Organic Cotton Workwear Pants Cut in 100% organic cotton drill our Workwear Pants are a chic essential you’ll want to wear every day. From a midrise waist, belt loops and pockets are easy utility, while the leg flows to a flattering straight leg crop.

Crafted from 100% organic cotton grown in India that’s certified by the Global Organic Textile Standard (GOTS) and made in a Fair Trade Certified™ facility.

Irene is 5’8” (171cm) and wears a size NZ 8/ US 4/ UK 8/ EU 36

Style code: 5861-01

An attack with an explosive device on an oil field in the northern Iraqi region of Kirkuk was blamed on Islamic State militants, according to an unnamed source who spoke to Turkey's Anadolu Agency.

No damage was done to the field, Bai Hassan, according to the source.

Earlier this year, suspected Islamic State militants blew up two oil wells at the Bai Hassan field, killing at least one security officer and setting the oil wells ablaze.

The Bai Hassan field that can produce around 200,000 barrels per day (bpd) of oil has more than 120 oil wells. Based on these reports, it is an attractive target for the Islamic State, which despite international efforts, is alive and well in Iraq and Syria.

A recent report by VOA News cited intelligence agencies as saying that the terrorist group remained resilient and ready to spring back out when the U.S. implemented its plans to "recede deep into the background."

"The group has evolved into an entrenched insurgency, exploiting weaknesses in local security to find safe havens and targeting forces engaged in counter-ISIL operations," a report by the UN sanctions monitoring team said.

"Attacks in Baghdad in January and April 2021 underscore the group's resilience despite heavy counter-terrorism pressure from Iraqi authorities," the report also said. Islamic State "is likely to continue attacking civilians and other soft targets in the capital whenever possible to garner media attention and embarrass the Government of Iraq."

Based on what we are currently witnessing happening in Afghanistan, the deeper in the background the U.S. recedes, the more emboldened IS will become, which could mean more attacks on oil fields in the oil-rich Kirkuk region. This would interfere with OPEC's second-largest exporter of crude with plans to boost its production considerably once the OPEC+ agreement expires.

By Irina Slav for Oilprice.com

More Top Reads From Oilprice.com:

The United Nation’s latest climate report paints the most dire picture yet of the warming planet, putting more pressure on the oil and gas industry to change business models and operations to avert the worst consequences of climate change.

The UN-backed Intergovernmental Panel on Climate Change, a group of hundreds of climate scientists around the world, last week issued its sixth report, a nearly 4,000-page analysis of climate research that forecasts extreme temperatures and weather a decade earlier than expected. The report found that unless there are immediate and large-scale reductions in greenhouse gas emissions, it will be impossible to limit global warming to the targets set out by the Paris climate accord of 2015.

“This IPCC report makes clear the clock has run out on business as usual for high-carbon industries, including oil and gas,” said Ben Ratner, the Environmental Defense Fund’s senior director of business. “This report is one more confirmation that fossil fuel dependence is risky and unaffordable for our planet. It’s crystal clear that oil and gas companies need to make big changes.”

Although the UN findings put mounting pressure on oil companies and their investors to rein in greenhouse gas emissions, the lack of concrete solutions, analysts said, will continue to expand the vast divide between U.S. and European companies in their approach to combating climate change.

European oil majors, such as BP, Royal Dutch Shell and TotalEnergies, have moved aggressively over the past year to shift from fossil fuels and expand investments in wind and solar power to meet their net-zero carbon emissions. They remain invested in highly profitable oil projects while divesting other oil assets to pay for their energy transition.

American oil majors, like Exxon Mobil and Chevron, have been slower to shift away from fossil fuels, betting that the world’s growing population will continue to rely on gasoline, jet fuel and natural gas to power their economies. Instead of focusing on renewables, these companies are looking to engineer their way out of the climate conundrum, investing heavily in carbon capture and storage technology to remove greenhouse gases from oil and gas operations and other polluting industries. At the same time, companies also are moving to end routine flaring of excess natural gas from shale wells.

On HoustonChronicle.com: U.S., European oil companies make opposing bets on future

“As populations grow and economies expand, the world will continue to need solutions that ensure access to the affordable, reliable energy modern life depends on and at the same time accelerate emissions reductions and improve environmental performance,” American Petroleum Institute, the nation’s largest oil and gas trade group, said in a statement. “Achieving a lower-carbon future will require new approaches, new policies and continuous innovation, and our industry will continue to lead the way by further reducing emissions, advancing cleaner fuels, investing in ground-breaking technologies, and advocating for the direct regulation of methane and market-based solutions like carbon pricing.”

Environmental groups, however, argue that the UN report is an urgent call to wean the world off of fossil fuels as wildfires rage across the West Coast, record-breaking heat sweeps the nation and hurricanes threaten the Gulf. The UN report comes on the heels of the International Energy Agency report, which warned nations they will need to halt oil and gas development this year to meet 2050 net-zero emissions targets. Both reports are expected to push companies and their investors to speed their shift from fossil fuels.

Activist investors have already shaken up the board of Exxon, long recalcitrant in the face of climate change. Exxon shareholders in May voted to add three directors backed by activist hedge fund Engine No. 1, which with a quarter of the Exxon board seats, has much more influence.

“The world must urgently wind down fossil fuel supply in an orderly and transparent way and halt high-risk high-cost oil and gas exploration now,” said Mark Campanale, executive director of London-based financial think tank Carbon Tracker. “That, or face physical catastrophe, stranded assets costs in the hundreds of billions to our infrastructure and a shock to the world economy a thousand times greater than the COVID pandemic.”

Ed Longanecker, president of the Texas Independent Producers and Royalty Owners trade association, said the IPCC report is a call for increased investment in carbon capture technology to reduce harmful greenhouse gas emissions from oil and gas operations, not to scrap one of the world’s most vital energy sources. He pointed to Exxon’s $3 billion investment into carbon capture projects and the Texas Methane Flaring Coalition’s goal to reduce methane emissions to 1 percent or less by 2025. Several companies, such as EOG Resources, Apache and Kinder Morgan have met its methane goals, and others are investing in real-time emissions monitoring systems to catch leaks, he said.

“We need to realize the U.S. is a global leader in clean air and water, and also the largest oil and gas producer,” Longanecker said. “They’re not mutually exclusive. We should not let some reports out there making catastrophic claims and projections drive overly aggressive regulations.”

On HoustonChronicle.com: Big Oil confronted with 'day of reckoning' on climate change after Exxon board shake-up

Erik Milito, president of offshore oil and wind trade group National Ocean Industries Association, sees the IPCC report as a reason to increase offshore oil production, which some say produces less carbon than shale production because it relies on pipelines, not trucks, to transport oil and natural gas. While offshore continues to produce under the threat of a spill, Milito said the industry implemented more safeguards after the BP Deepwater Horizon explosion in 2010.

“This should be a report that we all embrace as an offshore energy sector,” Milito said. “As long as we have demand, we need to make sure we get it from the lowest carbon sources. Let’s get it from offshore.”

Ratner with the EDF said no segment of the industry should get a pass in the transition to net-zero emissions. While environmental groups understand that oil and gas demand won’t drop to zero overnight, Ratner said every industry — including fossil fuel production — must be greatly reducing emissions immediately to avoid the worst outcomes of climate change.

Ultimately, this energy transition and reduction in carbon emissions will have profound implications for Houston, the “energy capital of the world,” and for Texas, the nation’s top oil-producing state. The state is home to many of the world’s largest oil companies, which still employ almost 150,000 workers despite layoffs that claimed about 60,000 jobs in 2020.

But Ratner said the IPCC report should not be met with doom and gloom in Houston. Instead, Houstonians should view the report as a call to action to innovate and expand into cleaner sources of energy.

