various intelligence sources, raising concerns in global security circles. Iran has consistently denied pursuing nuclear weapons, maintaining that its nuclear program is for peaceful purposes. However, Israel and other nations have long been skeptical of Iran’s intentions, pointing to Iran’s enrichment of uranium beyond the levels required for civilian energy production as evidence of military ambitions.

The reports, which remain unconfirmed by international bodies such as the International Atomic Energy Agency (IAEA), suggest that Iran may have reached a significant milestone in its nuclear capabilities. This potential development would drastically alter the security dynamics in the Middle East, where Israel has, until now, maintained a military advantage, partly through its own undeclared nuclear capabilities.

Israel’s Response: Shock and Strategic Reconsideration

Israel has responded with immediate alarm to these unverified reports. Israeli officials, who have been outspoken critics of the Iranian regime, were reportedly preparing for a potential military strike on Iran’s nuclear facilities, a strategy that has been discussed in Israel for years. However, the latest intelligence reports have cast doubt on the viability of such a plan, especially if Iran indeed possesses operational nuclear weapons.

The possibility of a nuclear-armed Iran presents a strategic nightmare for Israel, which has long relied on its qualitative military edge, including its own advanced missile defense systems such as the Iron Dome and David’s Sling, to defend against regional threats. A nuclear Iran would fundamentally alter Israel’s threat perception and may lead to a reassessment of its military strategies and alliances in the region.

Canceling Plans for a Strike on Iran

According to Israeli sources, the potential nuclear test has forced the government to reconsider its previous plans to launch pre-emptive strikes on Iran’s nuclear facilities. Israeli military planners have reportedly advised against any immediate action, given the risks of nuclear escalation and the potential for massive retaliation from Iran and its regional allies, such as Hezbollah in Lebanon and Shiite militias in Iraq and Syria.

Israel’s decision to halt these attack plans is also influenced by geopolitical factors, particularly the stance of the United States and European allies. The Biden administration has been attempting to revive the Iran nuclear deal (JCPOA), which aims to limit Iran’s nuclear activities in exchange for sanctions relief. Any unilateral military action by Israel could undermine these diplomatic efforts and lead to broader regional conflict.

Diplomatic Efforts and Regional Implications

While Israel has temporarily shelved its plans for a military strike, it is actively pursuing diplomatic channels to address the situation. Israeli Prime Minister Benjamin Netanyahu has called for urgent consultations with U.S. officials, and Israel is expected to intensify its lobbying efforts in Washington for a tougher stance against Iran.

In the broader Middle East, the possibility of a nuclear Iran is causing alarm among Arab states, many of which have normalized relations with Israel through the Abraham Accords. Countries like Saudi Arabia and the United Arab Emirates, which view Iran as a major regional rival, are likely to push for stronger security guarantees from the U.S. and possibly enhance their own military capabilities in response.

A Dangerous New Phase

The unverified reports of an Iranian nuclear test mark a dangerous new phase in the longstanding tensions between Israel and Iran. While the reports are not confirmed, they have already led to a significant shift in Israel’s strategy, prompting it to cancel its attack plans on Tehran’s nuclear facilities. As the situation continues to evolve, the international community will closely watch how Israel, Iran, and other regional players respond to this potential new reality.

This incident underscores the fragility of security in the Middle East and the potential for conflict escalation if diplomatic solutions are not pursued aggressively. Whether or not Iran has truly tested a nuclear weapon, the mere possibility has triggered a recalibration of military and diplomatic strategies across the region.

Kazakhstan's biggest oil field Tengiz, operated by U.S. major Chevron CVX, boosted output to a record high in October, sources told Reuters, potentially complicating the country's future efforts to comply with its OPEC+ quota.

OPEC+ has named top 10 global oil producer Kazakhstan along with Iraq and Russia as countries that have repeatedly failed to comply with its pledges to curb oil production this year.

Tengiz boosted daily production to 699,000 bpd in early October from 687,000 bpd in September, when output increased by 30% from August after the completion of maintenance, said two industry sources familiar with the data.

The field's operator Tengizchevroil, which has invested more than $70 billion since the project's inception in 1993, said its operations were continuing as usual and declined further comment.

Chevron CVX owns a 50% stake in the venture. Exxon Mobil XOM controls 25%, KazMunayGaz 442AC has a 20% stake, and Russia's Lukoil LKOH owns 5%.