“The outlook for oil and gas jobs is a challenging one, but there’s a tremendous need and opportunity for leadership and innovation,” Ratner said. “Houston has a problem, but it needs to be at the forefront of solutions.”

paul.takahashi@chron.com

twitter.com/paultakahashi

Mills in a number of China’s provinces have been ordered to reduce output. In Tangshan, which accounts for about 8 per cent of global steel industry production, have been told to reduce their output by more than 12 million tonnes, or about 8 per cent, this year as part of a 21.7 million tonne cut to volumes in the wider Hebei province. With the authorities mandating that China’s total steel production shouldn’t exceed last year’s, that implies that the industry will need to offset the 12 per cent increase in the first half with a similar reduction in the second half, which helps explain why the iron ore price has been tumbling. What was already a quite complicated picture for the iron ore producers and their steel mill customers has been made fuzzier by the emergence of the Delta mutation of the coronavirus and the recent outbreaks in China. There is a secondary factor in the curbs on Hebei’s mills, given their proximity to Beijing. As it did when it held the summer Olympics in 2008, China is determined to reduce pollution ahead of the winter Olympics in February next year. The restrictions on production will remain in place until after the Games.

The spike in iron ore and other commodity prices earlier this year and their impact on a surge in factory-gate inflation in China as the global economy bounced back from the worst impacts of COVID-19 alarmed the authorities. They have used a combination of threats and direct action – export taxes, reduced or cancelled rebates of value-added taxes and the release of strategic reserves – to try to dampen speculation in commodities, prevent hoarding and reduce demand. In a slowing economy with vulnerabilities in some of its most commodity-sensitive sectors the spiralling of input costs, particularly iron ore, represented a threat. The most effective of the measures Beijing has deployed, however, appears to be the overall ceiling on steel output. As it did when it held the summer Olympics in 2008, China is determined to reduce pollution ahead of the winter Olympics in February next year. The restrictions on production will remain in place until after the Games. Credit:Getty What was already a quite complicated picture for the iron ore producers and their steel mill customers has been made fuzzier by the emergence of the Delta mutation of the coronavirus and the recent outbreaks in China.

Global supply chains hadn’t recovered from the initial waves of the pandemic even before the Delta strain emerged. Shortages of semiconductors in particular have continued to plague manufacturers, most notably automakers, which are major consumers of steel. The logistics chains for global trade – ports, shipping and containers – were still struggling to cope. Loading Outbreaks of Delta in China this year have impacted factories, disrupting the flows of goods, and ports. China has a zero-tolerance policy towards COVID-19. In response to an outbreak last month in Nanjing the authorities implemented severe lockdowns and travel restrictions and cancelled conferences and other events of national significance.

Earlier this year Shenzhen’s Yantian port was closed for a month after an outbreak of the virus. This month a terminal at the Ningbo-Zhoushan container port – the world’s third-largest cargo port – was shut down after a worker tested positive. It remains closed. That has had flow-on effects to other Chinese ports, generating immense congestion, and has impacted the flow of goods across the Pacific. Ports on the west coast of the US are experiencing backlogs of container ships queuing up to berth. This latest disruption of supply chains is also flowing back to manufacturers already struggling to deal with the previous interruptions, shortages and price impacts of the pandemic, forcing them to reduce their own output, with obvious consequences for their demand for raw materials. Rio Tinto, BHP and Fortescue knew that the massive iron ore windfalls wouldn’t be sustained. Credit:Bloomberg Some of these influences will pass, with time. The effects of China’s slowdown, its ceiling on steel production, its efforts to slow the growth in its carbon emissions and to induce new supply of key commodities to drive down price – most notably iron ore – will, however, linger.

The remainder of this year will be particularly “interesting” if the steel mills continue to try to offset their record first-half volumes with matching reductions in the second half to meet the directive of no annual growth in production. Given that the Pilbara producers – Rio Tinto, BHP and Fortescue – are very low-cost producers the surge in iron ore prices earlier this year provided massive windfalls, but the companies knew they wouldn’t be sustained. Longer term, as Vale steps up production in Brazil and China fast-tracks the development of the big Simandou ore body in Africa there will be other structural pressures on the price but their positions on the cost and quality curves means that even at very low prices they will still be exceptionally profitable. Loading Putting aside the shorter-term volatility that the pandemic, the scramble to meet production limits and the pre-Olympics efforts to clean up its environment will induce, China is trying to restructure its economy and reshape it to deleverage and to reduce the rate of growth in its carbon emissions over the next decade and beyond. The big iron producers will in turn need to reshape their portfolios to reflect those structural changes concurring within their biggest customer.

This is the second installment of a series on global currencies. The first part details the forces eroding the U.S. dollar’s reserve status.

Half a century ago today, on August 15, 1971, U.S. President Richard Nixon took a momentous step.

After World War II, the U.S. had used its leverage as the last advanced economy standing to make the dollar the foundation of a global system of exchange rates. The postwar dollar was backed by huge gold reserves built up in part through American sales of munitions to Europe during the war. The system, known as Bretton Woods for the New Hampshire site of its enactment, played a key role in the reconstruction of devastated economies in Europe and Japan.

Related: 50 Years After Bretton Woods, the US Dollar’s Throne Is in Play

But by 1971, those recovering economies had become a threat to the gold-backed dollar. Rising exports from Europe and Japan eroded the U.S. share of global trade, reducing demand for American currency. Combined with excess U.S. spending, this convinced financial markets that the dollar was overvalued against its $35 per ounce gold peg. Starting in the 1960s, dollars were redeemed for gold at a faster and faster clip, a “gold run” motivated by the belief that the dollar’s peg might break, leaving dollar holders short.

Finally, 50 years ago, Richard Nixon suspended dollar redemptions for gold. Though the process took a few more years to play out, this effectively ended the gold standard and the fixed Bretton Woods exchange system that relied on it.

The significance of this moment is arguably exaggerated in the sweep of financial history – the “gold standard” that Nixon ended had lasted less than three decades, under extremely unusual circumstances. In its place eventually came the relatively free-floating exchange rates we know today, in which the relative value of currencies changes based broadly on the economic clout and political stability of the issuing nation.

Story continues

As it happened, despite the rise of Europe and Japan, this new currency regime still favored the (now unbacked) U.S. dollar. For the half-century since, it has remained the dominant currency for global trade, and the overwhelming choice of foreign central banks looking for a stable store of value. As we discussed in the first installment of this series, this has given the U.S. a variety of economic and political advantages, often referred to as the dollar’s “exorbitant privilege.”

Related: Honor Releases First Snapdragon Smartphone With Digital Yuan Wallet

But now, the status quo of dollar dominance is eroding. Post-pandemic inflation has reignited worries about the dollar’s declining reserve status, but it’s a much longer-term trend: In May, the dollar’s share of central bank reserves fell to a 25-year low of 59%.

The dollar’s lost share has been taken up in large part by growth in reserves held as euros, Japanese yen, and Chinese yuan. There’s also another competitor, though it’s still just a glimmer on the horizon: Crypto advocates have long argued that bitcoin or another digital asset could serve as a global reserve currency, and recently much more mainstream figures, including the former head of the Bank of England, have supported the idea of a supranational digital reserve instrument.

Reserve status is not a winner-take-all competition. The circumstances that led to nearly a century of dollar dominance were an anomaly, and experts generally don’t expect any single currency or instrument to become similarly dominant in the 21st century.

But which of the candidates have the best chance of stealing significant reserve market share from the dollar – along with a share of the power and privilege that come with it?

The Euro

The euro has many huge advantages as a potential global reserve currency. Despite a legacy of economic mismanagement by a few member states like Greece and Spain, the Eurozone is by and large made up of healthy, well-regulated economies, with a total GDP slightly higher than China’s. And while the European Central Bank is certainly not without its flaws, it is generally governed in a steady and fairly predictable manner. It has also weathered one truly terrifying crisis in 2010, managing to pull together a bailout package and ward off the euro’s dissolution, considered a real possibility at the time.

So it’s no surprise the euro is already the world’s second-biggest reserve currency, with roughly €2.5 trillion ($2.94 trillion) in central banks globally.

But there are barriers to further growth in euro reserves.The biggest of these is not economic, but political. Power over interest rates and other aspects of euro monetary policy is in the hands of the Governing Council of the European Central Bank, which is made up of a six-member Executive Board and the governors of all 19 Eurozone central banks. That means major conflicts between member states on monetary policy could lead to governance gridlock or breakdown, which creates risk relative to the more unitary U.S. Fed.

Another problem for the euro’s reserve currency potential, according to Stanford economist Darrell Duffie, is that the European Central Bank for many years did not issue Europe-wide bonds. The central banks of member states issue euro-denominated bonds, but they don’t mirror the strengths and weaknesses of the Eurozone as a whole. Each country’s bonds have their own independent yields, for instance. That adds to the complexity and risk of using them as reserves. Bonds, rather than currency, make up the bulk of international central bank reserves, so the lack of true “euro bonds” has constrained the euro’s reserve role.

This situation changed during the pandemic, however. The European Union announced last October that it would begin the first large-scale issuance of Europe-wide debt to fund pandemic relief. The bonds have been generally well-received by markets, and the European Commission plans to borrow 900 billion euros ($1.06 trillion) over the next five years. Though the bonds will go to a variety of buyers, that’s enough to significantly displace dollar-denominated bonds in central banks, which currently total close to $7 trillion.

More importantly, the issuance sets a precedent. “Whether there will be a lot more of them or not is hard to foresee,” says Duffie. “But because this kind of breaks the ice, it may mean there’s more in the future.” That wouldn’t simply add assets to the market for reserves – Duffie argues that shared debt issuance would increase European political cohesion, reinforcing the utility of the bonds as stores of value.

(A note: Despite its past glories, the British pound is not generally part of the discussion of reserve shifts, in part because of the U.K.’s relatively small economy – one fifth the size of China’s and half the size of Japan’s.)

The Yen

The situation of the yen is maybe the most counterintuitive when it comes to reserve status, and it casts crucial light on the challenges facing China’s yuan. Broadly, despite its economic strength, Japan’s financial system still has certain isolationist tendencies rooted in its export-driven postwar rebuilding strategy. Above all, most Japanese debt is held domestically, limiting the available supply of yen-denominated reserves.

“It’s never been Japan’s ambition” to have a global reserve currency, says Alicia Garcia-Herrero, Chief Economist for Asia-Pacific at investment bank Natixis. “If you have a current accounts surplus, like Germany and Japan, you don’t need an international reserve currency, because you don’t have anything to finance. You buy assets.”

In other words, if a nation is a net exporter, it may simply not have enough international debts for its bonds to serve as global reserves. Japan’s high domestic savings rate, which has averaged a stunning 30% over the last 40 years, also means there’s huge demand for government bonds at home.

It’s a strange insight when turned back on the dollar: one reason USD is a dominant reserve currency is because Americans can’t seem to live within their means.

The Yuan

The yuan is something of a boogeyman of the dollar these days – a threat looming just offstage, more rumor than light.

China has been trying to make its currency appealing as a global reserve and trading instrument for at least a decade, and as the world’s second-largest economy, it’s got the muscle. The push for reserve status has included creating offshore bond markets in Hong Kong, a troubled attempt to balance global yuan flows with the CCP’s desire for domestic capital controls. More recently, some observers argue China’s “digital yuan” project is an attempt to gain a technological edge that would increase the yuan’s share of trade transactions and, in turn, its viability as a reserve.

But these efforts face an array of challenges so great that most experts don’t foresee the yuan succeeding as a reserve currency any time soon.

One major obstacle is a global lack of faith in Chinese political stability and rule of law, which was highlighted recently by a sudden, broad crackdown on financial technology by the ruling Chinese Communist Party. Bitcoin miners were caught in that net, but the crackdown also crashed big portions of the Chinese stock market, as well as Chinese stocks listed abroad. That included some companies, such as Luckin Coffee, that were found to be engaging in large-scale accounting fraud.

This led Joseph Sullivan, an economist on Donald Trump’s White House Council of Economic Advisers, to call the CCP an unwitting ally to the dollar’s reserve status. Such interventions and collapses cast doubt on China’s commitment to free markets, its regulatory rigor and, in turn, the fundamental strength of the Chinese economy. The potential consequences are fresh in the memory of the finance industry: a similar stock market crash in June of 2015 was quickly followed by China’s central bank devaluing the yuan to boost export competitiveness.

This all stems from a likely irresolvable conundrum at the heart of China’s reserve-currency ambitions: Tight control over its currency has been a major pillar of its long rise as an economic power, but is incompatible with global reserve status.

This is where Japan is an illustrative comparison. Since the reforms of the late 1970s, China has modeled its development largely on Japan’s postwar rebuilding, above all its emphasis on domestic investment to build an export-based economy. There are very tight controls on the flow of capital out of China because the Communist Party wants domestic capital to be invested within China, whether to build factories for Apple contractors or fund AI development.

But to become a functional reserve currency, the yuan would have to be freely tradeable. Nations need their reserves to be quite liquid, partly so they’re ready for sudden, big shifts in market conditions – like, say, the coronavirus pandemic, which set off a flurry of U.S. bond sales. To get there, China would have to do what’s known as “open its capital accounts,” or allow free flows of capital in and out of its borders.

But “they don’t plan on opening their capital accounts anytime soon,” according to Emily Jin, a research assistant at the Center for a New American Security. “Their nightmare situation is they open an account and they immediately, the next morning, have massive capital outflows.” This could be exacerbated by recent stock market woes, since major outflows would be driven by Chinese investors looking for bigger or more reliable returns overseas.

China’s first attempt to square this circle was to create a two-tier system starting around 2010, involving offshore markets for yuan bonds. “China tried to create a tradeable yuan overseas, and then their own yuan at home,” says Garcia-Herrero. “It didn’t work. And the reason it collapsed in 2015 was a giant stock market correction.”

Now, Garcia-Herrero believes China’s central bank is trying to do something similar by creating the digital yuan, an electronic currency completely and directly controlled by the state bank.

“I have to say they are creative,” she says. “They’ve come up with another way to avoid compulsory convertibility. [With a CBDC], they know all the transactions. So if they thought someone was withdrawing too much, they can just take it back.” Garcia-Herrero doesn’t expect the plan to work, however, because of widespread awareness of this potential abuse, and continued distrust in Chinese leadership.

Some have argued that the digital yuan would also increase the yuan’s international appeal through technological innovation – a digital currency may offer speed or other utilitarian advantages over an old-fashioned dollar. But Emily Jin at CNAS doubts that a merely technical upgrade would have a long-term impact: “It might have lower frictional costs, but that’s not the only reason people park their money in USD.”

This tangle of conflicting forces has badly hampered China’s quest for reserve status. The yuan currently makes up a 2.3% share of global reserves – followed closely by the Canadian dollar, which makes up 2% of reserves. Canada’s economy is just 1/8th as large as China’s, and Canada has made no concerted effort to improve its reserve status.

Bitcoin, etcetera

https://finance.yahoo.com/news/ranking-currencies-could-unseat-global-120000610.html

From the Diário do Grande ABC

15/08/2021 | 12:17

OMA Galeria, from São Bernardo, opened the exhibition on the 7th, the first by the artist Isis Gasparini in the space. The exhibition is curated by Pollyana Quintella and displays a selection of more than 21,000 photographs taken by the artist, who investigates the relationship between the public and exhibition spaces, such as museums and art galleries.

The way in which the works are presented is beyond what was expected for an exhibition of photographs, as the artist transformed her collection into large volumes, some bound on all sides, which prevents the images from being viewed individually. Just inside the entrance, there is an apparently solid block. However, the longitudinal section that divides it in two shows clues to its content, made up of more than 500 superimposed photographs.

It only remains to imagine the content of the photographs, which were captured over ten years and include records, studies and completed works. In this exhibition, what matters is not the value of each of the images, but their accumulated volume, which is consolidated into blocks of different thicknesses that form reliefs that occupy the gallery's space. Its stacking materializes the act of photographing, repeated incessantly by the artist over time in different places, such as Germany and France.

The artist also occupies the Antonino Assumpção Chamber of Culture, in the Center of São Bernardo, with the exhibition Under the Risk of Losing the Meeting with Aurora. On the wall, the phrase 'Surviving as poetry' refers to the possibility of living off art, something increasingly difficult, but also reflects on art as a way of surviving setbacks, violence and the pandemic situation of the moment.