The Kazakh energy ministry did not reply to a request on comment about oil production plans for 2024 and 2025.

Kazakhstan - which relies on Tengiz and two other major fields, Karachaganak and Kashagan, for most of its production - is subject to output targets as a member of OPEC+, an alliance of OPEC and other top producers led by Russia

The country's oil production quota under the OPEC+ deal stands at 1.468 million bpd, a target it exceeded in September by around 170,000 bpd, according to Reuters calculations.

It is likely to remain within its targets this month because it will shut down the Kashagan field for maintenance, sources said.

Overall October production data from Kazakhstan is not yet available, but sources said Karachaganak will produce its regular volumes of 228,000 bpd, while maintenance at Kashagan will entail a complete stoppage of its 400,000 bpd facility.

While that means Kazakhstan will be able to achieve its October quota, the sources said, complying with OPEC+ quotas might become problematic again when the field returns from maintenance in November.

"Taking into account the expansion of Tengiz, compliance with the quota could become impossible," one of the sources said.

Chevron and its partners plan to expand output at the Tengiz project to 850,000 bpd in the first half of 2025. Expansion costs at the project stand at around $49 billion.

OPEC will release estimates of its members' September oil output next week.

The group's leader Saudi Arabia has repeatedly called on rival producers to improve compliance, saying it was the most paramount immediate task before OPEC+ embarks on releasing more barrels from December.

Global oil demand is set to grow next year at a lower rate than previously expected, the U.S. Energy Information Administration (EIA) said in its Short-Term Energy Outlook (STEO) for October, as it slashed its Brent oil price forecasts for 2025 due to lower expected demand increase.

The EIA now expects global oil demand to grow by 1.3 million barrels per day (bpd) in 2025, due to downgraded forecasts of consumption in developed economies in the OECD.

In the September STEO, the EIA had projected global consumption of liquid fuels would increase by 1.5 million bpd in 2025.

In the October outlook, the administration reduced its forecast of total OECD oil consumption by 200,000 bpd in 2025 compared with last month’s STEO, as a result of weaker expectations for industrial production and manufacturing growth in the United States and Canada.

Most of the EIA’s expected global liquid fuel demand growth is from non-OECD countries where liquid fuels consumption is set to increase by 1.0 million bpd in 2024 and 1.2 million bpd in 2025. This would be in contrast to consumption in OECD countries, which is projected to fall by 100,000 bpd in 2024 before increasing by a similar amount in 2025.

For the U.S., the EIA cut its estimate of liquid fuel consumption to 20.49 million bpd in 2025, down from the September estimate of 20.64 million bpd.

In the October STEO, the EIA slashed its forecast for the Brent crude oil spot price through the end of next year. In this month’s outlook, the administration expects the Brent price will average $78 per barrel in 2025, which is $7 a barrel less than the forecast in last month’s STEO. Lower crude oil prices in the forecast “largely reflect a reduction for global oil demand growth in 2025,” the EIA said.

Early on Wednesday, Brent Crude prices were slightly down by 0.4% at $76.80.

By Tsvetana Paraskova for Oilprice.com

Oil prices have seen their most volatile start to a month in almost two years as the spiraling tensions between Iran and Israel spur a bumper bout of volatility.

So far in October, Brent crude has traded in an average daily range of $3.73, the biggest for the same period in any month since December 2022, according to data compiled by Bloomberg.

Prices have gyrated mainly on the risk that Israel’s retaliation for a missile attack by Iran will involve energy infrastructure in a region that accounts for a third of the world’s oil output. But there have also been macro-economic drivers, including a blowout U.S. jobs report late last week followed by a strong market reaction to stimulus from China.

“The high level of volatility can lead to false positives in terms of buy/sell signals — making for a very challenging environment if you want to initiate directional trades,” said Harry Tchilinguirian, group head of research at Onyx Capital Group.

The sharp swings have also coincided with bumper activity in the oil options market. On average close to 250 million barrels of bullish calls have changed hands in each of the last 10 days, a record, as traders seek to protect against both higher levels of volatility and a price spike.

Those volumes have seen significant additions of call-option open interest at $100 for both West Texas Intermediate and Brent.

“Where do we see the positioning in oil, it’s in the options, which is part of the reasons why we see big moves,” said Jeff Currie, chief strategy officer for energy pathways at Carlyle Group. “I think it goes to that short-term, near-term myopic approach of trading oil.”

Oil prices slid on Tuesday, settling down more than 4 percent on news of a possible cease-fire between Hezbollah and Israel, although prices found some support on fears of a potential attack on Iranian oil infrastructure.

Brent crude futures settled down $3.75, or 4.63 percent, at $77.18 a barrel. U.S. West Texas Intermediate futures finished down $3.57, or 4.63 percent, at $73.57 a barrel. At their session lows, both were down more than $4 a barrel.

"We continue to be very headline dependent," said John Kilduff, partner with Again Capital LLC. "This morning, we heard about the potential cease-fire. Then we got indications targets are still being dialed in and energy targets are in the mix."

"That Hezbollah is open to a cease-fire, is the kind of headline that people jump on," said Phil Flynn, senior analyst at Price Futures Group. "There should be a lot of volatility up and down on this conflict."

On Monday, Brent rose above $80 per barrel for the first time since August after more than a 3 percent daily gain. That followed the largest weekly gain in over a year, roughly 8 percent, in the week to Friday on rising concerns of a spreading war in the Middle East.

Hezbollah left the door open to a negotiated cease-fire after Israeli forces raised the stakes in the conflict with its Iran-backed enemy by making new incursions in the south of Lebanon.

Israeli defense minister Yoav Gallant said it appeared the replacement for slain Hezbollah leader Sayyed Hassan Nasrallah had also been eliminated.

Late on Tuesday, Israel's military warned people away from specific buildings in the southern suburbs of Beirut.

The oil price rally began after Iran launched a missile barrage at Israel on Oct. 1. Israel has sworn to retaliate and said it was weighing its options.

Some analysts said an attack on Iranian oil infrastructure was unlikely and warned oil prices could face considerable downward pressure if Israel focuses on any other target.