Isis Gasparini lives in São Paulo and develops projects that have body, image and light as central materials. The artist thinks of these elements as presences that inhabit exhibitions and cause different responses in the body of the public, investigating the exhibition space as an element that politically interferes in the relations between spectators and works of art. Recently, he participated in group exhibitions in Berlin.

The exhibitions are free to enter and run until October 8th. The use of a mask is mandatory.

Da Redação

Do Diário do Grande ABC

15/08/2021 | 12:17

A OMA Galeria, de São Bernardo, abriu no último dia 7 a exposição, a primeira da artista Isis Gasparini no espaço. A mostra tem curadoria de Pollyana Quintella e exibe seleção de mais de 21 mil fotografias tiradas pela artista, que investiga a relação entre o público e os espaços expositivos, como museus e galerias de arte.

A forma de apresentação das obras foge do esperado para uma exposição de fotografias, já que a artista transformou seu acervo em grandes volumes, alguns encadernados em todos os lados, o que impede que as imagens sejam visualizadas individualmente. Logo na entrada, há um bloco aparentemente sólido. Porém, o corte longitudinal que o divide em dois mostra pistas de seu conteúdo, formado por mais de 500 fotografias sobrepostas.

Só resta imaginar o conteúdo das fotografias, que foram captadas ao longo de dez anos e incluem registros, estudos e obras finalizadas. Nesta mostra, o importante não é o valor de cada uma das imagens, mas seu volume acumulado, que se consolida em blocos de diferentes espessuras que formam relevos que ocupam o espaço da galeria. Seu empilhamento materializa o ato de fotografar, repetido incessantemente pela artista ao longo do tempo em diferentes lugares, como Alemanha e França.

A artista ainda ocupa a Câmara de Cultura Antonino Assumpção, no Centro de São Bernardo, com a exposição Sob o Risco de Perder o Encontro com a Aurora. Na parede, a frase ‘Sobreviver como poesia’ faz referência à possibilidade de se viver de arte, algo cada vez mais difícil, mas também reflete sobre a arte como forma de se sobreviver aos retrocessos, violências e à situação pandêmica do momento.

Isis Gasparini vive em São Paulo e desenvolve projetos que têm como matérias centrais corpo, imagem e luz. A artista pensa esses elementos como presenças que habitam exposições e causam diferentes respostas no corpo do público, investigando o espaço expositivo como elemento que interfere politicamente nas relações entre espectadores e obras de arte. Recentemente, participou de exposições coletivas em Berlim.

As exposições têm entrada gratuita e acontecem até 8 de outubro. O uso de máscara é obrigatório.

(translated by Google)From the Newsroom

Rate your very own experience and help us serve you better !!! By taking a few moments to rate local businesses, services, and destinations, you're helping friends, neighbors, and visitors find the best places to eat, shop, get stuff done, and enjoy themselves. By submitting your rating, you agree that Justdial may include your rating in its Justdial website and publicly post your comments. You may submit only one rating per local listing. Justdial reserves the right to refuse or remove any rating that does not comply with the below Guidelines or the Justdial Terms of Service. Justdial is not responsible or liable in any way for ratings posted by its users.

Guidelines to rate a listing

Be frank and honest. Tell us how you really feel and why. Useful ratings are detailed and specific, and give the readers a feel of your experience.

Think what information you want when you ask a friend or co-worker to recommend you a restaurant, a service, an activity, or a business.

Here are some questions you might want to answer in your rating:

Were you satisfied with the overall experience? Would you want to experience it again?

Do you believe this store/service was better as compared to other similar businesses that you have experienced earlier? Do you think you got value for your money?

Do you believe the whole experience was special? Did you have to compromise in any way? If yes, was it worth it?

Would you recommend this service to others?

Try to present facts and keep it objective. Was your pizza hot? Were the wraps fresh?

Keep it short & sweet. Write short sentences that stick to the point and focus on your experience. The recommended length for a local review is from 100 to 250 words.

Please

Do not spoil it for others. Do not abuse the service. Ratings should not harass, abuse, or threaten someone personal safety or property, make false statements, defame, impersonate anyone, contain profanity, be sexually explicit, illegal or otherwise objectionable content, as determined by Justdial in its sole discretion.

Do not post personal information. Never assume that you are completely anonymous and cannot be identified by your posts. Rating should not include personal information, such as email addresses, mailing addresses, phone numbers or credit card numbers belonging to you or others.

Do not post multiple or commercial ratings. Ratings should not include posts that have spam, commercial or advertising content or links.

Do not imitate or copy others' trademarks or material. Ratings should include your own, original thoughts. We want to hear from you!

How does the rating system work?

The rating a business or service receives is determined by the average rating it gets from all who have rated it. Ratings are based on a scale of 1 to 5 stars:

Boris Johnson certainly has a knack for bad jokes and his repertoire is nothing if not varied. Past “hits” include quips about dead bodies on the coast of Libya and tank-topped bum boys. He’s not quite Roy Chubby Brown, but he does seem to have an inexorable compulsion towards being provocative.

Last week, he made arguably his bravest attempt at banter yet and in doing so invoked the spirit of Margaret Thatcher. Our prime minister is a dedicated agitator – but at the expense of enraging newfound northern members of the Tories? Surely not. Unless of course he knows (as I do) that Thatcher isn’t nearly as unpopular in and around the “red wall” as everyone likes to believe.

There are some who loathe Thatcher. In fact, that doesn’t do it justice – they are physically repulsed at the mere mention of her name. Following her death in 2013, “Ding-Dong! The Witch is Dead” reached number two in the UK Singles Chart. Many revelled in sheer delight at the news.

To some people, she is the devil incarnate. These cranks probably weren’t even directly affected by Thatcher’s policies but they’re morbidly addicted to the monstrous narrative attached to her. On the other hand, there are some that are justifiably hurt and angered by her legacy. This is seen most predominantly in communities with links to the coal mining industry. Johnson should expect to receive some condemnation and criticism from these people after apparently laughing when stating: “Thanks to Margaret Thatcher, who closed so many coal mines across the country, we had a big early start and we’re now moving rapidly away from coal altogether.”

Of course, politics is an opportunistic game and this was a seemingly wide open goal for Johnson’s opponents to seize on. Finally – they thought – the ghost of Bullingdon past has let his mask slip and is at last revealing his contempt for the red wall. Keir Starmer accused the prime minister of being “out of touch” and called for him to apologise. The ever patient Labour mayor of Greater Manchester, Andy Burnham, wrote in the Evening Standard that “it will have raised eyebrows in the red wall seats”.

Labour, a party that has recently been pushing the message that we must look to the future, is still preoccupied with strikes that took place in the 1980s. Indeed Keir Starmer, perhaps it is you who is out of touch. Yours was a decent gesture no doubt borne out of empathy and understanding but it concerns a fight that has long since passed. You might say, we’ve slept since then.

This highlights an increasingly visible problem for the Labour Party: they’ve lost touch with the north. And in trying to shake off their cosmopolitan shackles, they’ve sold themselves a false narrative that traditional voters are still perturbed by historical issues. Going back to your roots does not mean literally entering a time machine. It is sad to see that Thatcher still haunts Labour from beyond the grave and their obsession with the north’s supposed universal disliking for her is often misguided.

Perhaps the north has always been more right wing than people like to imagine. One YouGov survey reveals that Thatcher is believed to be Britain’s greatest post-war leader. Indeed, of the 14 prime ministers since 1945, Thatcher tops the list with 21 per cent of the vote. In the north, she comes second only to Winston Churchill. A similar piece of research carried out by IpsosMORI found that 40 per cent of northern respondents think Thatcher did a good job.

Always remember that when Thatcher was asked for her greatest achievement, she replied: “Tony Blair and New Labour”. He still remains the party’s most successful leader. The two are politically dissimilar, but they are unified in their confidence and unwavering vision. Thatcher was irrevocably stubborn, but then again, so is the British public. We will go down with this Brexit ship. The people are not for turning.