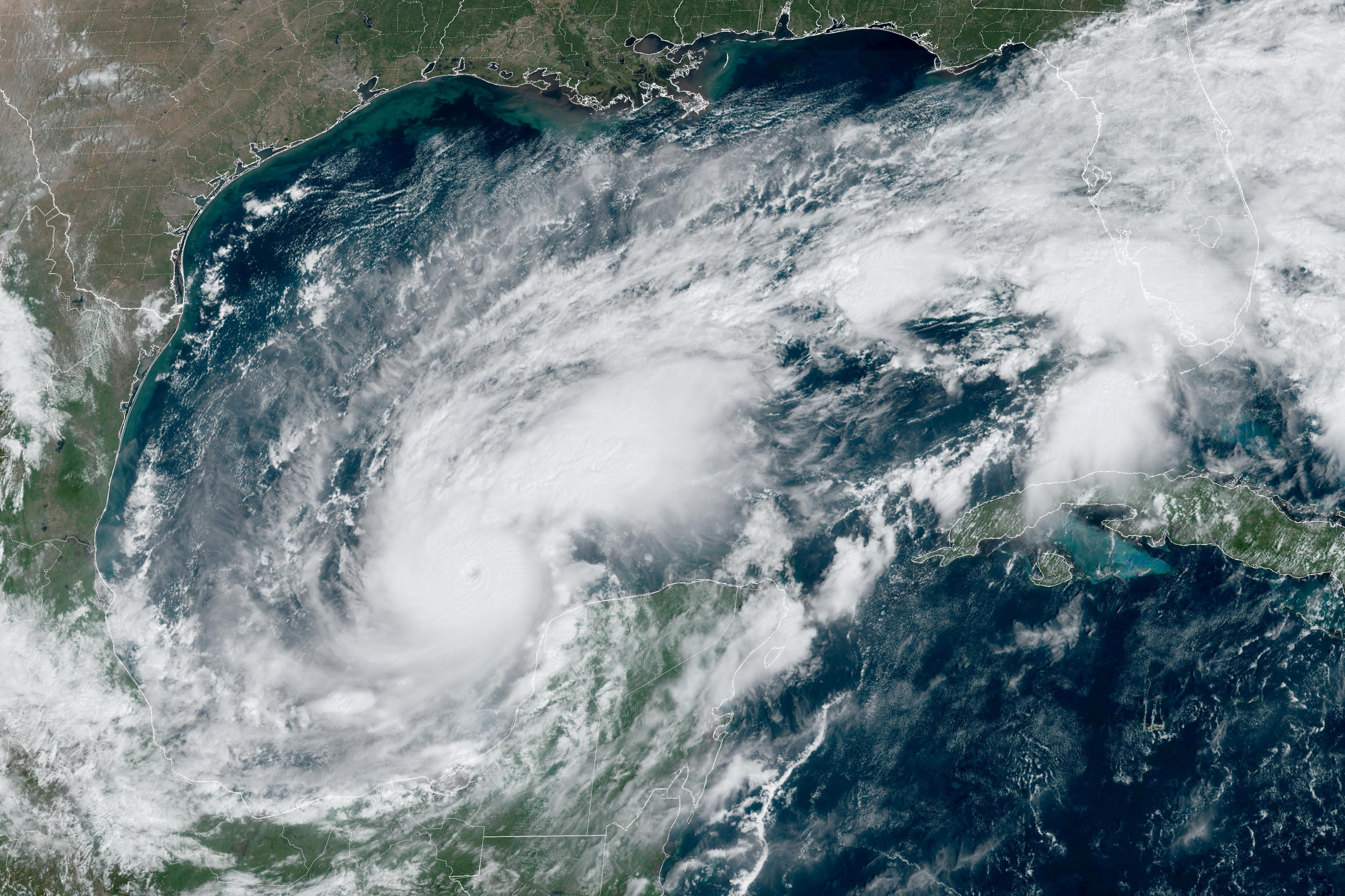

In the U.S., Hurricane Milton intensified into a Category 5 storm on its way to Florida after forcing at least one oil and gas platform in the Gulf of Mexico to shut on Monday.

U.S. crude oil stocks rose by nearly 11 million barrels last week, while fuel stockpiles fell, according to market sources citing American Petroleum Institute figures on Tuesday.

Crude stocks rose by 10.96 million barrels in the week ended Oct. 4, the sources said on condition of anonymity. Gasoline inventories fell by 557,000 barrels, and distillate stocks fell by 2.60 million barrels, they said. (Reuters)

https://www.koreatimes.co.kr/www/world/2024/10/501_383893.html

Oil Shorts Aren’t Ready to Give Up

By Alex Kimani - Oct 09, 2024, 7:00 PM CDT

The big oil price rally that kicked off last week and increased oil prices by nearly $10 per barrel has started unwinding. Brent crude futures for December delivery were trading at $76.63/barrel at 11.40 am ET on Thursday while WTI crude was changing hands at $73.24/barrel. That marks a sharp fall from their Monday 2-month high of $81.12 for Brent and $77.91 for WTI crude. The rally was triggered by Washington’s indication that Israel could strike Iran’s oil facilities.

Citi analysts have provided estimates that a major strike by Israel on Iran's export capacity could take 1.5M bbl/day of crude off the market, while an attack on downstream assets and other relatively minor infrastructure could take out 300K-450K bbl/day. According to ANZ Bank, Iran's oil output hit a six-year high of 3.7M bbl/day in August.

Meanwhile, Clearview Energy Partners has predicted that oil prices could gain as much as $28/bbl if flows are blocked in the Strait of Hormuz; $13/bbl if Israel strikes Iranian energy infrastructure and $7/bbl if the U.S. and its allies placed economic sanctions on Iran.

Unfortunately for oil price bulls, the shorts are not about to give up. According to commodity experts at Standard Chartered, the latest rally was triggered by short sellers running to cover after the Middle East crisis escalated. However, StanChart has warned that short sellers are not running for the hills. According to the analysts, once the unwinding of the undershoot in prices is accounted for, the market response to events in the Middle East, and particularly the threats made against Iranian energy infrastructure, was very underwhelming. StanChart notes that Brent’s front-month settlement on 7 October was lower than the settlement for the equivalent days in 2021, 2022 and 2023 while prompt prices have merely returned to where they were as recently as late August. There’s been little change to the overwhelmingly bearish sentiment that has dominated the oil market over the past three months, with many traders still prepared to short oil aggressively if the daily news flow and market momentum allow for it.

Indeed, positioning data shows little change in the week up to settlement on 1 October, with money-manager net selling of WTI crude futures exceeding net buying. StanChart’s proprietary crude oil positioning index was little changed w/w at -69.1. Neither the latest China stimulus nor the increase in violence in the Middle East seems to fluster the shorts.