And yet the Westminster bubble has always had a tendency to see the North as one homogenous cell bound together by our disapproval of Thatcher. Outside central Manchester, presumably we’re all living on the set of Billy Elliot nursing our miners-strike hangovers. It may come as a surprise to some, but not everyone worked in the pit. The majority of northern boomers and their offspring didn’t visit a picket line: they read about it like everyone else. The fact that political heavyweights are choosing to exploit this remark by Johnson shows that what they think is important to us rarely ever is.

Forgive me for thinking that this concern for our “red wall” feelings is both irrational and unwarranted. Johnson’s comment was not controversial, nor does it deserve faux-outrage.

I PRESUME YOU have read or heard about the IPCC 6th assessment report which was released this week. However, you may have missed it if you are on a digital detox or enjoying the beauty of a staycation.

Let me fill you in on the finer details – our climate crisis is getting worse, we need to act and we need to act fast. The crisis will affect every aspect of our lives and the future lives our children hope to have and everything our civilisation is built upon – a stable, reliable climate – is now a thing of the past.

These facts are undeniably terrifying and are so huge that it is hard for an individual to absorb the enormity of the situation, never mind feeling able to do anything about it. I have been reading and learning about climate change for almost two decades and with knowledge has come fear, anger, grief and a multitude of other emotions.

It is fair to say that I had eco-anxiety way before the term was coined. I see the debates and hear the conversations this week. It’s so tempting to throw your hands in the air and say, ‘what can I do when global governments and corporations have all the power’. I understand this, I have been there. However, what I feel now is something completely different: I feel empowered. I have become empowered because I have started to accept that I am one person who has one responsibility – that is to do my bit towards making things better.

One person can bring change

I have a busy life, three kids and a full-time job so I know how hard it is to find time to think about our climate let alone take action. However, I am happy to report that there are so many easy ways for you, your family, your workmates or your college friends to get involved and to make a difference.

In the grand scheme of things, any changes you make can seem like a drop in the ocean, but cumulatively we have enormous power. There are almost five million of us in Ireland, each of us can start to get involved in making ourselves, our households and our communities more climate ‘friendly’, or carbon neutral, or just better.

We are each of us pieces of a giant planetary jigsaw puzzle and each is connected to the other. We can influence, support and motivate each other to get involved. Covid-19 has taught us that while we were affected as a global population, the focus became very much about local – our homes, our communities. If we switch that up in relation to climate action and focus on our locality, we can make a global difference.

Another way of thinking about climate action is to see it as something that will benefit your family or your community or your sports club. Everyone is motivated in different ways but it is important to make the connection and recognise that you are part of something much bigger.

So what can you do? Start small and think big…

1. Money

We all know that money makes the world go round and your money is hugely powerful. If you are lucky to have savings or a pension you should explore where your money is being invested.

Your bank or pension provider should offer ethical investments, ones that are not linked to carbon-intensive industries but to more sustainable funds. Ethical funds have proven to be more resilient during the global pandemic so they make economic sense too. Don’t be shy, ask your employer, your financial provider, this is how change comes about.

2. Spending

If a courier is your new best friend then maybe it’s time to step away from the phone and have a rethink of how much ‘stuff’ you are buying and why.

We all know that ‘stuff’ doesn’t just arrive in a box but takes an enormous amount of energy to produce. From cotton production to transport costs, our addiction to ‘stuff’ has resulted in runaway consumerism and inevitably a hotter planet. Catch yourself when you’re ordering and ask yourself if you really need this piece of clothing, furniture or tech, etc or maybe you’ve just ordered it because an ad appeared in your social media feed.

If you do need (as opposed to want) ‘stuff’, then consider second-hand or borrow from a friend or neighbour. This particularly works for gardening tools. Check out https://www.thriftify.ie/ and www.weshare.ie/library-of-things.

3. Digital Footprint

Do you have hundreds of cat videos on your laptop? Or are you saving thousands of images onto the ‘cloud’? Over 4.9 billion people globally have access to the internet and are streaming videos, using video calls and uploading cat videos. This transfer of data uses a huge amount of energy and this will continue to increase as our reliance on technology grows.

There are some great ways to reduce your digital footprint and if 4.9 billion people did it then we could make big savings. Check out www.myclimate.org/information/faq/faq-detail/what-is-a-digital-carbon-footprint/ for some easy wins.

4. Plant, plant, plant

If you have a window box, garden, allotment or farm then now is the time to get planting. We have not only a climate crisis but a biodiversity crisis, so getting your hands dirty and planting is a really fantastic way to take action.

Try growing some food in window boxes or planting some pollinator-friendly plants to support our bees. Trees are carbon heroes and will absorb extra carbon from the air, as well as looking beautiful and giving a home to wildlife so if you have space plant a tree or a native hedge.

Children particularly love planting trees and they can watch it grow over their lifetime. Check out: https://pollinators.ie/gardens/

5. Warm your home

If your home’s temperature fluctuates between cosy and freezing then you know you need insulation, new windows or a new heating system. Insulating your home is a very positive step in reducing your energy bills and thus your carbon use. There are grants and support to help you when you are upgrading your insulation or heating system so check out: https://www.seai.ie/grants/home-energy-grants/ and www.superhomes.ie.

6. Do you need a car?

Modern society has somehow developed the idea of a ‘two-car family’ as the norm. I can hear those living in rural Ireland screaming now that yes, you do need your cars. It’s difficult to argue with that when Ireland’s rural transport network is far below par, but if you live in a city or town, ask yourself if you need that car (or cars). Cars are so costly, both financially and environmentally, that it is time to rethink our use of transport.

You could start by working out the cost – how much did it cost to buy, how much is the insurance, tax, how much is petrol/diesel weekly, etc. This will give you a potential savings cost for you or your family.

Bikes are much cheaper for those in urban settings and electric bikes are a great investment if you need to travel longer distances. Cargo bikes for families are now becoming much more common and are great fun – there’s nothing like watching your kids in one.

If you live in a more rural location, you can make changes. Consider investing in an e-car. They are expensive, but they hold their value and maybe you could trade two petrol cars in for one e-car. Again, it’s not an option for everyone because of the costs involved.

The main thing to consider is; Do I need to use my car today? Hopefully, you get into the habit of saying no more than yes. Try to keep it in the driveway as much as you can.

7. A load of rubbish

We have a waste crisis. Yes, we have the infrastructure in place to remove, sort and either compost, incinerate or recycle our waste, but the volume of waste we are producing is increasing, especially electronic waste.

Waste isn’t really waste but a valuable asset, and in time the hope is that we will have a circular economy whereby each product can be redesigned for use over and over. However, now we have a linear model whereby each product bought has a short lifecycle and can either be recycled once or ends up as waste.

Stick to the classic; rethink, reduce, reuse, repurpose and recycle. Get a compost bin, question the amount of packaging you are being given at the supermarket, stop wasting water (yes another resource to consider) and try to buy less plastic. It is a difficult one, but if each of us starts to complain at the check out then eventually big business will have to listen. Check out: www.mywaste.ie.

8. At work

Many of us are working from home, but it doesn’t mean that we can’t get involved in influencing how our workplaces take action on climate.

There is a growing corporate awareness of sustainability and many companies have signed up to Net Zero. This is a global campaign aimed at businesses and governments to set strong carbon reduction targets ahead of COP26. If you work in a corporate setting then you could find out more from the company’s Sustainability Officer or CSR Officer.

However, if you work for yourself, you can set your own targets. There are many organisations helping SME’s to set carbon reduction targets and many new employees are keen to learn more about how businesses are playing their part.

If you are a business owner, set the tone and be a leader – this may lead to many opportunities to network with like-minded people, save money, retain staff and ultimately help build a resilient economy. If you are an employee, start to ask questions, offer support and solutions and reach out to others who have done something similar. Check out: https://unfccc.int/climate-action/race-to-zero-campaign and https://www.bitc.ie.

9. Talk, share, engage

If we are to reach our national target of a 51% reduction in greenhouse gas (GHG) emissions by 2030 then we need to get behind the solutions offered. 2030 is only nine years away – near enough for FIFA to be planning the 2030 World Cup!

This means that we have to start stepping up to support radical decarbonisation, we can’t sit on the fence and wait for the dissenting voices to shout loudest. We need to vocalise our support for ideas or projects we feel will benefit us and the climate for example if there is a cycle lane proposed and you want to start cycling then offer support in writing or phone your elected representative.