The unfolding oil price selloff was triggered by the release of the latest Energy Information Administration (EIA) weekly report, which StanChart rates highly bearish according to its U.S. oil data bull-bear index. Total commercial inventories fell 0.91 mb w/w to 1.267.08 mb, with the deficit below the five-year average increasing by 1.72 mb to a 20-week high of 20.74 mb. Unfortunately, the bull-bear index was heavily affected by increases in crude oil, gasoline and distillates inventories in both absolute terms and against the five-year averages. Crude oil inventories rose by 3.89 mb w/w to 416.93 mb, with the deficit below the five-year average shrinking by 3.46 mb to 18.44 mb. StanChart points to a highly unusual trend whereby every element in the w/w crude balance changes was in the direction of higher inventories; higher domestic output, higher imports, lower exports, lower refinery runs, slower SPR fill and a higher adjustment term.

Europe’s natural gas prices slip

Meanwhile, European natural gas futures dropped below €40 per megawatt-hour to €38.52 per megawatt-hour, retreating from a 10-month high of €41 reached earlier in the week. The decline was largely driven by increased wind power generation coupled with a stable supply of Norwegian gas.

EU gas inventory builds have remained slow, with the increase over the past week falling to less than 30% of the five-year average. According to data by Gas Infrastructure Europe (GIE), Europe’s gas inventories stood at 111.05 billion cubic meters (bcm) on 6 October, good for a w/w build of 391 million cubic meters (mcm). Three of the daily changes were below 50 bcm, including a 42 mcm draw on 2 October. The deficit below last year has risen to 1.5 bcm, while the surplus above the five-year average has shrunk to a 23-month low of 6.17bcm. The current pace of inventory build implies this year’s seasonal maximum might only reach 112 bcm instead of the previous prediction of 166 bcm going by August's clip.

https://oilprice.com/Energy/Crude-Oil/Oil-Shorts-Arent-Ready-to-Give-Up.html

ST. PETERSBURG. Oct 10 (Interfax) - Hungary has independently solved the problem of Russian oil supply resumption to the fullest, without any support provided by the European Union, Hungarian Minister of Foreign Affairs and Trade Peter Szijjarto told reporters on the sidelines of the St. Petersburg International Gas Forum.

Oil supply has resumed, the contract has been amended, and oil is now delivered to the border of Belarus and Ukraine, he said.

The European Commission has given no assistance to Hungary, Szijjarto said. It is completely wrong and inadmissible for an EU candidate, Ukraine, to play games with the reliable energy supply to two EU member states, Hungary and Slovakia, he said.

It is a task of the European Commission to assist in the provision of safe energy supply, Szijjarto said. Ukraine took the unilateral step without issuing a notice or providing information to Hungary, and cut Hungarian oil imports by a third, he said, adding that Budapest had to adjust its contract with Russian suppliers.

Hungary and Slovakia stopped receiving pipeline oil from the Russian oil company Lukoil shipped via the Druzhba pipeline in the middle of July due to a transit ban imposed by Ukraine. Kiev tightened sanctions on Lukoil, effectively banning oil transport to Central Europe across Ukraine via the Druzhba pipeline. Lukoil is a major supplier to Hungary, where it accounts for around one third of crude imports, and to Slovakia with 40%-45%.

In September, the Hungarian MOL Group signed contracts with oil suppliers and pipeline operators to ensure continuous oil transportation by the Druzhba pipeline to Hungary and Slovakia via Belarus and Ukraine. The oil delivered to the border of Belarus and Ukraine has been designated property of MOL Group since September 9.

The updated contracts fully comply with all restrictions, including those imposed by the European Union and Ukraine.

The Japanese government announced a decision Sunday to expand a Japan-South Korea cooperation framework aimed at reducing emissions of methane from natural gas development projects.

Twenty-two Japanese companies, including Kansai Electric Power, Tokyo Gas and trader Mitsubishi, will newly join the framework, according to the government.

The government made the announcement at a meeting of liquefied natural gas producing and consuming countries in the city of Hiroshima.

Member companies on the procurement side will confirm efforts to reduce methane emissions by firms involved in natural gas production and urge them to disclose related information. Some firms have already given consent to the disclosure.

Methane's greenhouse effect is believed to be more than 20 times that of carbon dioxide. Leaks of methane from gas fields are a major issue that need to be dealt with.

The cooperation framework was announced at last year's meeting between LNG producing and consuming countries by Jera, a joint venture between the Tokyo Electric Power Company Holdings group and Chubu Electric Power and Korea Gas or KOGAS

The combined amount of LNG handled by Jera, KOGAS and the 22 new member companies a year stands at about 100 million tons, or some 25% of the total global LNG distribution volume. Information such as the amount of methane emissions from production facilities will be announced in an annual report.