#Open journalism No news is bad news Support The Journal Your contributions will help us continue to deliver the stories that are important to you Support us now

It is also important to listen to each other and talk about your thoughts and concerns about changes that will happen during this time. We have to be open to change but change can be hard and some of us will feel left behind, but if we have strong communities with strong leaders then we will be able to face these challenges. Therefore get to know your neighbours, volunteer if possible, vote and have your elected representative’s number on speed dial. Remember leaders come from all sectors of society – do you fancy being one?

10. Mix up the BBQ

For a few weeks there the Irish BBQ business was in full flow. Burgers were flying off the shelves and sausages were big business. We are big meat eaters in Ireland and we eat on average 10 times the amount of meat in comparison to someone from, say, Malawi. This means that our dietary carbon footprint is large especially when you add dairy into the mix.

However, we have a strong agricultural tradition in Ireland and farmers work hard. So how do we mix up our diet while at the same time supporting our farmers? It is critical that our agricultural system is supported so that it can adapt to our changing climate, whilst at the same time tackling its own carbon footprint.

Each of us has to think of our diet in terms of how it is impacting our national GHG targets. You could ask yourself if you could reduce the amount of meat and dairy you are eating. Should you be buying better quality, local food? How much value do you place on your food and where it comes from? Is ultra-processed food good for you or good for our planet?

Food is the ultimate gift from nature and should be treated with respect. In the face of this climate emergency, we must reassess how we value our food system, how much we are willing to pay for our food and ultimately what type of food we wish to pass on to the next generation. Being a small island means that we can and should be producing food of high quality for our own population, we are a nation that once understood what it was to be hungry and now is the time to value our food system once again.

11. Become a Climate Ambassador

If you want to learn more about our amazing planet, how its climate is changing, what solutions are available and how you can play your part then apply to become a Climate Ambassador. You will meet some great people from all walks of life, become excited about the solutions we have and feel empowered to get involved. Find out more at: www.climateambassador.ie.

Jane Hackett is Senior Programme Manager, Environmental Education Unit, An Taisce.

Amy Niu researches selfie-editing behavior as part of her PhD in psychology at the University of Wisconsin, Madison. In 2019, she conducted a study to determine the effect of beauty filters on self-image for American and Chinese women. She took pictures of 325 college-aged women and, without telling them, applied a filter to some photos. She then surveyed the women to measure their emotions and self-esteem when they saw edited or unedited photos. Her results, which have not yet been published, found that Chinese women viewing edited photos felt better about themselves, while American women (87% of whom were white) felt about the same whether their photos were edited or not.

Niu believes that the results show there are huge differences between cultures when it comes to “beauty standards and how susceptible people are to those beauty filters.” She adds, “Technology companies are realizing it, and they are making different versions [of their filters] to tailor to the needs of different groups of people.”

This has some very obvious manifestations. Niu, a Chinese woman living in America, uses both TikTok and Douyin, the Chinese version (both are made by the same company, and share many of the same features, although not the same content.) The two apps both have “beautify” modes, but they are different: Chinese users are given more extreme smoothing and complexion lightening effects.

She says the differences don’t just reflect cultural beauty standards—they perpetuate them. White Americans tend to prefer filters that make their skin tanner, teeth whiter, and eyelashes longer, while Chinese women prefer filters that make their skin lighter.

Niu worries that the vast proliferation of filtered images is making beauty standards more uniform over time, especially for Chinese women. “In China, the beauty standard is more homogeneous,” she says, adding that the filters “erase lots of differences to our faces” and reinforce one particular look.

“It’s really bad”

Amira Adawe has observed the same dynamic in the way young girls of color use filters on social media. Adawe is the founder and executive director of Beautywell, a Minnesota-based nonprofit aimed at combating colorism and skin-lightening practices. The organization runs programs to educate young girls of color about online safety, healthy digital behaviors, and the dangers of physical skin lightening.

(Bloomberg) -- Chinese technology stocks slumped Monday after sustaining another round of criticism from state media over online games.

Tencent Holdings Ltd., which gets about one third of its revenue from games, dropped 3.5% in Hong Kong. NetEase Inc. and Bilibili Inc., which each earned at least 45% of revenue from mobile games last year, slid 3.9% and 7.7% respectively. The Hang Seng Tech Index dropped 2.6% to the lowest in almost three weeks.

China should tighten regulations of online games to ensure they don’t misrepresent history, state media reported after a government-controlled agency criticized the industry earlier this month. Beijing’s clampdown on the Chinese technology sector has pushed the Hang Seng Tech Index down more than 40% from its February peak.

“This industry’s future direction might change from here. Investors are pricing in a bearish scenario,” said Castor Pang, head of research at Core Pacific Yamaichi Intl HK. “If they do not allow games to alter history, this may curb creativity and then ultimately hurt the growth potential.”

The onslaught faced over gaming is also reflected in policy curbs in other parts of the technology industry as the government tightens its grip. Digital finance, monopoly practices and preferential tax arrangements have also faced increased scrutiny.

Earnings Jitters

On top of all this, investors tend to remain cautious before earnings season, said Christopher Ho, an analyst at Kgi Hong Kong Ltd. Both Tencent and Bilibili are due to announce their second-quarter earnings this week. News that large foreign funds were selling Chinese tech names have also hurt the sentiment, said Ho.

“Weaker-than-expected growth data out from China has added woes to the share prices of China big tech stocks on top of the on-going regulatory uncertainties,” said Kelvin Wong, analyst at CMC Markets (Singapore) Pte. Investors are also waiting to see what impact the policy crackdown has on revenue guidance for companies like Tencent and Meituan, he said.

On the flip side, some sovereign entities have been buying the dips in China’s tech shares in recent weeks, according to UBS Asset Management.

(Updates trading prices in the second paragraph and added UBS comment in the last paragraph. An earlier version of this story corrected name of index in third paragraph.)

https://finance.yahoo.com/news/china-tech-stocks-hit-salvo-090948739.html

By Thomas Biesheuvel and James Thornhill

(Bloomberg) -- BHP Group unveiled the most sweeping change

to its business since the world’s biggest miner was created two

decades ago, as it plans an escape away from fossil fuels to

shift toward what it calls “future facing” commodities and

clears up some longstanding questions facing investors.

BHP will sell its oil and gas operations to Woodside

Petroleum Ltd. in exchange for shares that it will distribute to

its own investors, it announced Tuesday. The company also

approved $5.7 billion of spending to build a massive new

fertilizer mine in Canada and said it will unify its dual-listed

structure and shift to a single primary listing in Australia.

The shares in London jumped as much as 9.8% after the flurry of

announcements.

The decisions -- which come alongside record free-cash flow

for the year through June and a $10.1 billion final dividend --

represent a pivotal moment for Chief Executive Officer Mike

Henry, who took the helm in January last year. Investors have

been waiting years for a decision on Jansen, while the company

has said previously its dual listing was up for discussion after

coming under pressure from activist investor Elliott Management

Corp., which also pushed for an exit from oil and gas.

Since his appointment, Henry has been seeking to focus the

company toward metals and minerals that will benefit from global

efforts to reduce emissions, electrify cities and feed a growing

global population. A Canadian-born executive who joined BHP in

2003 from Mitsubishi Corp., he inherited a business that had

been stripped down and simplified under his predecessor, who

sold out of shale and spun off unwanted assets, but still faced

huge decisions on potash, the listing and the future of fossil

fuels.

“These are sweeping changes,” said Ben Davis, an analyst at

Liberum Capital. “The new, improved, not so-boring BHP.” The

change to the listing structure means “they can be more nimble

in the future,” he said. “It’s not just change today, but it

means there’s more change coming tomorrow.”

Summertime markets can be a bit dysfunctional. Last week, for example, the top two sectors were the classically defensive utilities, and the highly cyclical materials. The total market volume on the New York Stock Exchange and the Nasdaq on Tuesday was 59% below the peak of the year, and 19% below the year’s average.