Also at the Sunday meeting, the government-backed Japan Organization for Metals and Energy Security, or JOGMEC, and major Italian energy company ENI signed a memorandum of cooperation on diversifying LNG procurement sources.

The Japanese and Italian governments will shortly come up with a memorandum of cooperation for stable supplies of LNG.

Japan and South Korea agreed to conduct a test on LNG-related cooperation between the two countries' private sectors.

https://www.japantimes.co.jp/news/2024/10/06/japan/japan-south-korea-cut-methane-emissions/

A consortium led by US oil supermajor ExxonMobil ( Exxon ) has awarded a front-end engineering design contract to the French company Technip Energies ( Technip ) for a proposed liquefied natural gas (LNG) project in Mozambique .

The Rovuma LNG project, for which the final investment decision (FID) is likely in 2026, will have a nameplate capacity of 18mn tonnes per year and comprise 12 modular LNG trains of 1.5mn tpy each.

Exxon is the operator and Italian major Eni and China National Petroleum Corporation (CNPC) are its partners.

Technip said in a release on September 25 that it and JGC Corp. ( Japan ) were "honoured" to have won the contract for what will be Mozambique’s largest LNG plant.

The design will feature electric-driven LNG trains instead of gas turbines, reducing greenhouse gas emissions compared to conventional LNG projects. In addition, it will feature prefabricated and standardised modules to be assembled at the project site in northern Mozambique . This, it said, will be cost-competitive.

Mario Tommaselli , SVP Gas and Low Carbon Energies of Technip said: “By leveraging our expertise in modularisation and electrified LNG, we are committed to supporting ExxonMobil and its partners towards final investment decision, as well as strengthening our presence in Mozambique to contribute to long-term economic growth and its ambition to become one of Africa’s leading LNG exporters.”

Mozambique has attracted large investments into its developing LNG industry underpinned by the discovery of up to 180 trillion cubic feet (5 trillion cubic metres) of recoverable gas, most of it in offshore Rovuma Basin to the north. Eni started producing LNG at its floating plant in October 2022 , while TotalEnergies ( France ) expects to resume developing its 13mn tpy onshore plant in the same basin by December 2024 .

Farhan Mujib , representative director, president of JGC, hailed the environmental sustainability of the proposed project.

“With the global focus on decarbonisation and energy security, the JGC Group is accelerating the promotion of energy transition, and this project is firmly in line with the direction of our strategy. We are convinced this project of national significance will contribute to enhancing economic and industrial growth in Mozambique and East Africa ," said Mujib.

DUBAI, Oct 6 (Reuters) – Iran’s oil minister landed on Kharg Island, home to the country’s main export terminal, and held talks with a naval commander on Sunday, the oil ministry’s news website Shana reported, amid concern Israel could attack energy facilities.

An Israeli military spokesman said on Saturday that Israel would retaliate in response to last week’s missile attack by Tehran “when the time is right.”

U.S. news website Axios cited Israeli officials as saying Iran’s oil facilities could be hit, while U.S. President Joe Biden said on Friday that he did not think Israel had yet concluded how to respond.

Iran is a member of the Organization of the Petroleum Exporting Countries (OPEC) with production of around 3.2 million barrels per day (bpd), or 3% of global output. Iranian oil exports have climbed this year to near multi-year highs of 1.7 million bpd despite U.S. sanctions.

Most of its oil and gas wealth is located in the south of the country, where the Kharg Island terminal is situated and from which around 90% of Iranian oil exports are shipped.

Oil Minister Mohsen Paknejad arrived on Sunday “to visit the oil facilities and meet operational staff located on Kharg Island,” Shana reported, adding that the oil terminal there has the capacity to store 23 million barrels of crude.

State media reported Paknejad met with Mohammad Hossein Bargahi, a Revolutionary Guards Navy commander, to check the security of Iran’s South Pars gas platforms and assess the effective actions of the Guards’ 4th Naval Region.

“The Islamic Revolutionary Guard Corps Navy plays an important role in the security of oil and gas facilities,” Paknejad was quoted as saying.

China, which does not recognize U.S. sanctions, is Tehran’s biggest oil customer and according to analysts imported 1.2 to 1.4 million barrels per day from Iran in the first half of 2024.

(Reporting by Dubai Newsroom; Editing by Hugh Lawson and Barbara Lewis)

(c) Copyright Thomson Reuters 2024.

https://gcaptain.com/irans-oil-minister-inspects-export-terminal-amid-fears-of-israeli-strike/

BISMARCK — A federal judge in North Dakota has temporarily blocked a new Biden administration rule aimed at reducing the venting and flaring of natural gas at oil wells.

U.S. District Judge Daniel Traynor ruled on Sept. 13 that plaintiffs’ claims the rule was “arbitrary and capricious” was likely to succeed, the Bismarck Tribune reported.

North Dakota, along with Montana, Texas, Wyoming and Utah, challenged the rule in federal court earlier this year, arguing that it would hinder oil and gas production and that the Interior Department's Bureau of Land Management is overstepping its regulatory authority on non-federal minerals and air pollution.

The bureau says the rule is intended to reduce the waste of gas and that royalty owners would see over $50 million in additional payments if it was enforced.

But Traynor wrote that the rules "add nothing more than a layer of federal regulation on top of existing federal regulation."

When pumping for oil, natural gas often comes up as a byproduct. Gas isn't as profitable as oil, so it is vented or flared unless the right equipment is in place to capture.

Methane, the main component of natural gas, is a climate "super pollutant" that is many times more potent in the short term than carbon dioxide.

Well operators have reduced flaring rates in North Dakota significantly over the past few years, but they still hover around 5%, the Tribune reported. Reductions require infrastructure to capture, transport and use that gas.

SOUTH DAKOTA

Families sue state over giant sinkholes

Stuart and Tonya Junker loved their quiet neighborhood near South Dakota's Black Hills — until the earth began collapsing around them, leaving them wondering if their home could tumble into a gaping hole.

They blame the state for selling land that became the Hideaway Hills subdivision despite knowing it was perched above an old mine. Since the sinkholes began opening up, they and about 150 of their neighbors sued the state for $45 million to cover the value of their homes and legal costs.

Sinkholes are fairly common, due to collapsed caves, old mines or dissolving material, but the circumstances in South Dakota stand out, said Paul Santi, a professor of geological engineering at the Colorado School of Mines.

Crews built Hideaway Hills, located a few miles northwest of Rapid City, from 2002 to 2004 in an area previously owned by the state where the mineral gypsum was mined for use at a nearby state-owned cement plant.

Attorney Kathy Barrow, who represents residents who live in 94 subdivision homes, said the state sold the surface but held on to the subsurface, and it did not disclose it had removed the soil's natural ability to hold up the surface.

Since that first giant collapse, more holes and sinkings have appeared and there are now "too many to count," Barrow said. The unstable ground has affected 158 homes plus destabilized roads and utilities.

In court documents, the state called the sinkhole formation “tragic” but argued that it wasn't the fault of state officials. The state traced the area's mining history to the 1900s, noting a company that mined underground and on the surface before 1930. Beginning in 1986, the state-owned cement plant mined for several years.

The state claimed it wasn't liable for damages related to the underground mine collapse because the cement plant didn't mine underground and the mine would have collapsed regardless of the plant's activities.

By Katya Golubkova / Reuters

06 Oct 2024, 10:50 am

HIROSHIMA (Oct 6): Italian energy company Eni is in talks with Japan on supplying the country with liquefied natural gas (LNG), Cristian Signoretto, Eni's director for global gas and LNG portfolio, told reporters on the sidelines of a conference on Sunday.

"We already deal with Japanese buyers on a short-term basis and we would like to expand that collaboration also to a long-term basis," Signoretto said, adding that Eni plans to bring more LNG volumes to the market including from Indonesia and also wants Japanese financial institutions to support some projects.

Eni plans to build its LNG portfolio to 18 million metric tonnes per year by 2027 and would be ready to commit part of it to Japan if the opportunity is there, he added.

Signoretto said it was early to say about the specifics of the discussions, including whether Eni would insist on destination clauses, which are obligations in contracts for the buyer not to resell the gas to third parties.

In recent years, there has been a growing demand among Japanese buyers for deals with shorter duration and without destination clauses as this allows buyers in Japan, the world's second-biggest LNG importer, to stay flexible and also to resell LNG.

"Flexibility will be part of the discussion," Signoretto said, without providing details.

Uploaded by Magessan Varatharaja

EQT Corporation EQT has gained 1.2% in the past six months, outpacing the 0.9% improvement of the composite stocks belonging to the industry.

What's Favoring the EQT Stock?