Tavis McCourt, institutional equity strategist at Raymond James, points out the last two years, there was a big value and cyclical bias in stock markets after Labor Day, and in 2018, markets basically collapsed after the summer drew to a close. “We believe as the chase for the end of the year begins, a renewed value/cyclical outperformance is likely along with higher 10-year Treasury yields, but like it has been for the past 18 months and will be for the foreseeable future, the virus is the boss,” he says.

The 10-year, he says, is the linchpin to the whole market. Quantitative easing, bank liquidity, Treasury gamesmanship and delta variant fear should all fade in the second half, allowing yields to rise up to a reasonable level. That in turn will get the yield curve steepening, helping value stocks, small-caps and cyclicals — which have a long way to go, given the summer reversal in markets.

Another point he makes is there is no income or spending cliff. By the end of 2021, personal income will be about $1.2 trillion higher than the fourth quarter of 2019 — or put another way, almost exactly in line with the 4% annual average between 2010 and 2019. Since so much of the stimulus was saved, consumer spending should still grow, and an infrastructure stimulus would be a net positive.

Another huge tailwind, he says, is that financial obligations as a percent of disposable income are near 40-year lows. “Consumers have dry powder to spend, for a long, long time even with incomes returning to trend line,” says McCourt. Public company leverage also is down — on a next 12 month basis, net debt-to-Ebitda of S&P 500 companies has dropped to 1.07 in July from a peak of 1.55, and 1.28 in December 2019. Inventories, he adds, are “horribly low,” which while depressing this year’s economic output will lead to restocking demand over the next two years.

BHP has restructured its portfolio as it reported a rise in profit in the year to the end of June 2021, driven by higher prices of iron ore and copper.b The company’s attributable profit for the 2021 financial year stood at $11.3bn, marking a 42% increase compared with $7.95bn a year ago.

This includes a significant loss of $5.8bn, mostly related to the impairments of the miner’s potash and energy coal assets, as well as the impact of the Samarco dam failure. The firm’s underlying attributable profit soared 88% year-on-year to $17.1bn, due to higher commodity prices. Profit from operations climbed 80% to $25.9bn from $14.4bn, reflecting reduced fuel and energy costs among others.

Underlying earnings before interest, taxes, depreciation and amortisation (EBITDA) in the 12 months to June 2021 soared 64% to $37.4bn. In addition to generating free cash flow of $19.4bn, the firm strengthened its balance sheet by reducing net debt to $4.1bn from $12.04bn a year ago. The firm has announced a final dividend of $2 per share. This brings its full-year dividends to $15.2bn.

Additionally, BHP announced plans to make its operations simpler by unifying its corporate structure to a single primary listing on the Australian Securities Exchange (ASX). The firm currently operates as a dual-listed company. It has two parent entities, both holding primary listings, notably BHP Group Limited (BHP Ltd) in Australia and BHP Group Plc (BHP Plc) in the UK.

Furthermore, the company is pursuing the sale of its oil and gas business to Woodside Petroleum and has approved a $5.1bn investment for the Jansen Stage 1 (Jansen S1) potash project in Canada. BHP chair Ken MacKenzie: “Our plans announced today will better enable BHP to pursue opportunities in new and existing markets and create value and returns over generations.”

https://www.mining-technology.com/news/bhp-annual-profit-surges/

Industry Trends

Welcome to Thomas Insights — every day, we publish the latest news and analysis to keep our readers up to date on what’s happening in industry. to get the day’s top stories delivered straight to your inbox.

When LA-based blues and rock band Canned Heat wrote “Poor Moon” in the same year Neil Armstrong took his famous giant leap, their lyrics reflected the Cold-War-era concern that spacefaring nations would one day scar the moon by testing a bomb on its surface.

While this, thankfully, hasn’t yet happened, the moon — along with all the other planets, moons, and asteroids in the solar system — could one day be mined for resources to meet Earth’s ever-growing needs.

Why Mine Off-Earth?

Space Exploration Is Expensive

While the price tag involved in establishing a human colony on the Moon or Mars is mind-boggling, the costs of sustaining off-Earth colonies and keeping them resupplied indefinitely are even more so — unless the settlements can somehow pay for themselves. Mining for much-needed metals and sending them back to Earth could change the game for space exploration, transforming off-world ventures from prohibitively expensive to financially viable.

That being said, bringing a heavy payload of minerals down through Earth’s atmosphere is not currently feasible. Futurists believe that instead, minerals mined in space will be used in space as humanity spreads outwards.

Rare Earth Materials Are Abundant

There are around two million near-earth asteroids brimming with rare earth minerals, precious metals, iron, and nickel. The Moon contains helium-3, yttrium, samarium, and lanthanum, while Mars contains an abundance of magnesium, aluminum, titanium, iron, chromium, and trace amounts of lithium, cobalt, tungsten, and other metals. Importantly, many planetary bodies contain water, which through hydrolysis can be used as rocket fuel.

It Helps with Sustainability

Earth’s resources are finite. Non-renewable metal resources are inherently unsustainable, and mining causes environmental degradation all over the world. The answer is to source our minerals off-world. Off-world minerals are exhaustible as well, but the argument is that mining lifeless rocks such as the Moon or asteroids is infinitely preferable to continuing to damage Earth’s fragile biosphere.

Discoveries May Be Made

Opening space to commercial mining does not mean that science takes a back seat. Space-mining interests could drive scientific advancement by discovering extremely rare or unknown minerals on other planetary bodies.

Robotics Would Do the Work

While countless lives have been lost on Earth over the centuries due to mining accidents and disasters, it is likely that humans will not have to risk their lives by traveling in-person to off-world mining sites. Regolith-sampling probes are already in use and provide an early glimpse of what a scaled-up robotic mining craft may one day look like.

Off-Earth Mining and Space Law

The 1967 Outer Space Treaty is unclear in terms of whether any country — or private company — can claim mineral rights in space. It states that “exploration and use of outer space shall be carried out for the benefit and in the interests of all countries and shall be the province of all mankind.”

The 1979 Moon Treaty was an attempt to declare the Moon and its natural resources to be CHM (Common Heritage of Mankind). Significantly, it called for “an equitable sharing [by all countries] in the benefits derived from these resources.” Most nations, including the U.S., did not ratify this treaty.

Recently, the U.S. has accelerated its efforts to create a legal framework for the exploitation of resources in space.

The Obama administration signed the U.S. Commercial Space Launch Competitiveness Act of 2015, allowing U.S. citizens to “engage in the commercial exploration and exploitation of space resources.”

In April 2020, the Trump administration issued an executive order supporting U.S. mining on the Moon and asteroids.

In May 2020, NASA unveiled the Artemis Accords, which included the development of safety zones around lunar mining sites. Former NASA administrator Jim Bridenstine said: “It’s time to establish the regulatory certainty to extract and trade space resources,” and clarified in a separate statement that: “We do believe we can extract and utilize the resources of the moon, just as we can extract and utilize tuna from the ocean.”

NASA planned an Asteroid Redirect Mission which involved collecting a multi-ton boulder from an asteroid and redirecting it into a stable orbit around the moon, but the mission was canceled in 2017.

What Companies Are Preparing for a Future of Space Mining?

One thing that is becoming clear is that off-earth mining is unlikely to be a state-run activity. Instead, several private companies are jockeying to be first in line to access minerals in space.

iSpace (Japan) has a mission to “help companies access new business opportunities on the moon,” including the extraction of water and mineral resources to spearhead a space-based economy.

Planetary Resources (defunct) was founded in 2009 with the goal of developing a robotic asteroid mining industry. Despite having high-profile founding investors including Alphabet’s Larry Page, Eric Schmidt, and Virgin Group founder Richard Branson, Planetary ran into financial trouble in 2018 and was gone by 2020.

Deep Space Industries (defunct) was another early mover that intended to explore, examine, sample, and harvest minerals from asteroids. DSI was acquired by Bradford Space in 2019.

Offworld is an AI company building “universal industrial robots to do the heavy lifting [including mining] on Earth, the Moon, asteroids, and Mars.”

The Asteroid Mining Corporation (UK) is a venture currently crowdfunding for a 2023 satellite mission called “El Dorado,” which will conduct a spectral survey of 5,000 asteroids to identify the most valuable for mining.

Alongside the U.S., the tiny European nation of Luxembourg has also developed a space mining framework and has subsequently emerged as a European hub for the fledgling industry.

Image Credit: SeventyFour / Shutterstock.com

More from Industry Trends

Remember that weird Will Smith movie about robots?

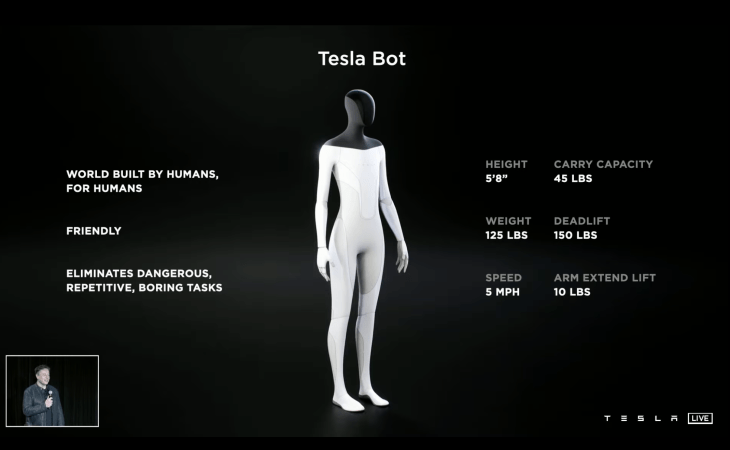

Yeah, neither do we. But Elon Musk does. Tesla is developing a 5’8” Tesla Bot, with a prototype expected sometime next year. The news comes during Tesla’s inaugural AI Day, which was streamed on the company’s website Thursday night.

The bot is being proposed as a non-automotive robotic use case for the company’s work on neural networks and its Dojo advanced supercomputer.

Image Credits: Tesla

Image Credits: Tesla

“Basically, if you think about what we’re doing right now with cars, Tesla is arguably the world’s biggest robotics company because our cars are like semi-sentient robots on wheels,” Musk said. “With the Full Self-Driving computer, [ … ] which will keep evolving, and Dojo and all the neural nets recognizing the world, understanding how to navigate through the world, it kind of makes sense to put that on to a humanoid form.”

The bot is “intended to be friendly and navigate through a world built for humans,” he added. He also said they’re developing it so that humans can run away from it and overpower it easily. It’ll weigh 125 pounds and have a walking gait of 5 miles per hour, and its face will be a screen that displays important information.

Interestingly, Musk is imagining this as replacing much of the human drudge work that currently occupies so many people’s lives – not just labor but things like grocery shopping and other everyday tasks. He waxed about a future in which physical work would be a choice, with all the attendant implications that might mean for the economy.

“In the long term I do think there needs to be universal basic income,” Musk said. “But not right now because the robot doesn’t work.”

Musk finished off by inviting engineers to “join our team and help us build this.”

Just remember, Tesla is not the only automaker, or even company, to produce a humanoid robot. Honda’s Asimo robot has been around for decades and it’s incredibly advanced. Toyota and GM also have their own robots, so why are we so hyped about Tesla’s? Is it just because it’s Tesla? Or is it because of this potentially really powerful vision-based supercomputer that will be powering it?

Who knows if anything will ever come of this humanoid robot, but we shall remain entertained by Tesla updates until such time as we can buy one of these things in a store and take it home to buy our eggs for us. Now that’s an AI utopia.

Saudi Aramco and Reliance Industries are engaging in advanced-level talks for an all-stock deal in the refining and chemical business of the Indian oil-to-telecom giant. The deal could be worth $20-25 billion if the talks of purchasing a 20 per cent stake by Saudi Aramco in Reliance O2C Ltd follows through, Bloomberg reported citing sources, adding the final announcement in this regard could come in a few weeks.

The talks between both the giants have been going on for the past two years. The delay was caused due to Covid-19 pandemic and falling crude oil prices. If the deal is signed, it'll be Saudi Aramco's first all-stock deal since the initial public offering (IPO).

In 2019, RIL Chairman Mukesh Ambani had said Aramco would pick up a 20 per cent stake in the newly-floated subsidiary Reliance O2C. In his address to the shareholders in June 2021, he said Saudi Aramco's plan to join Reliance O2C Ltd as a strategic partner is expected to be formalised in an "expeditious manner" this year.

Also read: Saudi Aramco's rising oil fortune to speed up Reliance O2C deal

The deal also ensures a dedicated market for Aramco's crude in India. As part of the deal, O2C will sign to buy 500,000 barrels of crude oil every day (28 per cent of the company's Jamnagar refinery requirement) on a long-term basis from Aramco. Besides, the O2C business will be a value-creating proposition for both the giants as it focuses to channel 70 per cent of the refined crude for manufacturing high-value chemical products.

Reliance Industries Ltd (RIL) had also inducted Yasir Al-Rumayyan, Chairman of Saudi Aramco and the Governor of the Public Investment Fund, on its board. The move is believed to have hastened the deal talks. The partnership of RIL and Aramco is expected to improve India-Saudi relations, especially while negotiating the crude price.

Also read: RIL's partnership with Aramco to be formalised in 'expeditious manner' this year: Mukesh Ambani

The relationship between the governments was also not smooth, which could also be the reason behind the delay in finalising the deal. India, the third-largest crude oil importer and consumer, in May had asked public sector crude refining companies to scale up imports from the US and Africa following Saudi Arabia's decision to raise the official selling price (OSP) of oil shipments to Asia. The action by Saudi, the world's largest crude exporter, was largely conceived as retaliation to India's plan to cut crude imports from the country.

Saudi Arabian state oil producer Aramco had reported a nearly four-fold rise in second-quarter net profit this month. The record profit was reported following higher oil prices and a recovery in the demand. The O2C business of RIL includes the twin refineries in Gujarat's Jamnagar and the adjacent petrochemicals complex, besides the petroleum retail joint venture of RIL-BP Plc.

Also read: Saudi Arabia to ship 80 metric tonnes of liquid oxygen to India

Also read: Saudi Aramco Q2 profit surges on higher prices, demand recovery

Also read: Saudi Arabia to ship 80 metric tonnes of liquid oxygen to India

Acceleware Kicks off Marwayne RF XL Commercial Pilot Drilling Program

GlobeNewswire2021-08-17

CALGARY, Alberta, Aug. 17, 2021 (GLOBE NEWSWIRE) -- Acceleware Ltd. (“Acceleware” or the “Company”) (TSXV: AXE), a leading developer of electrification technology targeting low-cost, low-carbon and clean extraction of heavy oil and bitumen, today announces that the Company has kicked off the drilling and completions program of the commercial-scale RF XL pilot project at Marwayne, Alberta (the “Pilot”), representing a major milestone in the execution of the Pilot.

Akita Drilling Ltd.’s Rig 29 moved onto the Marwayne site August 9, 2021. The RF XL producer well was spudded on August 12, 2021, followed by the heating well on August 13, 2021. Spud to completion of both the heating well and the producer well, barring unforeseen delays, is expected by late Q3. Facility installation will commence immediately thereafter, and RF XL heating starting shortly after final commissioning. While the initial heating phase is planned for approximately six months, this period may be extended to allow Acceleware to capture additional information on the efficiency and operation of the technology.

“Acceleware’s RF XL is designed to become an electrification work-horse for the clean energy transition,” said Laura McIntyre, project lead and CTO of Acceleware. “Our team, alongside multiple expert partners, has performed an incredible amount of design, planning and de-risking to get to where we are today – we are very excited to deploy this technology and to further prove out its feasibility at commercial scale.”

Partners involved in the drilling and completions program of the Pilot include Halliburton, Akita Drilling Ltd., Tristar Resource Management Ltd., Weatherford Canada Ltd., CES Energy Solutions, Precise Downhole Solutions, Tenaris, Stream-Flo Industries Ltd., Pro Pipe Service, Variperm Energy Services Inc., among others.

“We are excited to work with innovators that think outside the box,” said John Gorman, Halliburton VP Canada and West Coast USA. “Working toward a next generation technological solution is a critical step toward a low-carbon future.”